Are Public Pensions in a Crisis? Part 3: Is It Just an Accounting Problem?

by meep

I led with the Brookings paper, just because it doesn’t make me particularly angry, just tired.

Yes, IF this and IF that, everything can be okay. But some plans are in a bad place. Fine, I agree.

The following, I had a bad reaction to, just due to what the author wrote before. That said, I saw some good stuff in there, and I’ll be pointing out some of the good points along with the bad.

PENSION FUND ORG RELEASES PAPER

In July, a paper on this topic was published/sponsored by the National Conference on Public Employee Retirement Systems, which describes itself as:

The National Conference on Public Employee Retirement Systems (NCPERS) is the largest trade association for public sector pension funds, representing approximately 500 funds throughout the United States and Canada. We are a unique network of public trustees, administrators, public officials and investment professionals who collectively oversee nearly $3 trillion in retirement funds managed on behalf of seven million retirees and nearly 15 million active public servants — including firefighters, law enforcement officers, teachers, and other public servants.

Founded in 1941, NCPERS is the principal trade association working to promote and protect pensions by focusing on Advocacy, Research and Education for the benefit of public sector pension stakeholders…It’s who we ARE!

So let’s look at what they funded here. First, their press release:

New Study from NCPERS Lays Out Case for Revamping Pension Accounting Standards

Public pension accounting methodologies devised by the Governmental Accounting Standards Board (GASB) produce flawed results and are in urgent need of improvement, according to an independent study released by the National Conference on Public Employee Retirement Systems (NCPERS).

“When things go awry for some pension plans, it is often not because the accounting rules are ignored but because they are followed,” the study’s author, Brown University researcher Tom Sgouros, wrote in “The Case for New Pension Accounting Standards.”

GASB rules can mislead decision-makers’ views as to the health of a pension system, prompting poor decisions, the study found. The study recommended developing different rules that will address some of these shortcomings. By improving the rules, GASB could provide a better way to evaluate pension system health and provide better guidance to decision makers.

You might actually be surprised to find that I agree with some of what they have to say — GASB rules do encourage some of the positive feedback loop problems I mentioned in the first post of this series. The accounting rules reward injecting more risk into a public pension plan, even though it can make the situation more financially precarious.

But let me not interrupt:

“One of the many quirks of today’s pension accounting rules is that they value the promise of future contributions at zero, which is unlike any other government obligation, from revenue bonds to purchase orders,” Sgouros said. “As a result, the strength of the economy behind the pension plan counts for nothing from an accounting perspective. That is clearly a disservice to pension plan participants.”

This is where they lost me. It’s not just that they have Mr. Never-Fully-Funding-Is-Just-Fine as their researcher, but that “promise of future contributions” has tended to be completely groundless.

Does anybody have to bring up the frickin’ Edgar Ramp? Heck, who remembers this lovely Connecticut contribution “promise”?

That pattern was never going to happen in reality.

Let’s get back to the press release.

“We hope this study will help policymakers recognize that the rules themselves promote flawed decision making about public pension systems,” said Hank H. Kim, NCPERS executive director and counsel. “For example, the intense focus on the funding status of pension systems overlooks the fact that pension systems continue to meet all their obligations.”

Yes, it’s all fine until it’s like Prichard, and retirees go without any payments for over a year. What would funded status have to do with that?

Among the study’s criticisms: GASB’s rules are inconsistent in the way they regard pension “debt,” downplay the collective nature of pension investments, and downplay or mask risk in a variety of ways, such as treating all asset categories as equal. For example, the accounting rules imply that closing a fully funded pension plan is nothing more than applying pension assets to extinguish the debt, while in reality it is quite risky and many closed plans wind up costing plan sponsors millions of dollars.

The result of GASB’s approach is an analysis of public pensions’ health that is focused on the highly subjective measure of their funding status.

For public pension funds, “Following the rules closely means hiding some risks and exaggerating others, attending to unimportant details while ignoring important assets, and basing momentous decisions about the distant future on layers of guesses while delaying the consequences of poor decisions until the decision makers are long gone,” the study found.

