Kentucky Pension Battle: Reform Proposal Announced and Nobody's Happy

by meep

Last week, the governor of Kentucky unveiled his idea of pension reform.

Here’s a link to the official propaganda:

Highlights of the plan include:

“Keeping the Promise” will save Kentucky’s pension systems and meet the legal and moral obligations owed to current and retired teachers and public servants

Requires full payment of ARC and creates new funding formula that mandates hundreds of millions more into every retirement plan, making them healthier and solvent sooner

For those still working: no increase to the full retirement age, and current defined benefits remain in place until the employee reaches the promised level of unreduced pension benefit

For those retired: no clawbacks or reductions to pension checks, and healthcare benefits are protected

For future non-hazardous employees and teachers: enrollment in a defined contribution retirement plan that will provide comparable retirement benefits

For current and future hazardous employees: will continue in the same system they are in now

Closes loophole to ensure payment of death benefits for the families of hazardous employeesStops defined benefits plan for all legislators, moving them into the same defined contribution plan as other state employees under the jurisdiction of the KRS Board

No emergency clause: law will not go into effect until July 1, 2018

Structural changes should improve the Commonwealth’s rating with credit agencies, which have downgraded Kentucky’s rating, citing unfunded pension burdens

Gov. Bevin will call the General Assembly into special session in the coming weeks to pass into law these much-needed reforms.

Can’t you feel the excitement?

Here’s their handy PDFed version — same as the plaintext you see above, but it’s also got a nifty logo and checkmarks in boxes.

So you know you can rely on it!

Here’s his video:

NUTSHELL VERSION

I’ll keep this extremely simple: I’m basing my nutshell on this doc, and I’m grossly simplifying certain things

- Current retirees won’t get touched at all.

- Retirement age doesn’t change

- New employees would be in a defined contribution plan (ignoring police/fire – aka “hazardous” – trying to keep this simple)

- Legislators all get bumped to DC plan – NO DB FOR YOU!

- In general, current employees get transferred from DB to DC over time. Looks like many will end up with hybrid of old DB and new DC, but the details differ by plan.

- The current, unfunded liability will get amortized level dollar (not level percent of payroll)

- Supposedly the ARC will be paid… in addition to that level dollar amortization

A few of the Kentucky news outlets have done their own nutshell/analysis versions. Here are a few.

- Overview of the proposed pension changes

- Bill would allow legislators to opt out of General Assembly’s pension plan

- Kentucky officials outline overhaul plan for deeply underfunded pensions

- Kentucky governor, GOP pension reform recommendations include shifting some workers to DC plans

- How Kentucky’s pension proposal would affect stakeholders

- Kentucky seeks big pension changes to stem tide of red ink

- Kentucky pension reform: Matt Bevin’s plan would cut legislators’ pensions

REACTIONS

I will get to my own reaction in a little bit. As you can imagine, this topic is very hot in Kentucky right now.

