Chicago and Illinois Update: Strike Averted, but At What Cost?

by meep

So there was a last-minute deal with the Chicago Teachers Union earlier this week. There are various aspects to this deal, but I’m interested in the pension-related stuff.

This was what I read of the deal, initially:

It’s not yet clear how the Board of Education will pay for the new deal, or how much of the tax-increment financing money the union has sought as a solution for the cash-strapped district could be tapped.

According to the four-year agreement published early Tuesday morning, teachers will keep in years two, three and four the raises they get for added experience and education known as steps and lanes, raises the Board had suspended during negotiations. Cost of living raises of 2 percent and then 2.5 percent also are forthcoming in the third and fourth years of the deal, Lewis said. Teachers are currently in year two of the agreement that would replace the contract that expired in June 2015.

“The 7% pension pickup remains intact,” the union tweeted out — but Lewis clarified that only existing teachers would keep that much-discussed benefit that CPS decades ago had agreed to pay for them. New hires will assume that cost themselves, she said.

There’s stuff other than that in the deal, but that was the pension-related stuff I initially saw.

HOW MUCH WILL THIS COST?

So how much will this deal cost?

Costs of deal with Chicago Teachers Union not yet clear

Mayor Rahm Emanuel and the Chicago Teachers Union both declared victory after reaching a tentative contract settlement that averted a strike.

What wasn’t immediately clear, however, was the financial cost of the deal that was reached Monday moments before a midnight strike deadline.

To finance the deal for this year alone, Emanuel tapped nearly $90 million in tax increment financing district surplus, even though he had for months dismissed the idea of using TIF money to shore up the school district’s shaky finances.

Oh yay. A “win” on the TIF…. which is a one-time killing-that-goose-with-golden-eggs. That’s not an ongoing revenue source.

The point of TIFs is capital improvements, usually, for particular locations…. needless to say, pension pick-ups are not capital improvements.

Chicago Public Schools officials say the district would save $300 million over the life of the four-year contract. But a spokeswoman could not provide an accounting for that figure.

Oh lord. “Look how much I saved!” are the words out of every profligate’s mouth when justifying a bunch of extra expenditures they can’t actually afford.

An eight-page summary of the tentative agreement, which covers July 1, 2015, to June 30, 2019, indicates some uncertain financial consequences of the pending contract.

Oh really.

Tell us more about those uncertain financial consequences:

Civic Federation wants CPS to come clean about CTU contract cost

As the Chicago Teachers Union governing delegates prepared to meet next week to consider a tentative contract agreement that averted another teachers strike, the Civic Federation demanded Wednesday that Chicago Public Schools spell out the cost of the deal and questioned the wisdom a retirement incentive.

The retirement perk is tailor-made to replace veteran teachers who are paid more — and who would continue to contribute just 2 percent to their pensions — with younger teachers who will be paid less while also making the full 9 percent pension contribution.

Teachers who agree to take advantage of the offer will get a one-time payment of $1,500 for every year of service. That money would not apply to their pensions. But there’s a catch: The offer will kick in only if 1,500 teachers sign up for it.

There’s a similar, but cheaper, retirement option for teachers aides: $600 for every year of service. That offer will apply only if 600 aides sign up.

In either case, there is no age limit for any employees — they merely have to have worked a minimum number of years with the district, CPS said.

Wait, what is this crap? An early retirement incentive? I didn’t see that as part of the deal!

Civic Federation President Laurence Msall on Wednesday raised red flags about that incentive.

“Too often, there are unintended consequences and severe costs to government from offering early retirement,” Msall said.

Tell me about it. This is ridiculous. I hope the article reports it correctly and is showing a lump sum enticement, as opposed to an enhancement to the base pension amount, but I’ve seen all sorts of switcheroos on early retirement incentives, and it was never to make them cheaper.

UNAFFORDABLE FOR CHICAGO

Looks like Mayor Rahm is looking at a large increase in pension contributions:

Chicago mayor budgets 21% increase for pension contributions this fiscal year

Chicago’s pension contributions to its four funds could reach $1.03 billion in fiscal year 2017 under Chicago Mayor Rahm Emanuel’s budget proposal released Tuesday.

Mr. Emanuel’s budget proposal calls for $500 million for the $2.3 billion Chicago Policemen’s Annuity & Benefit Fund in fiscal year 2017, which started July 1; $267 million for the $4.6 billion Chicago Municipal Employees’ Annuity & Benefit Fund; $227 million for the $806 million Chicago Firemen’s Annuity & Benefit Fund; and $36 million to the $1.2 billion Chicago Laborers’ Annuity & Benefit Fund.

Mr. Emanuel’s budget represents a 21% increase from last year’s budgeted amount of $849 million.