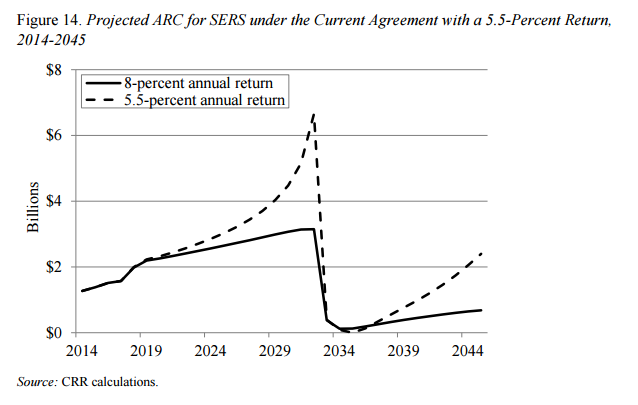

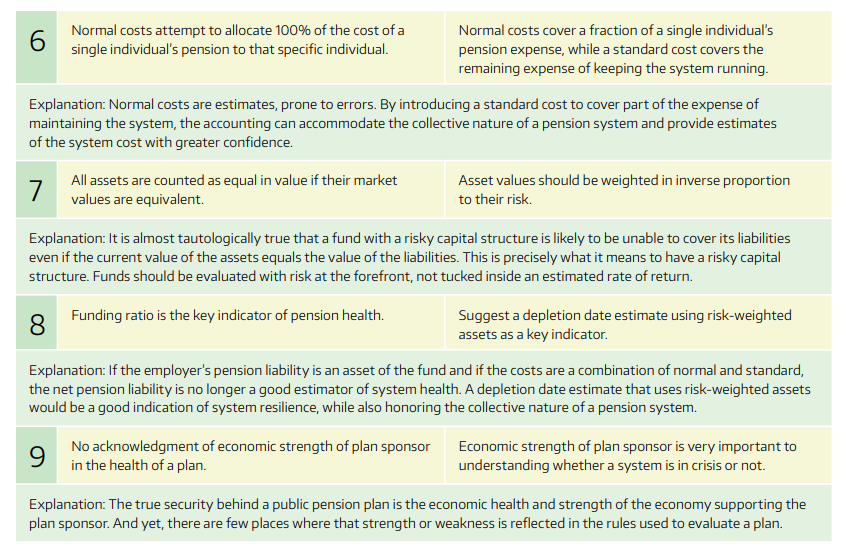

The report outlines nine specific proposals to change accounting methodology and the way accounting is used to inform policy, with the goal of providing more realistic assessments of pension systems’ financial position. For example, the study made the case for abandoning the funding ratio as a key indicator of pension systems’ health. Instead, pension plans should shift to a depletion date estimate using risk-weighted assets as a key indicator.

In another example, the study said estimates of net pension liability figures should not be held out as a basis for policy decisions. These calculations are inherently flawed because they result from subtracting low-accuracy liability figures with high-accuracy asset figures, the study found.

I highlighted one line, because I’m going to come back to this in part 4 of this series — does closing a DB plan to new entrants really make it more expensive? (I’ll let you ponder that one til I get part 4 up, on Thursday).

I like how they mention “low-accuracy liability figures”. Yes, by all means, let’s do some stochastic valuation and put a confidence interval on the costs. We all know that, ultimately, one set of cash flows will emerge, and one path of experience. But if we’re trying to plan, it’s good to see all the places it can end up, which includes figuring out the possibility the funds run out.

Like with the Brookings paper, I agree with some of what they have to say — pension accounting rules do hide some risk, such as the leverage from the fake arbitrage that is pension obligation bonds. The rules encourage that sort of behavior, and that makes a precarious system worse.

In any case, that was the press release. Let’s turn to the research/position paper itself.

THE CASE FOR ACCOUNTING CHANGES: CRITIQUE OF CURRENT

The position paper is called The Case for New Pension Accounting Standards

There are two parts: a critique of the current approach, and recommendations for a new approach (or new approaches).

