Introducing this Week's State Pensions Example: Nevada

by meep

I haven’t really written about Nevada pensions before, but as part of my State of the States project, this seems like a good one to pick next.

NEVADA NOT GREAT

In fact, it’s among the worst in financial condition, compared to the state’s resources.

From an article about the countrywide pension problem from last year:

States Face a $1 Trillion Pension Problem: Here Are the Worst 10

While a handful of states including West Virginia, New York and Indiana have made important strides in reducing major shortfalls in their employee pension plans, many others are just treading water or losing ground, according to a new study by the Pew Charitable Trust.

…..

The study uses a “net amortization” yardstick for measuring the relative success or failure of all 50 states in making the necessary payments to meet the cost of retirement benefits while gradually shrinking their unfunded liabilities. In Pew’s first report card using this metric, 15 states were found to be currently following policies that meet the “positive amortizing benchmark,” while the remaining 35 states are falling short.The ten worst performing states were: Kentucky, New Jersey, Illinois, Pennsylvania, California, Nevada, New Mexico, Colorado, Texas and Hawaii.

When I get to looking at the pension liabilities, we’ll see why the pensions are negatively amortizing.

SOME HIGH LEVEL DETAILS OF THE NEVADA PLANS

An explainer from the Nevada Independent:

The Indy Explains: The Public Employees Retirement System of Nevada

BY MICHELLE RINDELS……

Is having an unfunded liability healthy?

An unfunded liability is common — it happens when the state doesn’t hit its assumptions (projections) on when beneficiaries die, how many leave the fund before they “vest” (are in it long enough to be eligible for benefits), what their salary increases will be and how many active, contributing employees are on the payroll.

There’s a general understanding that a public pension plan that’s at least 80 percent funded is healthy, although the American Academy of Actuaries has cautioned against leaning too much on that figure and recommended everyone aim to attain and maintain a funded ratio of at least 100 percent over a reasonable period of time.

Yeah, this will be coming back in my 80% roundup soon.

Numerous factors play into the unfunded liability figure. The first is investment returns — pension funds all over the country took a dive when the recession hit. Another is about how accurately actuaries predict how much the fund will have to pay out.

Policy changes also alter PERS’ liability. For example, Leiss said that in the 1980s, PERS’ “funded ratio” dropped to 55 percent. That was because lawmakers decided to institute a plan for post-retirement pay increases.

It came at a time when inflation was much higher than it is today, and lawmakers wanted to ensure employees’ pensions reflected the rising cost of living, even if it increased the fund’s obligations.

The unfunded liability figure represents how much the state would have to pay out if for some reason, the government were to stop all operations at once and need to settle current and future debts to all PERS participants immediately.

Because that situation is unrealistic, and government is expected to go on forever, there’s a range of opinions on how concerned Nevada should be about its unfunded liability. Some Republican lawmakers say it’s not cause for alarm, but needs to be managed so it doesn’t snowball and so debt service doesn’t start taking away too much money from other programs

“I feel comfortable that it’s growing. In my mind that’s too low,” Kieckhefer said about the 74.1 percent funded ratio. “The prospect of unfunded liability for the state for PERS is not necessarily troubling but something you need to address.”

Democratic Senate Majority Leader Aaron Ford said he’s pleased with how PERS is doing and doesn’t support legislation overhauling the system.

“It’s entirely satisfactory,” Ford said of the funded ratio. “I think if you talk to experts in our caucus and experts throughout the state, you’d hear them report on the positive nature of our situation, especially compared to other states.”

According to Pew, you look compared only to Kentucky, New Jersey, Illinois, Pennsylvania, and California.

Guarding against political manipulation

Projections about the long-term health of a pension can look rosy or apocalyptic depending on the assumptions that go into them. Someone could distort the state of the fund by projecting unrealistic 10 percent returns on investment and make the politically popular move of reducing contributions, saving employees and the state huge sums of money in the short term.

But if that prediction is wrong, and investments far undershoot it, the pension fund would be badly destabilized and underfunded.

That’s why Nevada has protections in place to guard against politically motivated manipulation of PERS’ financials. A constitutional amendment proposed in the mid 1990s by then-Assemblyman Dean Heller and then-Assemblywoman Marcia de Braga strived to remove pension funding from the political sphere, giving the Legislature the authority to design the benefit structure, putting a PERS board in charge of managing the system and requiring the PERS board to base its actions on the advice of an independent actuary.

Yeah, and I will be coming back to that as well.

Transforming PERS to a hybrid plan

Worried that the unfunded liability is an unsustainable weight on the taxpayer and forebodes a future crisis, officials — mainly Republicans — have sought to restructure PERS over the years.

