Kentucky Pensions Update: Governance Woes

by meep

You remember the time I tried out a new blogging toy? (which I promptly forgot about.)

Here’s the quick recap: in May, there was a showdown of sorts between the power of the governor of Kentucky (Bevin) and the just-fired chair of the board of the Kentucky Retirement System (Elliott). The director of KRS (Thielen) announced his retirement effective September 1. And there was some kind of state trooper on hand to loom menacingly from a doorway, to give stink-eye to the fired guy who said nuh-uh I ain’t fired. Later, the governor fired the entire board. Lawsuits all around.

Background:

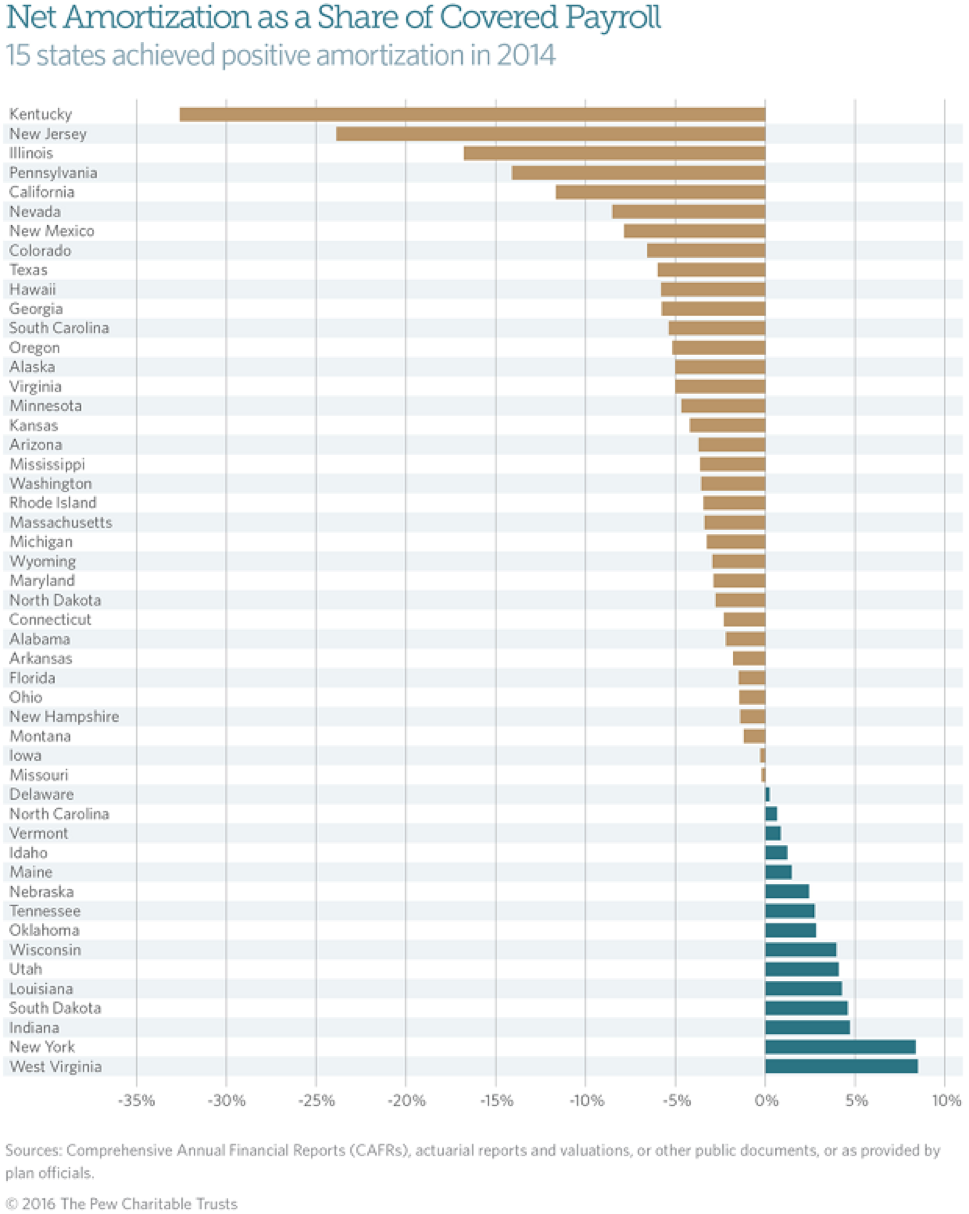

Kentucky’s pensions are in a really poor state. Their investment performance has been poor, and their contribution history has been no great shakes.