Let’s look at the top points of the critique, from the executive summary. They are bullet-pointed, but I’m going to number them for easier navigation.

1. The GASB treatment of a pension liability as equivalent to a debt is questioned. A debt, for example, is owed to someone, but there is no one who can book the unfunded liability of a pension plan as an asset. It is not plan members, since they are owed the money regardless of the funding status, but if not them, who?

This is so idiotic, and I will explain why.

Do you, gentle reader, own any type of insurance as an individual? Say, life insurance?

Do you book the life insurance as an asset? (whatever that’s supposed to mean)

It is an asset for you, by the way, but individuals generally don’t have to deal with keeping a full balance sheet, unlike entities such as a life insurance company. The only time full net worth for an individual is reckoned up is generally at a death (which is one reason why wealth taxes are idiotic.)

Of course, the insurance companies do have to book whatever is owed to you, following some fairly complicated rules, as a liability. The promises made are definitely a “debt” or a liability, even if the timing (if not the amount) is going to be a lot more uncertain than pension promises.

If this is what one leads with… dear lord. This requires somebody who just barely passed one semester of an accounting class, who remembers that assets and liabilities tend to pair up.

Just because one side is not formally accounting for a promise does not make it a non-asset.

If the argument is that one cannot sell that pension promise to someone else… ugh. Do I have to go through restricted asset crap? Do I really?

This is so fundamentally dishonest, just to lead with this. Tom Sgouros ran for treasurer of Rhode Island, so one would hope he’d understand the philosophy of accounting, and it’s pretty clear to me that he prefers playing games.

2. Several ways the current accounting rules mask risk and provide unjustified precision, allowing plan managers to be comforted when no such comfort is warranted—or alarmed when they should relax, a risk that appears of equal significance to those who closely follow the issue. For example, under common conditions, a system that is making its investment targets risks losing money nonetheless, something that is not at all apparent from the calculations prescribed by the GASB rules. This is particularly relevant in the case of a closed plan.

I agree that having to put down a point estimate is misleading.

It’s why insurance companies not only hold reserves, they have to put in risk capital on top of that. Maybe they use reinsurance to limit the potential range of results. And then there’s stuff like cash flow testing, ORSA, stochastic testing, etc. Insurers know there’s a wide range of possible outcomes.

Of course, accounting doesn’t allow one to put down a range of values for the balance sheet (nor the income statement). But just because a point is being reported does not mean insurance company management is ignorant of reasonable ranges of results.

I even agree that one can hit the time-weighted target and have dollar-weighted return problems.

3. The GASB rules are philosophically at odds with the nature of a pension system as a mutual aid compact among plan members. It is not easy to disentangle the contribution of individuals from such an arrangement, and attempting to be rigorous about it threatens to undermine the system.

Hey, maybe all those mutual life insurers could teach you how to do it.

I worked at TIAA, and I have a pretty good idea of how they disentangle the contributions attributed to individual members. They tracked it better than any mutual insurer I know out there.

Yes, it’s complicated. TIAA has been doing it longer than many public pension plans have been around.

Why not ask them? Just because it requires work does not mean it’s untenable.

4. The economic impact of pension fund accounting rules has likely been much more significant than widely assumed. There are over $4 trillion in state and local pension assets, the vast bulk of which were accumulated between 1980 and 2010. At the end of that period, federal GDP was about $19 trillion, but it took 400 years to grow so large. In other words, there have likely been years in the recent past when the bulk of the nation’s economic growth was poured into purchasing sterile financial assets rather than into investments that would create economic growth.

My face. Ow. My face.

Yes, I agree, pension obligation bonds are sterile.

That’s what you meant, right? (actually, it may be.)

PROPOSED CHANGES

So, this one is less easy to copy & paste, because of how this compare-contrast is structured.

I am simply going to take some screenshots.

I actually agree with a lot of these points — at a high level. The devil is in the details, though.