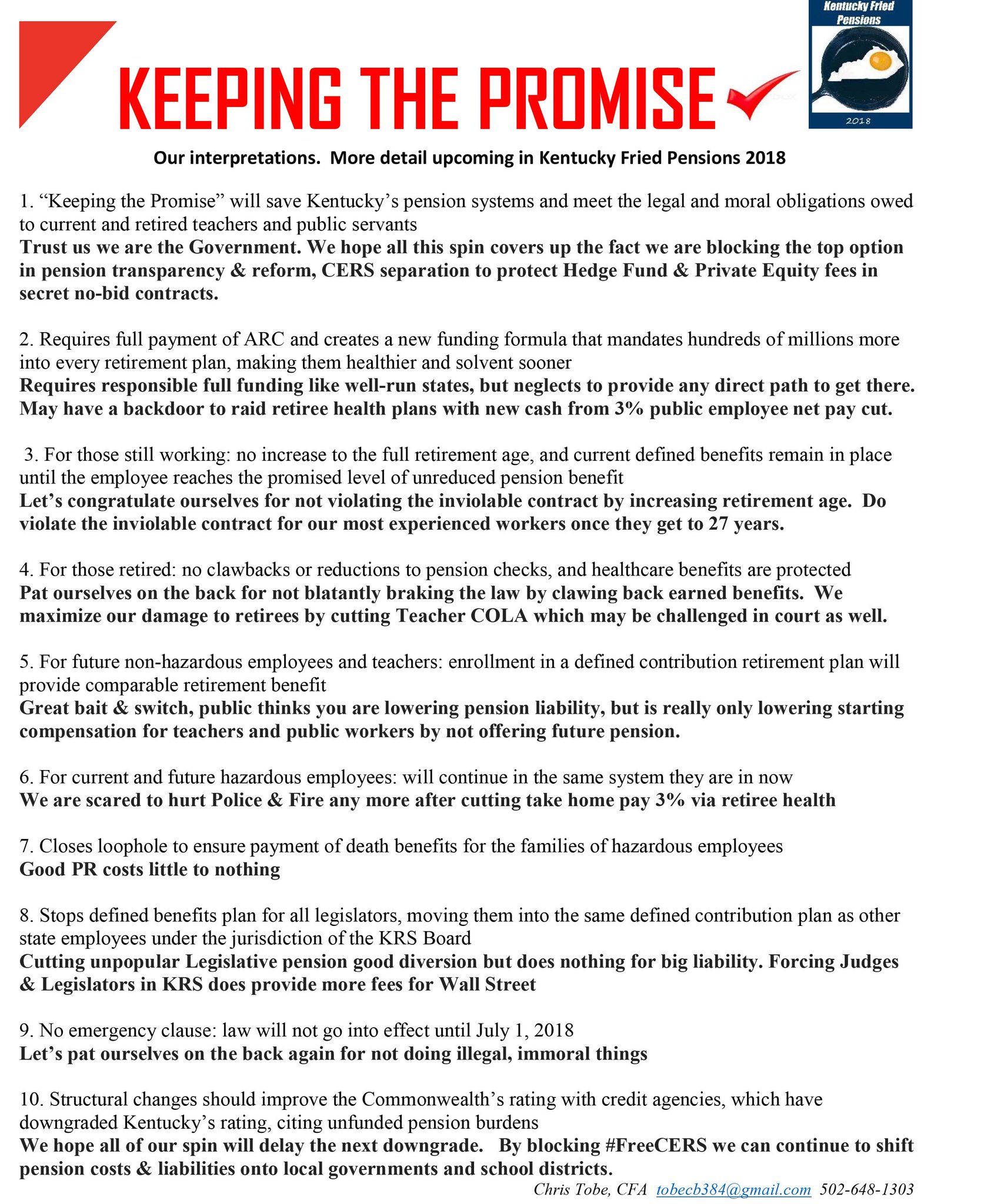

Here is Chris Tobe’s annotated list:

And an accompanying tweet:

S&P (the referee on pension information) doubts the legality of the Bevin Pension benefit cuts. The fact that legal opinions on these options have been withheld discredits this entire plan

BGPolitics</a> <a href="https://twitter.com/hashtag/KentuckyFriedPensions?src=hash&ref_src=twsrc%5Etfw">#KentuckyFriedPensions</a> <a href="https://twitter.com/KYHouseDems?ref_src=twsrc%5Etfw">KYHouseDemsKYSenateDems</a> <a href="https://twitter.com/KYSenateGOP?ref_src=twsrc%5Etfw">KYSenateGOPKYHouseGOP</a> <a href="https://t.co/kMhQSZx6zd">pic.twitter.com/kMhQSZx6zd</a></p>— Chris Tobe (tobecb) October 25, 2017

So, to keep it simple, let me just link to all the pieces:

- Bluegrass Beacon: Taxpayers deserve at least honorable mention in pension debate

- Bevin deserves credit for tackling pensions, but hard work is ahead

- University Senate meets to discuss pension plans, revenue shortfall

- Opinion: Three persistent myths about Kentucky’s teacher pension system

- Letter: Pension reform framework penalizes employees, lowers standards of living

- Northern Kentucky teachers rally against pension reform proposal

- It’s good. It’s horrible. Here’s what people are saying about Bevin’s pension reform

- Bevin’s Pension Plan Won’t Raise Retirement Age, Ky. Retirees Respond

- Bluegrass Institute responds to proposed pension plan

- Has Kentucky Lost its Pension Mind?

- Educators, lawmakers react to proposed pension system changes

- Covington mayor says pension proposal leaves more questions than answers

- Locals fear Governor Bevin’s pension proposal

- Experts say Bevin’s new pension plan is “sign of the times”

- Pension plan stiffs retirees, helps who?

- Retirement questions surface after pension plan announced

- Pension Rally Takes Place At Harrison County Courthouse

- At rally, Harrison Co. teachers react to governor’s pension proposal

- ELLIS: No one said pension reform would be easy

- Watch: Teacher’s five-minute rant to lawmakers at pension town hall goes viral

Here is the video of that teacher:

THE ANGER IS LATE

I understand the anger, but the time for anger was when this was happening: [this is a graph of the contributions made by the state, as a % of payroll]

The undercontributions for years is what undercuts your retirement security – not a change in law, not going to a DC plan (and you can buy income annuities with that money, but funny how those annuities cost so much more than public DB pensions value them at.)

