Public Finance: Illinois wants to tax ALL THE THINGS!

by meep

Obligatory meme:

Illinois considers applying sales taxes to more services

SPRINGFIELD — If you get your nails done at a salon or have your lawn mulched next spring, the service could be taxed under a plan Illinois lawmakers are considering to help fill a multibillion-dollar hole in the state budget.

The idea comes as part of a proposal to increase state revenue tied to a Senate compromise intended to break the state’s two-year stalemate over an annual spending plan. The “grand bargain” stalled last month before the revenue measure came to a vote.

The provision would tax eight service categories at the same 6.25 percent rate applied to most sales in Illinois. These newly taxable services constitute the second-largest source of annual funding in the proposal after the revenue bill’s income tax increase.

Here’s what the sales tax expansion would do:

LAGGING BEHIND ITS NEIGHBORS

Illinois has one of the narrowest tax bases in the nation — a potential problem for a state that, according to the Commission on Government Forecasting and Accountability, is more dependent on services than any of its Great Lakes neighbors.

The commission reports that Illinois taxes only 17 services compared to a national average of 56. And 12 of those come from public utilities levied under separate statutes such as the gas tax. Sales taxes do apply to five services including photo processing and car rentals. But that total puts Illinois behind all other surrounding states.

Oh dear lord.

Just stop.

BUILDING A BROADER TAX BASE

Hutchinson’s proposal would tax the use of storage space, including parking garages and boat docks; repairs and maintenance of personal property such as cars; landscaping services such as sprinkler installation and snow removal; dry-cleaning; cable TV, satellite and digital streaming services; pest control; use of a private detective or installation of a home security system; and personal care, ranging from tanning to tattooing but not including hairstyling. Some states tax other major services such as internet access and gym memberships. Illinois would not.

Taxing these services was originally projected to bring in $360 million per year, but an adjusted estimate now places that number at $291 million — a smaller piece of the $6 billion puzzle Hutchinson’s revenue bill must complete to help balance the budget.

Tom Johnson, president emeritus of the Taxpayers’ Federation of Illinois, said taxing services is a commonsense place to start because it targets purchases made most often by those with more disposable income.

I agree a broader base needs to be established. But can you not just do a level tax across the board for sales of goods/services?

The issue I’m seeing here is if it’s service-by-service, then you’ve got your lobbyist payoffs for tax breaks.

THE PROS AND CONS

Hutchinson says lawmakers are past due for a frank conversation on raising revenue as social service providers and universities await state funds and Illinois’ budget deficit grows by $11 million each day.

“Nobody can balance the budget on only one side of the books,” she said.

But Illinois Chamber of Commerce President Todd Maisch questions the practice of targeting selected services for taxation.“Every taxpayer should be very concerned when state government decides to pick winners and losers,” he said, adding that the tax would make small businesses less productive and crimp employee earnings.

Actually, if they cut costs, they absolutely could balance the budget. They aren’t thinking broadly enough.

That said, if they think they have to pay stuff like the pensions, then yes, revenue must be increased in some way.