Gov. Brian Sandoval proposed a plan in the 2011 session that would have switched the state to a hybrid retirement system. The issue didn’t get traction that year, but was a major point of discussion in 2015 in the Republican-controlled Legislature when then Assemblyman Randy Kirner introduced AB190.

The bill called for Nevada employers to put their new workers on a hybrid model that had elements of the traditional pension plan and elements similar to a 401(k). Kirner argued that the bill would reduce costs for employers, and thus taxpayers, and would boost returns for employees.

It attracted fierce opposition from PERS officials and unions, who said it would reduce benefits for retirees, and it ultimately died when officials said it would cost more than $800 million to implement.

PERS officials said the hybrid model would not get rid of the system’s unfunded liability, but would create a pool of participants that’s increasingly full of retirees and is getting no new money. The $800 million price tag reflects the cost of paying off that unfunded liability while transitioning to the new model.

We’ll take a look at that as well.

ROBERT FELLNER PIECES

Robert Fellner is Transparency Director at the Nevada Policy Research Institute, has been writing quite a bit about Nevada pensions. He’s also made my 80% funding hall of heroes. Actually, he’s been there twice.

From December 2016:NVPERS leadership discounts member complaints

Chair blanks on key issues, while insisting ‘Members don’t understand!’Is a very simple error — looking only at one side of the balance sheet — the source of a huge and growing rift between Nevada’s largest teachers union and the Public Employees’ Retirement System of Nevada (NVPERS)?

On the popular TV show, Shark Tank, it’s a virtual certainty that if a presenter boasts about his firm’s sales or revenue, at least one “shark” will immediately ask for the expenses during the same accounting period.

That’s because each of those two data points is only one-half the information needed to assess the health of a business. Relying on one without the other would be incomplete at best, and dangerously misleading at worst.

…..

Thus, attempting to evaluate the System’s performance without also including those costs is like valuing a business on gross revenues while ignoring expenses.In other words, you’d be flying blind.

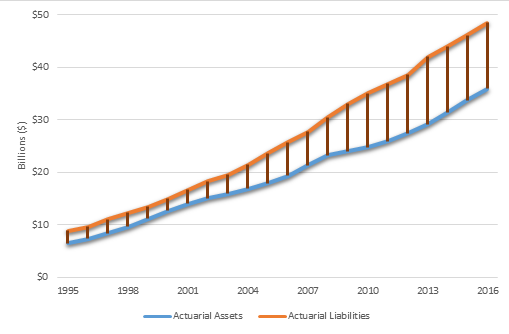

What’s worse, the asset-only chart erroneously suggests that NVPERS has never been in better shape.

Complete information, however, shows that the exact opposite is true:

Chart 2: NVPERS fund and liabilities, 1995-2016

….

But nothing like the above chart has ever followed the assets-only chart routinely displayed at board meetings. In fact, a records request for any document in the possession of NVPERS that displayed assets alongside liabilities came up empty.

Such an inordinate emphasis on investment returns is what most likely blinded the Retirement Board to the System’s soaring debt and the consequent burden that debt has imposed on members.

Nowhere was this clearer than at a board meeting from March of this year.

Just minutes after citing the data depicted in chart #1 as evidence of the System’s strong performance, investment consultant Ken Lambert turned the discussion to complaints coming from members of the Nevada State Education Association (NSEA) over their rising contribution rates.

….

But the key to understanding members’ complaints can be found within the System’s own governing documents, which the Retirement Board itself adopted.After fully funding retirees’ promised benefits, the second goal listed in NVPERS Actuarial Funding Policy is to ensure that costs are spread in a fair and equitable manner.

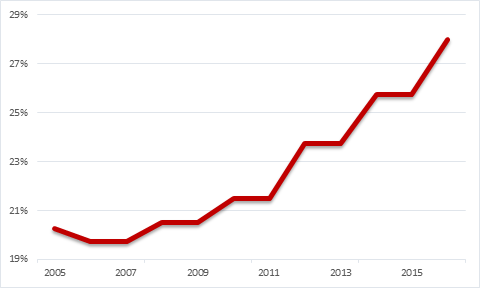

Thus, the 40 percent increase in members’ retirement costs over the past decade — all of which went towards previously accumulated debt, not the future benefit of the employee paying them — represents a spectacular failure of this goal.

Chart # 3: NVPERS costs as a percentage of members’ salary, 2005-2016

From From November 2016:

Government Pension Plans Are Headed for Disaster

…..

The Trouble in NevadaWhile most financial experts are warning of future teacher shortages, decaying roads, higher taxes and cuts to public safety, the Public Employees’ Retirement System of Nevada (PERS) is confident they can avoid all that by doing one simple thing: produce investment returns higher than what even Warren Buffett expects to get!