Here’s an update.

WHO’S GOT THE MONEY?

From the beginning of August:

Ky treasurer seeks intervention in pension suit:

FRANKFORT, Ky. – Kentucky’s state treasurer is seeking to intervene in a lawsuit filed by the former state retirement systems chairman against Gov. Matt Bevin.

Kentucky Treasurer Allison Ball filed an intervening motion Monday in the suit to stop the retirement board’s former chairman, Thomas Elliott, from using $50,000 in legal funding from Kentucky Retirement Systems to sue Bevin.

Elliott is suing to overturn Bevin’s order removing and replacing him. Bevin has also issued an executive order that removed all the current members of the retirement system board.

Ball said in a release that Elliott’s use of the funding is inappropriate, since he is no longer on the board.

“After conducting an internal review, it is clear there is no legal authority for a removed trustee to use retiree pension money to pay for legal counsel, which is what Mr. Elliott is attempting to do,” Ball said in the media release.

Kentucky Attorney General Andy Beshear has also sought to intervene in the suit in an attempt to overturn’s Bevin overhaul of the board.

The $50,000 in funds came to light in a report by the Kentucky Center for Investigative Reporting, which obtained the legal bills through a public records request.

Important notes: AG Beshear is the son of the immediately prior governor of Kentucky. (ex-governor Beshear couldn’t run again due to term limits.)

Both Beshears are Democrats. Gov. Bevin is a Republican. Allison Ball, also elected to her position, is also Republican.

Judge: AG can intervene in Bevin’s pension suit:

Judge: AG can intervene in Bevin’s pension suit

FRANKFORT, Ky. — Franklin Circuit Judge Phillip Shepherd on Tuesday allowed Attorney General Andy Beshear to intervene in a lawsuit challenging Gov. Matt Bevin’s orders overhauling the Kentucky Retirement Systems Board of Trustees.

At issue in the case are Bevin’s orders removing Thomas Elliott as chairman of the Board and expanding the membership of the Board, adding new transparency requirements and other changes to the oversight of a pension system that handles assets that total around $16 billion.

Elliott and Beshear contend that Bevin lacked the legal authority to issue the orders. And for more than four hours Tuesday they argued for a temporary injunction that returns the board to its former status until Shepherd can rule on the merits of the case. Shepherd said after the hearing he would rule on whether to issue that injunction “as soon as possible.”

During most of Tuesday’s hearing Retirement Systems Bill Thielen testified that he believes the governor’s orders will have a disruptive effect and cause harm if later the court, or the General Assembly reverses them.

Throughout the hearing Steve Pitt, general counsel for the Governor’s Office, repeated an argument he’s made in this case and other cases challenging Bevin’s reorganizations. “The legislature has clearly given governors the ability to propose reorganizations” that take effect immediately but that the legislature can reject at the next regular legislative session, Pitt said.

…..

Beshear has taken legal action against Bevin not only in the pension board case but also in a separate suit he has filed regarding the governor’s overhaul of the University of Louisville Board of Trustees. The attorney general has said that Bevin’s reorganizations of both these boards are about control and power, not efficiency. The U of L case will get its own hearing Thursday morning.

Remember the name of that judge: Phillip Shepherd. It’s not because I have any particular thing to say about the judge – it’s that he has stuff to say, and he’s the decider in real-time. We shall see that annoying the judge has real-life consequences.

HEDGE FUNDS WON’T FIX YOUR WOES

A little asset-side interlude for now. I did mention that the KRS returns were dismal… like pretty much all pensions.

So what to do when you’re the worst-funded state for public pensions?

Why, try to fill that hole with outsized returns! From opaque investments!

Kentucky Pension Recommits to Hedge Funds Amid Governance Turmoil

Following a string of high-profile hedge fund exits, the Kentucky Retirement Systems (KRS) investment committee recommended $300 million in allocations to its board of trustees Thursday.

….

Amid this turbulence, the investment committee approved initial investments of $20 million to $30 million each in Anchorage Capital Partners, BlackRock’s Global Alpha Opportunities fund, and the Finisterre Global Opportunity fund. It also recommended an increased target allocation to Prisma, KKR’s hedge fund-of-funds arm.As of March 2016, the $15 billion pension and insurance fund had $1.6 billion in “absolute return” strategies. The new investments will not affect KRS’s target hedge fund allocation of 10%, said CIO David Peden, but will replace investments in Pacific Alternative Asset Management Company and Blackstone Alternative Asset Management.