People don’t take this stuff as real:

An eroding funded ratio, with no step up in contributions, is an indication that the state wasn’t planning on keeping the promise. It has built up over years. Have you been asking for the state to increase its contributions for all that time?

Yes, I know some people have… but not enough. Many figured that the money would appear… somehow… when the time came.

The time has come.

Where’s the money?

WHAT ABOUT THE COUNTY PLAN?

I’ve been following the #freeCERS campaign on twitter, where people want the Kentucky County plan – CERS – to be governed/administered/etc. completely separate from the state plan – KERS.

We appreciate the continued support for separation! #freeCERS

— FreeCERS (@freeCERSky) October 23, 2017damon_thayer</a> <a href="https://twitter.com/RepLinderKY?ref_src=twsrc%5Etfw">RepLinderKYPrattforKY</a> <a href="https://twitter.com/staterep78HD?ref_src=twsrc%5Etfw">staterep78HD https://t.co/dcKzBpICNt

Cities are continuing to pass resolutions calling for the separation of CERS, the latest from Science Hill. #freeCERS

RickGirdler4KY</a> <a href="https://t.co/Qgtfd7PLoy">pic.twitter.com/Qgtfd7PLoy</a></p>— KY League of Cities (KyLeagueCities) October 19, 2017

Here are two representative op-eds making the case:

Guest Opinion: Protect CRS from politics

BARNES: Time to separate CERS from KRS

I agree that CERS should be separated from KERS, for governance reasons if nothing else.

Thing is, CERS isn’t in a great position itself, even though they were paying 100% of ARC. That said, if they stood alone, they couldn’t point to KERS as an excuse anymore and would actually have to see that they are paying way too little for the benefits.

BOTTOMLINE: DOESN’T FIX THE PROBLEM

This doesn’t fix the problem per se — it recognizes the problem, though. So that’s one up on so many other approaches.

The big picture: Bevin doesn’t try to pretend he can just wipe away the already accrued unfunded pension liability.

And the approach he takes in discharging that unfunded liability — level dollar amortization — is more stable than level percent of payroll amortization.

So yay for level dollar amortization, and yay for realizing you can’t just legislate away the already accrued pension benefits.

But.

Where is the money going to come from?

Bevin pretty much admits that:

5. Lookout, 2018-20 budget

Assuming the bill passes this fall in a special session, the next chapter of the pension story may be more interesting when the 2018 General Assembly takes up the state budget for the two-year period beginning July 1.

One major provision in the plan calls for changing the basic way the state funds pension plans to a “level dollar” method that would spend a flat amount each year to cover state contributions to pay for pensions and the pension systems’ massive multibillion-dollar debts. But that method requires major increases in state funding for pensions starting with the new budget.

This approach takes an immediate bite out of the pension debt but, according to a summary of the plan, also “mandates hundreds of millions more into every retirement plan, making them healthier and stronger.”

Such increases are likely to require major spending cuts to other government services. “We are going to see a brutally difficult budget session,” Bevin said.

Jason Bailey, executive director of the Kentucky Center for Economic Policy, said, “We are likely to see major new cuts in the next two-year budget if a framework like this moves forward without new resources on the table.” [aka new taxes]

But it’s easy to pass this law saying to make the full contributions — but the law for appropriations will be in the budget.

Just take a look at Chris Christie — got a law passed about “required” contributions to the NJ pensions…. and. Well, this will give you an idea:

The law said make full contributions. The budget that was actually passed kept underfunding.

I haven’t tried looking at the itty-bitty details, and some have called into question the constitutionality/legality of the moves.

It’s going to take a while before there’s an actuarial analysis of this proposal, I’m guessing. And I hope the legislators require one before voting (unless they’re just going to vote it down, in which case, whatever. It’s obvious no Democrats will vote for this.)

While we wait for actuarial analysis, you can check out my overview of Kentucky pension asset trends and Kentucky pension liability trends.

Oh, and where I project Kentucky ERS running out of money.

Enjoy.

Related Posts

Kentucky Pension Liabilities: Trends in ERS, County, and Teachers Plans

STUMP Podcast: Choices Have Consequences: Retirement Policy

Friday Special: Social Security and Medicare Trust Funds - What's Real?