Public Pensions, Fictional Scenarios, and Suspension of Disbelief

by meep

The following came to my attention yesterday morning:

On TV tonight on #DesignatedSurvivor President wants to fund a Public Pension bailout

— Chris Tobe (@tobecb) October 26, 2017

My response:

…i mean, my suspension of disbelief would be strained and I watch scifi/fantasy TV shows primarily

— Mary Pat Campbell (@meepbobeep) October 26, 2017

I don’t watch Designated Survivor (or much TV other than aforementioned fantasy/scifi — if you’re an Amazon Prime subscriber, check out The Tick! It’s great!)

So I looked up a recap of Season 2, Episode 5:

Kirkman Morals Win Again

The moment of truth has everyone on the edge of their seats. Lyor, Seth, Aaron and Emily all sit and stare as Kirkman sits on Carson Kramer Live, addressing Suckergate. He fails to use Lyor’s bait against Carson and admits that, yes, he told the truth. He believes the American people are suckers for believing in the American dream, but he includes himself in the fact that Americans believe in better tomorrows despite the obstacles they face, and this is why Congress must back the pension bailout bill. “Our boss may have just pulled off the greatest escape,” laughs Lyor.

Senator Carson enters the Oval Office where he announces to the President that he will support the pension bill. His wife Sonia has ovarian cancer and this bill will undoubtedly help his family. Carson also admits that he had an affair, but he and Sonia are now seeking counseling. Well, guess what was in Lyor’s little blue folder? You guessed it! The photos of Carson and his woman on the side. Kirkman advises him to take care of the issue now before it gets out. From here, Kirkman speaks with Senator Krantz who he reveals her secret. Her husband was one of the perpetrators who pocketed money. She now works as an advocator for those who deserve the money they earn. He finds that they both share the same luck and with that lucky, they should pay it forward.

I assume they never mention how much any of that cost. I’m sure that would have been super-boring.

But that bolded bit — can’t you imagine Trump tweeting that? Well, not in those words.

OTHER KINDS OF FICTIONS: FEDS HELPING ILLINOIS GET AROUND ITS CONSTITUTION

Speaking of my disbelief being stretched, there’s this:

Rauner looks to Washington for the power to change pension benefits

Stymied by a Democrat-controlled General Assembly and still in a contract dispute with the largest state employee union, Republican Gov. Bruce Rauner is looking to Washington for help advancing his agenda to weaken the influence of organized labor in Illinois.

He’s lobbying Congress to give states like Illinois the power to change public employee pension benefits, which he argues are overly generous because of a “corrupt bargain” between politicians and union negotiators. And the governor is hoping to get legal victories over unions at the U.S. Supreme Court, where the recent appointment of a new conservative justice could tilt decisions in his favor.

…..

Speaking to a gathering of business leaders in late September, Rauner said he was turning to Washington for help with one part of that effort — getting control of Illinois’ massive pension debt, which stands at about $130 billion and ranks among the worst in the nation.“We need the help. We need the help because the system’s rigged. Can’t change it, can’t fix it,” Rauner said.

As a candidate and as governor, Rauner had proposed cutting pension costs by transitioning workers to less generous benefit packages or 401(k)-style retirement plans. But past attempts to cut retirement costs have run up against legal problems. The Illinois Constitution stipulates that benefits cannot be “diminished or impaired” once they are bestowed to workers, and the state Supreme Court has stood by those words.

The governor thinks Congress can release the state from that restriction by passing a law that would give states permission to come up with cost-saving changes to their pension programs. The option would be available to states only after they had established that spending money on workers’ retirement plans is hampering other essential services.

Governor Rauner: Congress can’t amend the Illinois state constitution for you.

Mind you, it has been shown that pension benefits can be cut through federal municipal bankruptcy….key word: municipal.

But there are grave constitutional (specifically FEDERAL constitutional) issues in trying to extend this to states themselves.