Oh wait. That’s not including the schools pension cost at all. I don’t want to get into why the schools are treated separate of the other Chicago groups. But every time you hear about Chicago pension deals, you have to look closely to see if they’re talking all the pension obligations tied to Chicago, or everything excepting the teachers pension:

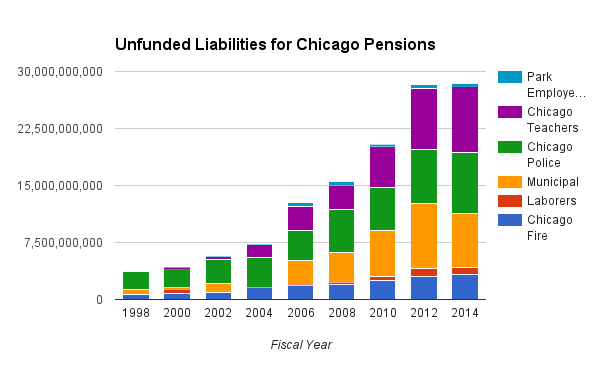

I always throw it in.

From the Illinois Policy Institute, 3 Reasons Chicagoans Can’t Afford the Agreement:

Here’s why Rahm shouldn’t have caved to the CTU’s demands:

Chicago taxpayers are already overburdened.

This latest contract will likely cost CPS hundreds of millions of dollars that they’ll pass on to Chicagoans through additional taxes.

The problem is, city residents and businesses are already overburdened with an oppressive amount of taxes and fees.

Chicagoans already pay more in taxes and fees – including property taxes – than residents in any other major Illinois city. Chicagoans pay almost double what residents in Cicero – the next most taxing-city – pay.

Speaking as a person living in the actual highest-tax place in the country, I find this hand-wringing grimly amusing. The only thing that makes me happy about this is that we are doing our damnedest to pay for what we promise, so no unhappy surprises down the road.

Back to the two other reasons:

2. Ordinary Chicagoans already struggle to pay for teachers’ top-ranked salaries.

CPS agreed to the CTU’s demand for salary increases despite the fact that, according to a 2014 report from the National Council on Teacher Quality, Chicago teachers already earn the highest lifetime earnings compared with teachers in the 10 largest school districts in the nation.

Private-sector Chicago workers, who make a median salary of $32,000, will be forced to pay additional taxes to provide raises to CPS teachers, who make an average of nearly $73,000 a year.

…..

3. Chicago taxpayers already pay for millionaire teacher retirements.The high salaries CPS pays its teachers translate directly into generous pension benefits. The average pension for a recently retired career (30 years or more) Chicago teacher is now $72,000. A career teacher can expect to collect $2 million in benefits during his or her retirement.

In all, the pension benefits promised to Chicago teachers have grown by 400 percent since 1987. That’s an annual rate of 6.1 percent a year, more than twice the rate of inflation and far faster than the growth than CPS’ revenues or Chicagoans’ incomes.

Again, where I work has extremely highly-paid public school teachers, and high pensions.

And we’ve been paying for it.

So here’s the deal: there were already very expensive promises being made in Chicago. They added a little more with the early retirement incentive. They didn’t make it any cheaper by making veteran teachers pay the portion of contributions that all other employees make.

Which reminds me: I love the “screw the millennials!” aspect of the deal that the younguns are going to have to make the full 9% contribution while the people who already go there are paying only 2%. It’s nice to finally see my generation (Gen X) getting in on the screw the young behavior. I like feeling old.

And when a union agrees to a “screw the young!” (and I don’t mean the schoolchildren) strategy in contract negotiation, I assume that they think their union is already going to weaken over time, so they don’t have to worry about solidarity.

Usually we see the undermining of solidarity when it comes from active workers (who pay dues and can strike) versus retirees, but it’s lovely to see it when a union does it against yet-to-be members.

They may also be strategizing that they can go and clawback the 7 percentage point difference in future contract negotiations…after all, they’ve done various clawbacks before.

NO HELP FROM ILLINOIS

Surely, the state can step in and help defray these costs.

You mean the state that has trouble making state pension contributions?

Illinois warns bondholders about possible pension payment delay

Ahead of the sale of $1.35 billion of debt on Thursday, Illinois issued an ominous warning to potential bond buyers that it may not have enough money to make its fiscal 2017 pension payments on time.

The nation’s fifth-largest state, which is limping through its second consecutive year without a complete budget, said it is possible that its five retirement systems may not receive payments when due because the state’s general fund may be low on cash.

“A failure by the state to meet its payment obligations may result in increased investment risk for bondholders,” the state said in a supplement to its bond sale prospectus released late on Tuesday.

Illinois already has the lowest credit ratings among the 50 states. A budget impasse, along with a $111 billion unfunded pension liability and a growing pile of unpaid bills, have pounded Illinois’ ratings into the low investment-grade level of triple-B.

The supplement said that without full and timely payments, the pension funds may have to sell assets to raise money to cover retirement benefits. That in turn reduces investment returns, driving up the unfunded liability. Illinois owes the pension funds $7.826 billion in fiscal 2017, which ends June 30.

That state?