I agree that there’s a range of liability outcomes, compared to market valuation of assets. However, that’s because instead of looking at the liability cash flows and discounting them at a near-risk-free rate, they’re trying to value the liabilities by the extremely variable asset cash flows. Well, that’s just silly. I think the assets & liabilities need to be valued separately, unless there’s an explicit tie in the cash flows between each (such as with a longevity swap.)

Sgouros tries to get around that by saying riskier assets need to be “weighted less”. No, I think it’s that the market value already baked into the assets’ risk (unless you’ve got alternative assets… which do need to be discounted more heavily than they are). But that you’re trying to value liabilities as if they were risky assets themselves.

I agree that one should note sponsor financial strength in trying to determine whether a plan is in a good position. I definitely agree that the funded ratio is insufficient in determining whether a plan is financially sound. The two together could be helpful.

I really like this idea:

Suggest a depletion date estimate using risk-weighted assets as a key indicator.

And obviously, this should be a range, as the assets are riskier than the liabilities.

This would really help out showing that very risky assets supporting “sure-to-be-paid” pensions is not necessarily a good idea.

AGREEMENT: PENSION OBLIGATION BONDS INCREASE RISK, NOT DECREASE IT

I’m trying to be positive, so let me pull out the good ideas in the paper.

This is what Sgouros has to say about pension obligation bonds:

Because of the GASB rules, a pension liability appears as a debt on the balance sheet of the plan sponsor, along with other debt. If one debt is as good as another, it makes sense to consider substituting a debt with a lower interest rate for one with a higher rate, and this is what a pension obligation bond (POB) does. It’s a simple, common-sense policy that is actually fraught with risk, masked perfectly by the presentation of two very different debts in exactly the same way.

I totally agree. They should both be valued at the same interest rate.

Issuing such a bond is actually a very risky form of investing on the margin, where timing is usually the only difference between success and failure (Munnell et al., 2014). The debts may be numerically equivalent, but they are not at all the same thing, and a government has far less control over the management of a bonded debt than it does on the pension debt. The Government Finance Officers Association (GFOA) maintains a list of “best practices” that has an admirably clear entry on the subject: “[GFOA] recommends that state and local governments do not issue POBs” (GFOA, 2015).

Again, I agree. There is a big difference between POB cash flows and pension cash flows: you know exactly what needs to be paid back to bondholders and when. The pension cash flows have a somewhat indeterminate amount (not locked in until retirement) and timing (when the person retires, and when they die). That the sponsor “must” pay them in either case is equally true.

Seems to me that if both these debts aren’t valued by discounting future cash flows at the same discount rate, one should discount the pension cash flows by a slightly lower interest rate, due to the habit those have of escalating faster than expected (“unexpected” raises when contracts negotiated, pension spiking, etc.)

Along with the obvious, that the return earned on the borrowed funds might not exceed the assumed rate of return, the GFOA points out other risks. POB structures often incorporate guarantees and other provisions embedded in the fine print. They often delay the repayment of principal, leading both to a deceptively low payment schedule and to a high probability of rolling over when the term is up. At least as important, the ratings agencies may not consider pension liability in the same way they do bonded debt.

“Deceptively low payment schedule”? Man, what was that about the Edgar Ramp?

Also, rating agencies are providing ratings for the information of investors — you know, the people who buy bonds. Of course, they’re being paid by the bond issuers. But still, they have their own reputation and credibility to consider.

The credit rating agencies absolutely care whether bonds are defaulted on or not. They don’t really care if the pensioners are defaulted on. They care to the extent that judges force issuers to default on the bondholders first.

And given recent developments in bond-related lawsuits… (that’s for part 5 of this series.)

Anyway, GASB accounting should not encourage POBs. They still do. In that much, I agree with Sgouros. My proposed fix (that the liabilities be valued at the same interest rate, at most, as the POBs) is not the one Sgouros wants.

However, I’ll give him the last say here, because I completely agree:

A government that has taken out a large POB to finance its unfunded liability is in a much riskier situation than a government that merely has a large unfunded liability. It does not seem unreasonable that the balance sheets of two such governments should make the difference clear. Otherwise, what is the balance sheet good for?