“There’s so many things that we can’t touch because we’re unreasonably hamstrung,” Rauner said. “And the federal government can say, ‘No, federal restructuring law supersedes the state restrictions, Congress is freeing up states to restructure their pensions as they need to, as they see fit.’”

The idea comes from conservative policy circles but hasn’t been written into legislation that’s been seriously considered in Washington. Critics like Democratic Illinois Senate President John Cullerton said the idea raises “serious constitutional concerns.”

“Frankly, I find it troubling that a governor would turn to Congress and Donald Trump to try to invalidate his own state’s constitution,” Cullerton said. “If it starts with workers’ retirement security, where would it stop?”

This is one of the few things I agree with Cullerton on. It’s not just a matter of workers’ retirement security. It’s federalism, plain and simple. (I will come back to the “security” comment at the very end of this post.)

I am not a constitutional lawyer, scholar, or otherwise. I’m just somebody who grew up on Schoolhouse Rock shorts. And I got plain old Civics classes and had to pass a citizenship test in Maryland in high school.

The times the federal government has superceded a state constitution, as far as I know, involved a big war in which a bunch of states left the U.S., and they lost that war, and then new constitutions were imposed on these states during Reconstruction.

Yes, there’s the supremacy clause in the U.S. constitution, and all the Supreme Court cases seem to involve state statutes, not constitutions. This would be breaking new ground.

In any case, if there were political will in Illinois to cut these pensions, they would amend their state constitution. Running to Mommy Federal Government, even if it could pass such a law, would not be much of a help. If there’s no will to amend the state constitution, I doubt there’s will to go out and cut retiree benefits.

Rauner would have been better off staying in Illinois and trying to convince people the state constitution needs to be fixed to allow COLA cuts, retiree healthcare reductions, etc. All the stuff that had been stricken by the Illinois Supreme Court.

Reminders:

- 2014 July: Public Pensions Watch: Illinois Law v. Reality – Illinois state supreme court ruled that retiree health benefits could not be cut

- 2014 November: Public Pension Watch: Illinois Reform Goes Down (as Expected)

- 2015 May: Illinois Pensions: How Did We Get Here? The 1970 Constitution

But perhaps I misinterpreted what Rauner is trying to do. It’s not like he didn’t already know about the problem.

MARK GLENNON’S TAKE

Mark Glennon explains what’s going on with Rauner & the feds — Here’s What’s Really Going On With Bankruptcy-For-States Chatter – Wirepoints Original:

Now widely reported, initially by the Chicago Tribune, Illinois Gov. Bruce Rauner made some public comments last month that he talked to members of the United States Congress about federal legislation to allow Illinois to reduce some pension benefits, overriding the state constitutional ban thereon.

But what Rauner is saying and doing is only part of the story. There are two broad ideas afoot in Washington. Other states also have pension crises so this is about more than Illinois.

Breaking in: that’s an understatement.

One major, national, blue chip law firm is actively talking up the idea Rauner spoke about and another major, national blue chip law firm is actively promoting a broader concept.

Here are the specifics:

Rauner said, “We’ve got a bill now. We’re working with Congress to pass a law. We’re lobbying right now that would allow states to reorganize and restructure their pensions.” He added, “If we can get this bill passed in Congress, and I’m hoping to get it done with this tax overhaul that we’re doing, if we can get this bill passed, [it will be] transformative to Illinois taxpayers.”

He’s referring to a pension-only concept along the lines of what the Manhattan Institute has been promoting for about a year. See their article on it linked here. Let’s call it “Bankruptcy Lite.” It would give states the option to file for a limited form of bankruptcy under which just pensions could be reformed. It’s premised, however, on the federal bankruptcy power which is express in the Constitution.

The other concept is a fuller bankruptcy proceeding along the lines of the current Chapter 9 for municipalities or PROMESA, the bankruptcy-like statute passed for Puerto Rico. Specific modifications would be included for states themselves to file bankruptcy, but the basic elements of a full bankruptcy would be maintained, which include the power to adjust all debts (not just pensions), power to cancel contracts and a stay on litigation. For more background on the this concept, see our earlier articles linked here and here.