This recommitment to hedge funds comes weeks after the $55 billion New York City Employees’ Retirement Systems voted to do away with hedge funds altogether. The California Public Employees’ Retirement System famously made a similar move in 2014.

Insurance giants AIG and MetLife also recently announced decisions to slash their hedge fund portfolios.

However, research by data firm Preqin shows that public pension funds on average are increasing their allocations to hedge funds, growing their investments from 7.2% of their total portfolios in 2010 to 9.2% in 2016. KRS comes in slightly above average, with an allocation of 10.6% in March.

JEEEEZ.

WORST. FUNDING. EVER.

(okay, maybe not. Puerto Rico is worse.)

This is not really a good move:

Kentucky’s unfolding drama is one of many to play out with new Republican Governor Matt Bevin seeking to take control over pensions and change investment policy. At on point he sent a state trooper to make sure certain board members didn’t participate in a meeting. Lawmakers, after failing to adequately fund pensions for 15 of the last 22 years, allocated $1.28 billion, including money beyond what was required.

S&P Global Ratings said in a report in April that the state may not be able to sustain increased spending on pensions provided this year. It tapped into one-time sources such public employee health insurance trust funds that may not be available in the future.

….

Stumbo called the meeting in reaction to reports the funds paid $171 million to managers while losing money on investments in the year ended June 30. Stumbo said on Twitter this week that the returns were “far below what was needed” as the systems paid “exorbitant fees.” On Facebook he called it “a whole lot of money to be spent only to lose more money.”“The state has invested $1.2 billion in pension funds hoping to solve liquidity problems,” said Brian Wilkerson, Stumbo’s spokesman, in an interview. “With the influx of new money were hoping they can focus less on liquidity and more on investment performance.”

Republicans critical of the meeting said the information about losses and fees had been out for weeks and discussed in committees, and that if Stumbo was so concerned about fees he should have let lawmakers consider a law this year that would have required disclosure of fee information.

There are many reasons that state funds should not be getting involved in any funds that aren’t transparent.

I leave it as an exercise for the reader to generate that list of reasons.

Here is somebody putting something out in June saying Kentucky is on track for repairing pensions, but I think this is quite premature. But let this person give it their best shot:

Three years after major reforms were made to the Kentucky Retirement System (KRS) for new hires in 2013, Pew Center on the States’ pension expert David Draine returned to Kentucky at the invitation of the Kentucky Chamber with an analysis of the progress report of the changes which he says are on track to save the state and provide more stability to the pension system and its recipients.

….

Draine noted that the state is now paying the full actuarially required contribution (ARC) to KRS and an amount over and above the ARC despite rising costs facing the state pension system. The Pew pension expert said this will continue to help the state get on a more stable track and shore up its retirement system.The reforms, Draine said, have also resulted in more transparency from the system, but the state should keep pushing for more transparency, particularly in terms of investment costs, and continue its efforts to provide funds in excess of the ARC to address Kentucky’s unfunded pension liability.

Mmmm, sounds like this person was more poking at Kentucky to quit with the ONE QUICK FIX! idea with hedge funds, etc. Also, if you read about the teachers fund…

As for the Kentucky Teachers’ Retirement System, Draine said that while Pew did not look at that system while they were in the state three years ago, policymakers need to look at the data before making significant changes and understand that a new plan design does not solve the issue of unfunded liability for the system. He also noted that while approximately 94% of the ARC for KTRS was funded in the recently enacted budget, the challenge of fully funding the ARC remains.

According to projections by KTRS’ actuaries Draine cited in the meeting Wednesday, if no actions are taken and no reforms are made, KTRS will run out of money by 2039.

Yeah, I think the editor who wrote the headline was being a bit misleading more than the expert was too sunny in predictions.

And yet another pile on, showing how much both Kentucky and Illinois suck at pension funding. I believe I’m characterizing those properly.

BOARD RESET? OR NOT?

But back to the lawsuits.

A couple weeks ago, the judge scolded the governor and said he was putting Elliott back on the board:

Judge scolds Bevin for ‘strong arm tactics’

FRANKFORT, Ky. – Franklin Circuit Judge Phillip Shepherd on Monday [August 22] temporarily restored Thomas Elliott as a member of the Kentucky Retirement Systems Board of Trustees and scolded the Bevin administration for using “lawless, strong arm tactics” to block Elliott from participating in a board meeting in May.