ILLINOIS PENSIONS COST LOTS OF DOUGH

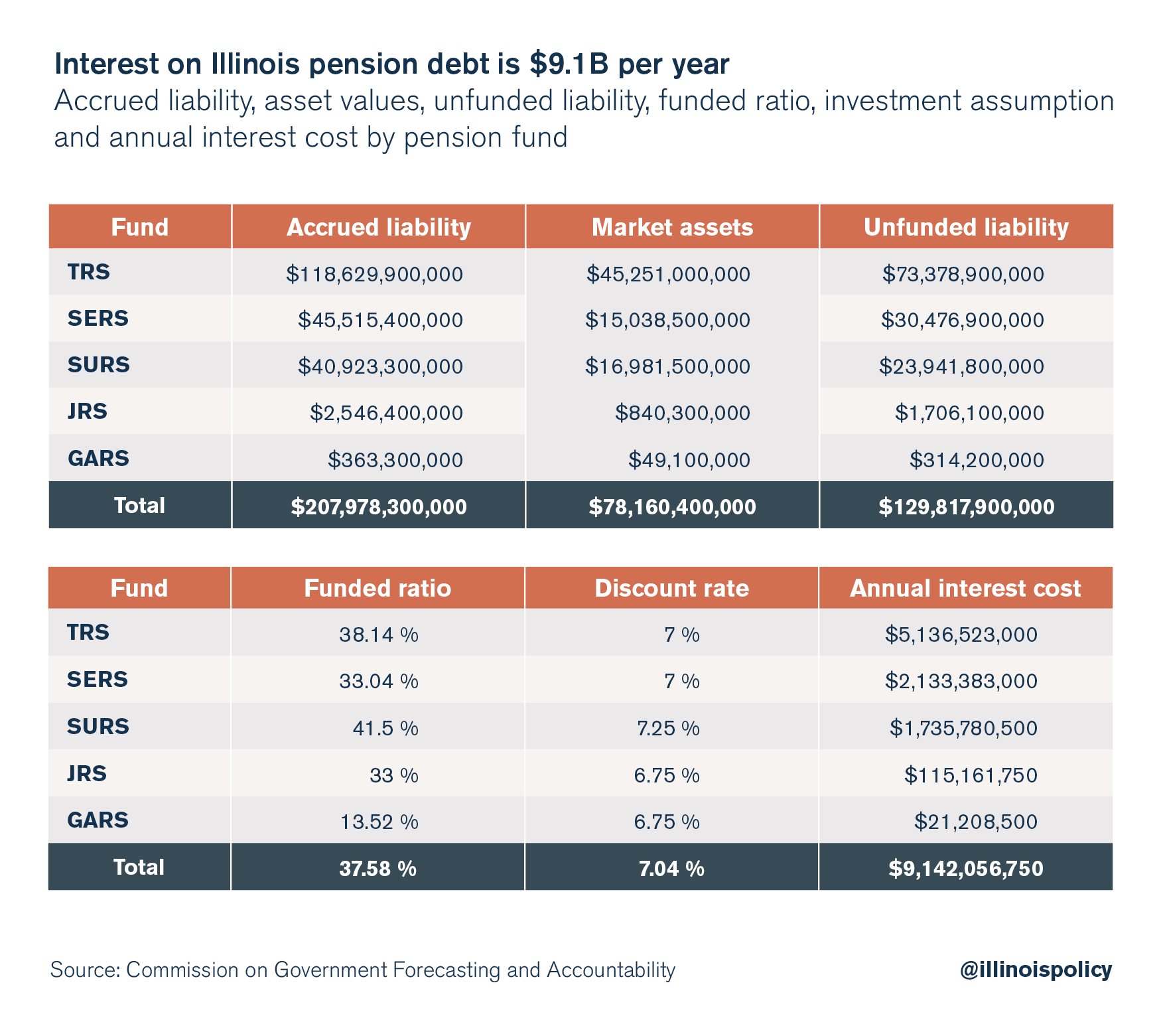

INTEREST ON ILLINOIS’ PENSION DEBT IS $9.1B PER YEAR:

Illinois isn’t covering the interest payments on its pension debt. Those interest payments total $9.1 billion a year.

This is the reason Illinois’ pension debt continues to grow. As with personal credit card debt, until the interest is paid off none of the actual debt gets erased. Illinois’ pension debt is so large that it’s unlikely payments will cover the interest on the pension debt until 2028, according to a November 2016 special pension briefing from the Commission on Government Forecasting and Accountability.

Illinois politicians have known for years about the state’s pension crisis, even if they have not taken serious steps to address the problem. Gov. Bruce Rauner recently spoke out on the cost of interest on the pension debt.

They aren’t even covering the pension interest costs, much less the newly-accrued pension liability earned in a year (for just the state plans). See the full item for details.

I decided to look up Illinois state revenue. Did you know the U.S. Census Bureau keeps track of that?

Total taxes for Illinois was $39 billion in 2015.

Of that, $16 billion was taxes on sales and services; $20 billion was income tax.

How much of taxes do pension costs eat up? I’m glad you asked!

Twice the rate of other states. That’s how much. I thought Nevada looked bad. And the Illinois costs are still probably measured too low. But then, that’s true for most public pensions.

In any case, the point is that if they can’t cut the pension costs (indeed, if they’ll only grow), then one must expect taxes to go up to cover them.

TAX REVENUES HAVEN’T BEEN UP TO SNUFF

So here’s the deal. They keep raising tax rates and what is taxed in Illinois.

The actual revenue is lacking.

‘Like a Broken Record,’ IL State Revenue Dropped Again in February; Downward Projection Expected – Wirepoints Original

Posted March 2, 2017

By: Mark Glennon*

Base revenues for the State of Illinois fell again in February (compared to last Feburary) according to today’s report from COGFA, the Commission on Governmental Forecasting and Accountability. “Like a broken record,” COGFA says, monthly declines reflected weaker income taxes along with poor federal sources.

For the fiscal year-to-date, base receipts are off $1.453 billion, or 7.5%, compared to the same period last year. “Weakness is widespread, and has resulted in year over year losses in key areas such as income taxes and federal sources,” says COGFA

COGFA has scheduled a meeting for March 7 to discuss projected revenue revisions for the year, “with the likely outcome showing a significant downward revision necessitated by year to date performance.”

