Do the Hokey-Pokey: Chicago Public Schools Strike Threat and Debt

by meep

It’s back-to-school season… you know what that means: time for teachers to train to strike!

Not sure why they need to train to use the chants they always use, but the last “day of action” was less than productive (from the Chicago Teachers Union point-of-view), so let’s see if they’re changing things up:

Our bully mayor, billionaire governor, and greedy corporations in Illinois are pushing a coordinated agenda. They want to slash wages, abolish pensions, outsource jobs, and gut public services. We’ll need unity to fight back and win.

But the good news is, among us we’ve got the creativity and knowhow to beat back the concessions and build a better city and state. That’s why troublemakers from different unions and worker centers are coming together August 20 to build skills and share strategies.

….

Workshops Include:Secrets of a Successful Organizer: Beating Apathy

Secrets of a Successful Organizer: Turning an Issue Into a Campaign

Inside Campaigns: Workplace Tactics That Win

Planning and Winning Strikes

How to Get Your Message Out

Oh, are those workplace tactics stuff like threatening fellow teachers? That really got results, didn’t it? Like bad PR. That’s a result.

But why are the teachers needing to strike anyway?

Money, of course. Same as it was in the spring.

MONEY MONEY MONEY

So let’s see what the money situation for Chicago Public Schools is.

Here are a few headlines:

August 16:

CPS wants permission to borrow up to $945 million in new bonds

August 22:

CPS wants approval for $1.5 billion in short-term loans

Wait a second… are these separate bond issue requests?

Short answer: yes.

The August 16 story is about long-term bonds, supposed to be for capital spending purposes:

The latest borrowing for the broke school system will be up to $945 million “for the purpose of financing the rehabilitation, renovation, construction and acquisition of school and administrative buildings and equipment, site improvements and other real and personal property, funding of contract obligations, the purchase of school grounds for the construction of or additions to school buildings and costs of issuance and other costs and reserves related to the foregoing.”

The district will hold a public hearing at 8:30 a.m. on Aug. 24 at its headquarters, 42 W. Madison, just before its 10:30 a.m. meeting, when the Board of Education will vote on authorizing the borrowing.

CEO Forrest Claypool told reporters Tuesday that the authorization would support capital improvements over multiple years and that a $45 million capital levy recently passed by the City Council would primarily pay the bonds back.

The August 22 story is about borrowing for operational expenses:

In addition to passing a $5.4 billion operating budget, approving up to $945 million in bonds for capital projects, and voting to raise property taxes by more than $250 million, Chicago’s Board of Education on Wednesday also will consider authorizing a 45 percent increase on Chicago Public Schools’ line of credit to $1.5 billion.

All of the district’s financial proposals to the seven appointed board members are expected to pass.

….

Appearing with the mayor at a South Side elementary school, CEO Forrest Claypool chalked up the increase in the line of credit — up from just over $1 billion in the last fiscal year — to a “huge mismatch between revenues and expenses” between February, when an annual debt service payment for $373 million is due, and March, when property tax revenue begins to roll in.

…..

And without any remaining cash reserves it used to rely on, CPS now leans on costly short-term borrowing to cover such gaps.“The line will extend down to the $1.5 [billion] or probably $1.4 [billion] for that three-week period and then it will be immediately repaid with the March property tax receipts,” Claypool said.

……

Claypool said earlier this summer that the budget will not depend on borrowing for actual operations, just for cash flow purposes.

Sure it will.

I will just mark this down on my calendar, to keep an eye when this “short-term” debt use would kick in. Maybe Claypool is on the level, and this is just a liquidity issue.

But I find this worrisome, in terms of the magnitude of the line of credit. It is dwarfing the new long-term debt they want to take on, and is fairly large compared to the $5.4 billion operating budget. And I don’t think the secrecy surrounding the capital improvement projects really inspires confidence, either.

That large bond payment in February — is that capital spending bonds, or is it the accumulated “scoop and toss” crap (i.e., a bunch of old operational costs that were turned into long-term debt.)

And don’t get me started on the CPS pensions.

Not today, at any rate.