To be sure, it looks like they’ve reduced their floating rate exposure, so that’s good.

And yes, that lack of ability to make planned contributions sounds more like a short-term liquidity issue (hmmm, have we heard that one before?)

But here’s the deal: has the state made full pension contributions in the first place? Let’s see!

Illinois Teachers:

The underfunded liability development for the state plans:

See the big green bar? That’s the accumulated underpayments. It’s a huge reason the pensions are underfunded.

So ignore that short-term liquidity issue and look at the very long-term underpayment. The state can’t give much help.

BAIT AND SWITCH?

The editorial board of the Chicago Tribune has a question:

Editorial: CPS, CTU and taxpayers: What happened to Mayor Emanuel’s ‘shared sacrifice’?

The good news: Classrooms opened Tuesday for Chicago Public Schools’ 378,400 students. The city averted a teachers strike — for now. But at what cost?

Chicago Teachers Union members still have to vote on the tentative contract, which includes the continuation of a generous perk: Teachers now in the system will keep paying just 2 percentage points of their 9 percent employee share of pension contributions. Taxpayers will keep picking up the rest. Nearly every other city worker pays the full 9 percent.

…..

We don’t yet know the price tag of the contract. So far, it’s tough to see where the teachers gave up much of anything. Where’s the “shared sacrifice” often referenced by Mayor Rahm Emanuel and other elected officials? As often is the case with public sector workers, the threat of a disruptive strike was enough to dissolve whatever gumption Emanuel and district officials had stockpiled. By keeping the pension pickup in place for current teachers, taxpayers lose out on desperately needed short-term savings of roughly $127 million annually. Even an impartial arbitrator ruled earlier this year it was not unreasonable to ask teachers to pay more toward their own pension costs. No matter.…..

Taxpayers have shouldered the maximum property tax levy for 22 of the last 25 years. District officials continue to rely on borrowing for day-to-day expenses at alarmingly high interest rates. CPS budgets for years have been balanced only on paper; this year’s budget depends on money from Springfield that’s contingent on a statewide pension deal that for now is a daydream. And raiding tax increment financing districts will never be enough to reverse the structural deficit of CPS.

Officials, parents worry Chicago schools deal won’t stick

Teachers in the nation’s third-largest school district pulled back from a threatened strike after a tentative last-minute contract agreement that Chicago officials acknowledged Tuesday may amount to a temporary fix and parents worried would fall apart.

“It wasn’t easy, as you all know,” Chicago Teachers Union President Karen Lewis said after Monday’s late-night agreement, which now goes to the union’s House of Delegates and all 28,000 members for a final vote. Vice President Jesse Sharkey said Tuesday that he’s “confident that it’ll pass” because it has wins for students and for school workers.

…..

One casualty due to the TIF money diversion, which required several aldermen to sacrifice projects in their wards that would have been paid for with those funds, was a $60 million selective-enrollment high school to be named after President Barack Obama. Alderman Walter Burnett said he agreed to sacrifice it indefinitely; the proposed school and its name stirred controversy when Emanuel announced it in 2015 due to its location on the near North Side — far from where Obama built his political career on the South Side.

Hey, shared sacrifice.

Parents and others who dropped off children Tuesday remembered the teachers’ strike of four years ago and worried that, somehow, the current agreement would fall through.

“I just think that this is a temporary fix and I believe that the solution coming out is temporary,” said Keisha Smith, who was dropping off her 6-year-old granddaughter at Ronald E. McNair on the city’s West Side. “We have to remain mindful that this is something for now … like a Band-Aid and the issue is not resolved.”

Yeah, I think they know the money is not there.

And here’s a nice non-pension aspect of the deal: throttling charter schools.

The Chicago Teachers Union (CTU) got the tentative deal they wanted Monday night and a strike has been averted, but hidden in the complex collective-bargaining negotiations is an unprecedented attack on school choice directly from the teachers’ union. What makes this deal unique is that it includes an item restricting any growth of charter schools in the whole district — both new schools from opening and existing schools from increasing current enrollment. CTU sees the restriction of charters as part and parcel of their unionized teachers’ salary and job security.

Thing is, there are unionized teachers at some of the charters, but obviously they’re not part of the CTU.

We have seen increasing expenditures on charter schools (the lavender “tuition” portion of the bar in this graph)

I guess clawing back money from any competing group is looking out for union members. As opposed to the “screw the younger members” aspect.

We’ll see if the union officially accepts the agreement. I doubt they can get “better”, but it’s not at all clear that Chicago can pay for this contract for more than a year, if that.

ADDITIONAL: Mayor Rahm gives up to 30% raises to staff. That’s gotta be sweet. I don’t think I’ve ever gotten a raise that high.

Related Posts

Update: Why Have "Full Contributors" Lost So Much Ground In Twenty Years in Public Pensions?

Pennsylvania Pension Trends: Assets

Some Public Pensions Take (Small) Losses from FTX Disaster... But What About Other Alt Messes to Come?