*Mark Glennon is founder of Wirepoints. Opinions expressed are his own.

Overall base revenues fell $423 million in February. Like a broken record, monthly declines reflected weaker income taxes along with poor federal sources. Unfortunately, February’s lackluster performance was widespread with only a couple sources managing to show gains. One less receipting day likely contributed to the decline, though certainly not the primary culprit.

….

Through the first two-thirds of the fiscal year, base receipts are off $1.453 billion, or 7.5%. Weakness is widespread, and has resulted in year over year losses in key areas such as income taxes and federal sources. With renewed uncertainty of sales tax performance, and with only four months left in FY 2017, it will be very difficult to alter the trajectory of what has turned into a dismal year for revenues.

Let’s take that first item, and pretend that 28 days vs. 29 days made the difference. 1/29 = 3.4%.

And, more to the point, it can’t explain the 7.5% drop for 2/3 of a fiscal year. Only 1/3 of the FY to go, and revenues are down? Yeah, that’s unlikely to change. Better be hoping on that Trump economy to kick in sales taxes. If you weren’t so busy trying to boycott Ivanka Trump.

I don’t think this ploy to make for new tax categories is going to help a lot. Perhaps simplifying the taxes would help, and just get rid of exemptions. Might be able to get away with a lower tax rate that way, too.

PLOTTING SOME NUMBERS

This is not relevant to much but UGH the Illinois Dept of Revenue website is ugly. Hey, Illinois, you match my 1990s web style!

So I decided to grab their tax stats, to see what’s up. (I will just grab the state tax revenue… and because it’s all PDF, I’m just making a really simple spreadsheet.)

This is what’s up:

They don’t have a taxing problem per se. They definitely have a spending problem. State taxes have gone up well beyond the population amount.

The big problem, of course, is how much of the spending is baked in.

CHICAGO ALSO WANTS REVENUE

We already knew about Chicago’s desires, but let’s check out the latest fun.

Weekend parking crackdown yielding thousands of tickets

A crackdown on illegal weekend parking in Chicago has led to nearly 4,500 additional tickets being written so far this year.

To create parking turnover that helps businesses serve more customers and reverse a 5 percent drop-off in ticket writing, Mayor Rahm Emanuel’s 2017 budget called for having the city’s parking enforcement aides work in tandem with “contractor teams” on weekends.

City Hall is also upgrading the software used to issue parking tickets to include “data analytics” to help pinpoint where to deploy those weekend ticket writers for maximum efficiency.

…..

Downtown Ald. Brendan Reilly (42nd) said the weekend crackdown is “very helpful to local businesses” because it creates “more frequent turnover of parking spaces for other customers.”“The bulk of the enforcement is needed in the evenings and on weekends, especially in the hospitality corridors like Hubbard and Rush streets,” Reilly wrote in an email to Sun-Times.

“Folks are parking illegally in loading and tow zones, and valet companies park many of their customers’ cars illegally on the street.”

Suuuuure, it’s to improve shopping turnover.

I’m thinking it’s to improve city revenues.

Even so, that is likely to be a side benefit at a time when booting and ticketing are going in opposite directions.

The Chicago Sun-Times reported last fall that the city booted 4,995 vehicles a month during the first seven months of 2016, a 10 percent increase over the same period the year before.

That provided a windfall for the city on the heels of Emanuel’s decision to raise the booting fee from $60 to $100 and set the stage to give scofflaws the long-awaited opportunity to remove their own wheel-locking Denver boots instead of waiting for city crews to arrive.

City boot crews work from a list that includes more than 500,000 eligible license plates, many registered to motorists who live outside the city.

While booting was on the rise, the number of parking tickets issued during the first seven months of last year was down 5 percent, to 1.31 million.

So, what’s the net take? They have to pay the traffic officers/contractors, after all.

MICHAEL LUCCI TALKS ABOUT OUT-MIGRATION

Driven by taxes and other things:

Thousands of taxpayers flee Illinois every year. For those still in the state, is there really any reason to stay? On this edition of Against the Current, Dan Proft poses that question to Michael Lucci, vice president of policy at the Illinois Policy Institute, taking into account the state’s unfriendly business climate, tax and regulatory policies and quality of K-12 education.

Lucci explains who is leaving Illinois, why they are leaving and where they are going. What does Illinois need to do to keep them? What impact does out-migration have on Illinois?

Related Posts

More Puerto Rico: Round Up of Current Commentary and Followups

Taxing Tuesday: Save Us Rich People From Senator Candidates

State Bankruptcy and Bailout Reactions: More Reactions