WHAT ABOUT THE TAXPAYERS

You remember the bit about the increased property taxes hitting Chicago residents?

That was for non-school stuff. Get ready for the CPS-related tax increases:

Chicago Public Schools is looking to get 14 percent more from taxpayers this year. The district’s entire property tax levy would increase to $2.7 billion this year, up from $2.3 billion.

At a hearing Thursday (August 18), held during the day and sparsely attended, CPS Budget Manager Cameron Mock seemed to blame mostly teachers for the increase. The biggest chunk of the property tax increase is for $250 million and would go directly to the pension fund.

For decades, CPS failed to pay its contributions to the teacher pension fund, but Mock said that the biggest reasons for the district owing so much are underperforming teacher pension fund investments underperforming, and increased benefits for teachers. He also said a big problem was that the school district has been picking up 7 percent of the employee contribution to the pension fund. That’s more than other taxing bodies pick up, he said.

Oh, I guess I let the pensions in a little. The teachers keep threatening to strike over the CPS wanting them to have to contribute 7 percentage points more to their pensions.

By the way, Rahm is trying to get the word out about tax rebates. I’m sure getting a couple hundred bucks back on tax bills that are thousands will be appreciated.

In my own case, I prefer to have the tax bill reduced, rather than have to pay thousands up front and then a couple hundred a few months later. I think New York figured it out, because I don’t see them doing that move much any more.

WHAT ABOUT BOND INVESTORS

Let’s see what Bloomberg has to say:

Chicago Schools Step Back From Brink Ahead of Bond-Market Return

District looks for aid, teacher givebacks to balance budget

Board seeks approval to sell as much as $945 million of debtA year after being cut to junk by all three major bond-rating companies, Chicago’s school system has won an influx of state aid, secured extra tax money for its pensions and quieted speculation that the crisis is so severe that bankruptcy is inevitable. Its bonds have rallied.

Emanuel’s pension bill: $1.1 billion a year—and counting

After years of maneuvering, Chicago taxpayers finally know the size of the tax bill they’re getting to stabilize City Hall’s major government pension plans: roughly $1.1 billion a year.

But as big as that number is, it’s only preliminary, with changes going upward a distinct possibility based on factors such as return on investments and the outcomes of labor negotiations. And concern is rising in the business community, which will pick up much of the tab and is worried that the tax hikes are starting to take a toll on the city’s economy.

The $1.1 billion figure is based on a series of deals Mayor Rahm Emanuel has struck with state lawmakers and local unions to refinance retirement systems that, in some cases, had faced insolvency within a few years if they didn’t get help. The first deal was enacted nearly a year ago for the police and fire department funds; the most recent, two weeks ago affecting white-collar city workers.

Each deal requires a series of tax hikes, generally to be implemented over a five-year period. When fully in force, the four city funds—and a related one that covers Chicago Public Schools teachers—in theory will be getting the actuarially required amounts needed to reach the 90 percent-funded level in 40 years or so.

Okay, it’s really tough to get away from the pensions issue when we’re talking about Chicago debt.

Note: they can’t get to full funding in even 40 years, even with all this increased contributions. Take a look at John Bury’s numbers.

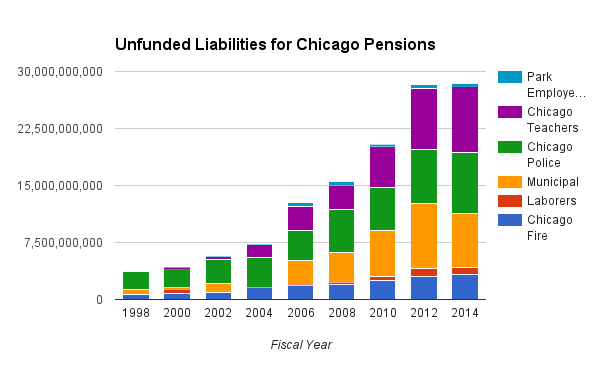

Heck, take a look at this graph:

They have hiked up taxes already that’s not even covering all the non-teachers pensions.