Because PERS has failed to hit its investment targets over the past 5-, 10-, 15-, 20- and 25-year periods, government workers’ retirement costs have soared to today’s record-high 28 percent of pay (40.5 percent for police and fire officers) — which now consumes more than 12 percent of all Nevada state and local government tax revenue combined.

And as more money is sent to PERS, less is available for salaries, like the only $34,684 offered to new Clark County school teachers last year — almost certainly a driving factor behind the district’s perennial teacher shortages.

What’s worse, over 40 percent of what all government workers — excluding police and fire officers — pay towards PERS is spent on the system’s previously accrued debt, rather than on financing the employee’s future benefits.

……

Unfortunately, if PERS investments underperform that target, taxpayers and government workers must bail them out via higher contribution rates.But using expected investment returns to discount guaranteed future benefits amounts to serious malpractice, which is why such an approach is rejected by private US pension plans, public and private plans in Canada and Europe, and 98 percent of financial economists. US public pension plans are the only dissenters from this consensus.

The easiest way to see why this is wrong is to look at what happens by raising that rate. Imagine if the governor and the legislature uniformly demanded the PERS board must immediately pay down the approximately $11 billion unfunded liability it currently reports.

That sounds like an impossible task, right?

But because of the flawed PERS accounting methodology, the board could appear to pay off that entire amount in an instant. All that would be needed is for the PERS investment advisor to claim that instead of an 8 percent annual return, he now believes PERS can return 10.5 percent.

Presto! PERS would have eliminated their entire $11 billion debt, and would actually enjoy a slight surplus to boot!

Of course, their actual unfunded liability — over $50 billion using correct accounting — hasn’t changed.

If that approach sounds fishy to you, you’re in good company.

……

After a careful selection process, PERS last year commissioned a second-opinion review by Wilshire Associates, which, on August 20, 2015, informed the Board that it was most likely to realize only an average annual return of 5.85 percent over the next decade — not the 8 percent minimum PERS must hit to avoid falling further into debt.…..

After a careful selection process, PERS last year commissioned a second-opinion review by Wilshire Associates, which, on August 20, 2015, informed the Board that it was most likely to realize only an average annual return of 5.85 percent over the next decade — not the 8 percent minimum PERS must hit to avoid falling further into debt.…..

PERS now finds itself in a Catch-22 situation: Because board members have for so long failed to face reality, costs will skyrocket if they should now adopt correct assumptions. Yet, failing to do so will only compound their initial mistake — and the resultant carnage — when the day of reckoning finally arrives.

Yup.

Need for pension reform becoming more urgent

Nevadans should brace for reduced services, higher taxes or both — the necessary consequence of the Public Employee Retirement System of Nevada (PERS) having badly missed its investment target last year, as the Review-Journal recently reported.

Every year, PERS debt grows by 8 percent. Consequently, if investment returns don’t at least match that rate, taxpayers must make up the difference.

Last year’s 2.3 percent return means PERS has now missed its target over the past five, 10, 15, 20 and 25 years — suggesting that another taxpayer-rate hike is on its way. Remarkably, this shortfall has occurred even though markets have nearly tripled from their 2009 lows, and currently sit at or near all-time highs.

Nevada’s soaring pension costs — ranked third-highest in the nation at 9.8 percent of own-source revenue, according to 2013 data from the Public Plans Database — aren’t just due to overly optimistic investment assumptions, however. Another factor is the extraordinarily generous nature of the benefits.

MORE ITEMS

Just a few things culled from stories from 2016:

Nevada one of the ‘California Rule’ states:

‘California Rule’ Case Could Bring National Pension Ripples

PHOENIX – The Supreme Court of California has a case before it with the potential to alter the political and legal conversations about pensions in the Golden State and beyond.

Within a few months, the state’s top court is expected to hear an appeal of a landmark pension ruling out of Marin County that challenges the decades-old precedent known as the “California Rule.”

An appellate court ruled unanimously in August that the Marin County Employees’ Retirement Association was free to modify the pension formula to reduce unearned benefits for current employees, a decision that flies in the face of the state Supreme Court’s 1955 ruling granting employees the right to continue earning pension benefits throughout their careers that are at least as good as those offered when they were hired.

……

Experts on pensions and bankruptcy said that the ruling has the potential to be far-reaching not only in how pension benefits are negotiated in California, but also in other states because of how influential the California Rule decision has been nationally.In a May 2012 paper critical of the rule published in the Iowa Law Review, Amy B. Monahan noted that courts in at least twelve states have cited the California Rule in their own pension decisions. She cited Alaska, Colorado, Idaho, Kansas, Massachusetts, Nebraska, Nevada, Oklahoma, Oregon, Pennsylvania, Vermont, and Washington.