But in the same 20-page order, Shepherd allowed to stand – again, temporarily – sweeping changes including new transparency requirements that Bevin ordered for the Kentucky Retirement Systems last spring.

Shepherd’s order came in a lawsuit filed by Elliott and another board member, Mary Helen Peter, claiming that Bevin did not have the legal authority to remove Elliott from the board by executive order last April. The suit also challenged a second Bevin order that added four additional members to the board and established new policies for the pension systems.

So that would seem to be that, right? But wait — there’s more — Beshear was going to continue fighting:

“For now, until the case is finished, this board will remain in place and will be making decisions,” Bill Thielen, the Kentucky Retirement Systems’ executive director, said on Tuesday.

Thielen, who is retiring on Sept. 1, said the board is expected to name someone to replace him on an interim basis at its meeting on Wednesday.

he Republican governor called on the Democratic attorney general to “drop his politically-motivated lawsuits and stop his efforts to fight transparency and protect the status quo.”

But Beshear was not budging.

“Our goal is to quickly move this case to a final decision at the trial court level and ultimately to the Supreme Court of Kentucky,” he said in a statement.

So the lawsuits continue to duke it out, and the pushed-out guy stays right where he is.

Not so fast, bucko.

FIRE FOR NO-SHOW?

After the temporary reprieve, Judge Phillip Shepherd was getting annoyed at Elliott for not going to the meetings:

Judge Slams Reinstated Pension Official For Missed Meetings

The absence of the former board chair of the Kentucky Retirement Systems at official meetings is “not acceptable,” according to a judge who temporarily blocked the governor from removing the official.

Franklin Circuit Court Judge Phillip Shepherd ruled last week that Tommy Elliott could still be a member of the agency’s Board of Trustees while the court decides if the governor had the power to remove him from the board three years before his appointed term was set to end.

But Elliott did not attend meetings of the full KRS board or investment committee last week.

During a scheduling hearing on Tuesday, Shepherd said the poor condition of the pension system is an “all-hands-on-deck situation” and he criticized Elliott for not showing up.

“If Mr. Elliott’s too busy to serve, he ought to resign or he ought to be prepared to be replaced,” Shepherd said.

What was Elliott’s explanation? He was scared and busy:

Kentucky Retirement Systems board member Tommy Elliott says he didn’t attend a recent meeting of the pension board because he says there was a “dynamic of fear” over whether he would be arrested by state troopers for participating.

…..

Elliott also argued that after the judge issued his order restoring him to the board, he didn’t have enough time to reschedule business plans before the first of the two pension meetings.“It was not a meeting that I could so quickly adjust,” Elliott said.

Let’s hope he really did have business (as opposed to vacation) going on at the time. Annoying the judge is not a good move, especially when the governor is arguing heavily for you to be removed:

Governor’s Office asks judge to remove former state pension chair

…..

Franklin Circuit Judge Phillip Shepherd heard a motion by the governor’s attorneys Wednesday to modify part of Shepherd’s original injunction allowing Elliott to participate in Bevin’s reorganized board and its investment committee.Steve Pitt, Bevin’s general counsel, filed the motion on behalf of the governor and Mark Lattis, Bevin’s last appointee meant to replace Elliott on the new board, asking Shepherd to restrain Elliott from participating until the case is settled and before Thursday’s full board meeting.

So we’ll see….

BREAKING NEWS: ELLIOTT OUT

And here’s the downside of prepping these posts ahead of time. All the above seems to be wiped away.

Via Brad Bowman’s twitter feed, I find the judge says Elliott can attend but not vote in the meeting.

Judge rules former ousted state pension chair can stay but not vote

After removal by executive order, the threat of arrest by Kentucky State Police and extensive court hearings on the issue, Franklin Circuit Court Judge Phillip Shepherd issued an order Thursday replacing former Kentucky Retirement Systems (KRS) chair Tommy Elliott as a voting member for his lack of participation.

So there ya go. No danger of arrest, but also total impotence.

Sounds like a compromise.

Anyway, the lawsuits really are ongoing, but in the meantime, decisions (like the hedge fund allocations) will continue. I imagine I’ll have plenty to cover on Kentucky for years to come.

Related Posts

Taxing Tuesday: California Wants All the Money, Chicago Needs All the Money

Puerto Rico Quick-take: You Found How Much Just Lying Around?

The California Rule Court Case: What Can Be Changed on Public Pensions?