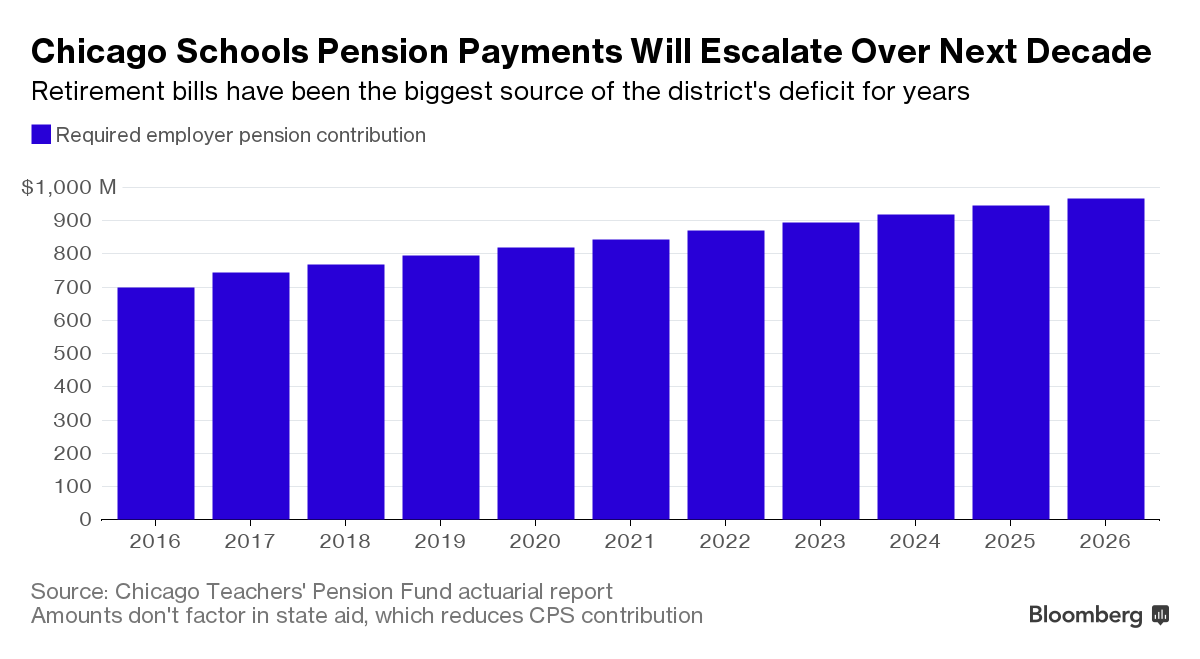

This is what they’re supposed to be doing for the teachers pensions:

That’s a huge hole to fill.

I think some of the investors don’t see bankruptcy just around the corner… but what about ten years from now? Twenty?

Here’s what some of the credit rating agencies had to say back in January:

UPDATE 2-S&P drops Chicago Board of Education rating deeper into junk

Jan 15 Standard & Poor’s on Friday dropped the credit rating for the financially struggling Chicago Board of Education deeper into “junk” ahead of the school district’s $875 million bond sale slated for later this month.

S&P cut the rating two notches to B-plus, while warning it could fall even further if the nation’s third-largest school district fails to beef up cash flow to cover costs.

“The rating action reflects our view of the board’s low liquidity and significant reliance on market access to continue supporting operating and debt-service expenses,” S&P analyst Jennifer Boyd said in a statement.

She added that “adverse business, financial, or economic conditions will likely impair the board’s capacity or willingness to meet its financial commitments.”

…..

Last month, Moody’s Investors Service downgraded CPS to B1 from Ba3. The district also has a “junk” rating from Fitch Ratings. (Reporting By Karen Pierog; Editing by Chizu Nomiyama and Tom Brown)

Just checking the CPS’s own site, those ratings haven’t improved. To be sure, credit ratings tend to move slowly — but I’m extremely skeptical that specualtion over eventual Chicago bankruptcy is gone.

Especially given what happened to Detroit.

Related Posts

Taxing Tuesday: What's the Real Tax Rate?

Taxing Tuesday: New Jersey Wants to Be Number One; More Federal Tax Comparisons

Taxing Tuesday: Illinois Tax Persiflage