“In nearly all of these jurisdictions, the courts adopted the California Rule without much discussion, appearing to merely find it the most attractive of the available non-gratuity options,” Monahan wrote.

Some states went on to subsequently modify the rule, and some states, such as New Jersey, explicitly rejected it, Monahan noted.

Nevada public pension costs cut deep into education funding, study says

Nevada is one of only eight states that experienced both declining per-pupil expenditures and growing pension contributions, according to the study from the conservative Manhattan Institute think tank.

“Teachers are feeling the effects of more and more of the state education budget having to go toward these legacy benefits, promises, instead of in today’s classroom,” said study author Josh McGee.

STAGNANT SALARIES

The complex public pension system is one that’s sparked much debate, both locally and nationally.

In Nevada, the pension contribution rate for regular public employees — including teachers, but excluding firefighters and police, who have a separate fund — is currently set by an actuary at 28 percent of entire payroll.

The public employer pays half of that cost, while the other half comes from all the public employees.

Teachers typically fall under a contribution plan in which the school district pays the entire contribution up front. In return, they might not receive a salary increase or may see a salary reduction from one year to the next.

The contribution rate is the estimated amount required to fund current benefits and pay off a portion of benefits accruing in the future, known as an unfunded liability.

The rate is higher than the previous 25.75 percent rate — and while pension costs have risen, money spent on other educational costs have declined, the study concludes.

From 2000 to 2013, total education expenditures in Nevada declined 13 percent, according to the study. Meanwhile, the necessary contribution grew by $380 per pupil.

…..

Contribution rates have risen due to a number of factors, she said, including the Great Recession that impacted investment markets. Nevada’s teacher shortage could also play a role in rates.Another factor is payroll growth, as contributions are conducted based on a percentage of the entire payroll amount. Payroll growth has been flat or negative since about 2008, Leiss said.

Nevada State Education Association Nick Di Archangel said the study makes a “strange connection” between per-pupil expenditure and employee contribution, two separate pools of money.

It’s often said — usually by the winners — that elections have consequences. That’s especially true at the grassroots level, where balloting for state and local races will likely have more community impact than the outcome of high-profile national races.

Democrats on Tuesday regained control of both the Nevada Assembly and Senate. That’s bad news for progress and reform on a number of different fronts.

Take pension reform, for example.

Few candidates for the Assembly or state Senate want to talk about it, and fewer still want to do anything about it. Yet as rising pension obligations swamp more and more jurisdictions, inaction becomes malfeasance. How long can taxpayers expect to fund lucrative retirement benefits for public employees that are unavailable to the poor saps in the private sector footing the bill?

…..

The Institute’s Robert Fellner points out that Nevada taxpayers and public employees contributed almost $1.5 billion to the system in 2013, which equaled 12 percent of all state and local tax revenue combined that year. That’s the second highest rate in the nation.

Ooops, there’s Robert Fellner again!

In addition, Mr. Fellner reports that about $600 million of that money went toward paying the retirement system’s debt, which has soared given its failure to regularly reach its overly optimistic investment goals. That money “provides no benefit whatsoever to the current worker, taxpayer or employer paying the ‘pension tax,’ ” he writes.

Officials with the Nevada Public Employee Retirement System argue that the benefits are set by statute and that most retirees receive more modest annual stipends. The average yearly pension for police and firefighters in 2015 was just below $60,000. For non-public safety workers, the number is $33,180.

But that latter figure is meaningless without accounting for years of service. And, in fact, Mr. Fellner notes that the “average” PERS recipient collecting $33,180 has worked an “average” of just 19 years. Imagine retiring in the private sector after less than two decades and collecting a guaranteed annual payout of more than $33,000 for life. The only place that happens is in Dreamworld.

…..

One obvious reform would be to transition the system — which has an unfunded liability of between $11 billion and $52 billion, depending on accounting metrics — from a defined benefit plan, which promises a specific annual payout based on years of service and salary history, to a defined contribution approach now common in the public sector and embodied in 401(k) plans.State Controller Ron Knecht has asked for a bill draft along these lines. But expect it to receive a chilly reception — particularly given the new makeup of the Legislature — until taxpayers demand reform at the ballot box.

Look out for further Nevada posts this week as I look at the assets & liabilities. We’ll see that the assets are actually just fine. The trouble is pretty much entirely on the liability side.

Related Posts

Mornings with Meep: Two Pension Stories and Skin in the Game

Happy Idea: Moving from Defined Benefit to "Defined Ambition"

Welcome to the Public Pension Watch: Hurray for New Jersey!