The municipal bond community would be delighted with Bankruptcy Lite. It would relieve states of some of their pension debt, leaving other debt untouched and freeing up more money for bond payments. Pensioners obviously would prefer the broader bankruptcy option because the losses would be spread among other creditors besides themselves.

Both concepts may seem extreme to most folks, which is to say they prefer a third option of doing nothing.

For now, that is.

But they’ll eventually see that doing nothing will devolve into the disorganized chaos of mass creditor litigation with arbitrary winners. More importantly, they’ll understand that bankruptcy-for-states is anything but a “bailout,” as some critics have said.

Bankruptcy is definitely not a bailout. Bailout is when the federal government throws a bunch of money at the states so that the pensions don’t get whacked. That’s not going to happen.

Back to Glennon:

To the contrary, denying states the option to adjust their debts is the bailout. Broke states like Illinois are a drag on the national economy. Their contribution to to the federal taxes is reduced and they suck up more Medicaid, food stamps and the like than they would if they were in recovery. When they try to tax their way out of their problems, as Illinois is doing, those taxes are deductible at the federal level so the rest of the nation is shouldering part of those tax increases.

None of this is to say that either option being discussed is a good one. This is about what’s unavoidable and inevitable. The facts dictate the options, and they are very, very narrow.

It will take time to sink in.

That’s not a bailout either. (And hey, wait for when SALT deductions go away!) At some point, Illinois won’t be able to cover the old promises made.

I’ve had this argument with Glennon and others before with respect to state bankruptcies. We’re essentially not in disagreement in terms of what would be good or bad options. There are no good options. It’s like World War I – there were bad choices, and there were catastrophic choices.

Our difference is primarily in what we think will happen more than what we want to happen.

Here’s more from Glennon on the issue of Illinois unfunded pension liabilities:

It all comes down to four simple realities most editorial writers can’t seem to get:

1. Unfunded pension liabilities have to be cut. That’s why nobody ever lays out a specific plan for dealing with them without cuts.

2. The only legal ways to cut them are a state constitutional amendment deleting the pension protection clause or federal bankruptcy.

3. The state amendment probably won’t work because of federal constitutional challenges and, in any event, it would take years to implement and litigate.

4. That leaves only bankruptcy.

If you go to the link, you’ll see Mark & I have a back & forth in the comments.

I think there would be federal constitutional challenges even if one went the federal law route and not the amending-state-constitution route.

The only plus in trying to do it on the federal level is that multiple states would come into play (like Kentucky, New Jersey, California…) and it could all be resolved for all states, rather than have it one-by-one.

But if the Supreme Court of the U.S. (aka SCOTUS) tells the Congress “nuh-uh, you can’t provide bankruptcy processes for states, even if only limited to pensions, because sovereignty” then that’s that.

STATE BANKRUPTCY LITE WOULD BE THE BEST OF AWFUL OPTIONS

I’m going to be grim: I think Glennon has an optimistic take on the situation.

Glennon thinks that eventually some kind of bankruptcy for states will be formalizes via federal legislation. He thinks there will be a orderly process to deal with de-facto-bankrupt state pension systems. Here is his argument, from June 2017, explaining he thinks the feds will allow for bankruptcies of states to discharge pension debt.

I don’t.

I think there will be cuts without any nicety of a judicial process. It will be a purely political (and reality) process. I don’t think people take this seriously until the cash actually runs out, at which point, it’s pretty much too late.

To be sure, there will be lawsuits, but funny how suing states doesn’t make money come into being.

And then there’s the matter of bondholders…. but that’s for another time.

SHORT TERM WARGAMING

But let’s step back and assume Rauner can swing the federal legislation bit (yeah, it’s not like Congress is progressing on much of anything right now, but let’s pretend.) So he goes back to Illinois and….

….then what?

We saw what happened with the state budget – he was overridden by Republicans, not just Democrats, in the back-and-forth. The various “neat tricks” to make pensions “cheaper” are illusory. And everybody knew it.

Rauner can’t get anything done within Illinois as it is. I don’t see that changing in the next year, or even the next decade, if he hangs around. While there’s no term limits for Illinois governors, the history hasn’t been good for longevity in office.

Which is interesting given how long people like Madigan and Cullerton have hung around.

It’s an intellectual exercise re: Illinois right now. It’s just like authorizing Chicago to pursue Chapter 9 bankruptcy. The Illinois state legislature could do it (and Chicago needs it), but it’s not like the politicians running things have the appetite for going through that process.

Yet.

For ideas like this, it’s obviously a longer-term game. You’ve got to start at some point.

But it may have helped to start with explaining why it’s a crisis well before the cash in the funds runs out.

RETIREMENT SECURITY: WHO WEAKENED IT?

Back to Cullerton’s “retirement security” comment.

Illinois public employee retirement security, for some of the funds, is already weak.

Because of decisions made over decades.

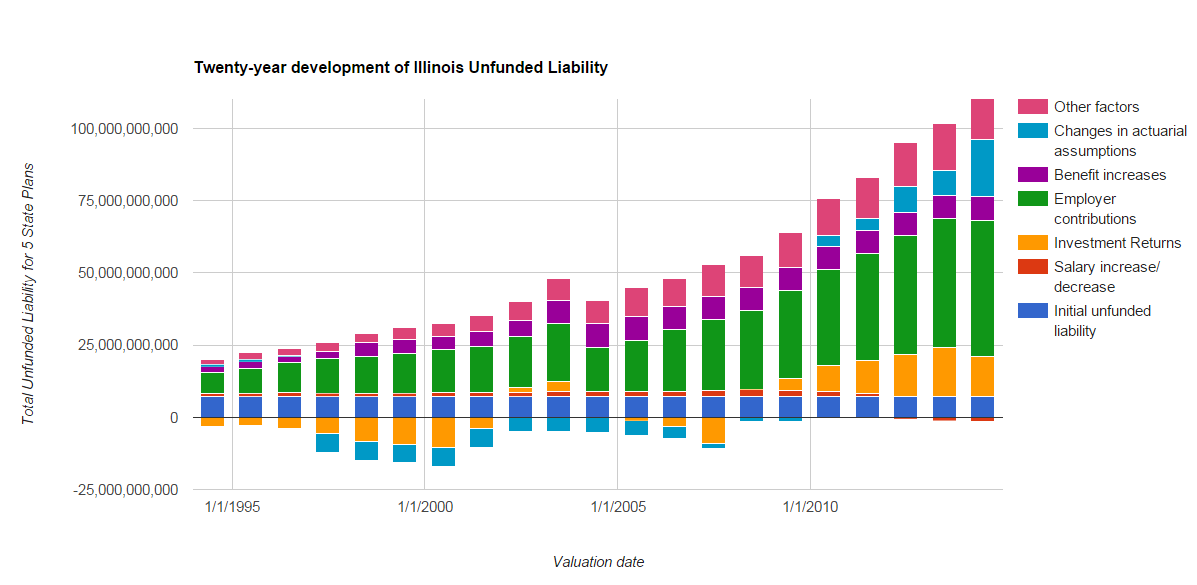

That’s the 5 Illinois state pension unfunded liability, by cumulative cause.

The green bar, the largest component, is undercontributions. Thirty years of undercontributions.

That was what undermined retirement security. Not Rauner. Not possible bankruptcy processes.

Hey, Cullerton — when did you enter the Illinois legislature? Oh look, been in the legislature continuously since 1979.

I would say that you, Cullerton, (along with Madigan and cohort) are the reason Illinois public employees need to be worried about their retirement security.

Maybe you should look into that. Or perhaps retire and get out while the getting’s good.

Related Posts

Kentucky Pension Blues: Let's Get This Fire Started

San Diego City ERS Has No Business Giving Out 13th Checks

STUMP Classics: The Fragility of Public Pensions Due To Can't-Fail Thinking