Yes. I agree.

DEPLETION DATE: A GOOD IDEA THAT I’VE BEEN ASKING FOR

Well, I’ve been asking for the probability the fund will run out of assets, but timing of that depletion is also good.

The problem is in the implementation. And the definition of stable.

The Social Security system—which is, after all, a regular pension plan—does not use a funding ratio as a planning value. Instead, it acknowledged from the beginning that the contributions of active members would be used to subsidize the pensions of its retirees. As a consequence, it uses a very different accounting model, which includes the use of a depletion date as a planning value. The depletion date measures how far in the future the system is projected to run out of funds. If, at the end of a year, the depletion date is no closer than it was at the beginning of the year, the system is stable. If the depletion date is closer, then there is trouble. This is perfectly comparable to using the change in the funding ratio to monitor the health of a pension plan.

This is pretty much an equivalent definition of “stable” as we saw in the the Brookings paper.

In the Social Security case, as with the Brookings and this NCPERS case, they’re counting future “expected” contributions, generally a percentage of income. Social Security can do that, as that’s statutory. Public pensions have had a way of ratcheting up that percentage each year, without thinking about where the cap is.

So let’s do an extreme case of this definition: let’s say I project that funds will be depleted in 5 years (2024). If I put in enough money this year (and pay out benefits, yadda yadda) such that at the end of the year, the depletion date is again 5 years away (now 2025), then this is a stable system.

Wow, no wonder there’s no crisis — one changes the definition of “crisis” and “stable” to suit current needs to prevent anybody noticing trouble.

One obvious disadvantage of this approach is that depletion-date accounting does not do away with the rhetorical issues surrounding the funding ratio. Needless panic induced about when a system will run out of money is likely no improvement over needless panic induced about not having enough assets to pay the liabilities. It does, however, paint a picture of a system that is closer to the mutual aid pact that a pension plan truly represents. Pension plans were not originally designed to be an elaborate savings plan, with funds accruing to a member’s own advantage.

A pension was meant as an ongoing enterprise whereby members of all ages help those who are no longer able to work, in exchange for receiving such help in their turn (Clark, Craig, and Wilson, 2003; Costa, 1998). Accounting that reflects that purpose will serve better than accounting that forces a system to be something it is not, despite the unwanted cargo the term carries.

Oh, I need to see these references. It’s true that Social Security never had any intergenerational equity (meaning, the youngsters pay for the oldsters, far beyond what the oldsters “contributed”). But public pensions in the modern era have been intended to be pre-funded by members’ own contributions (or employers for the members) during their working lifetimes. That’s how various actuarial funding methods were set up.

That the “oh, we can pay more later” set in for public pensions (and, in a different way, for multiemployer pensions) does not mean that the systems were originally set up that way.

So let’s find those sources.

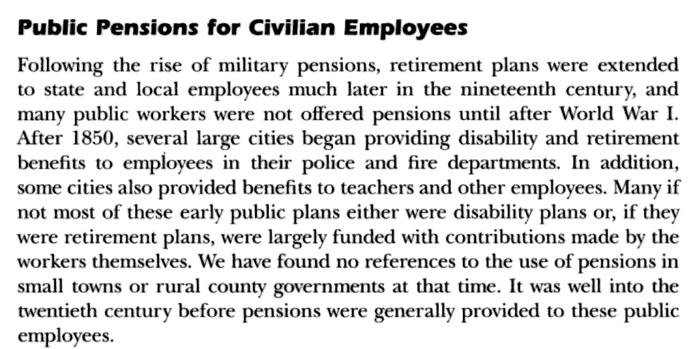

A HISTORY OF PUBLIC PENSIONS IN THE U.S.

Clark, R. L., L. A. Craig, and J. W. Wilson. 2003. A History of Public Sector Pensions in the United States. Philadelphia: University of Pennsylvania Press.

This seems to be the book. I don’t have a copy, but let’s see what I can grab via google:

Mmmm, historical examples of public pensions on a pay-as-you-go basis going flop. That’s how the book starts. Not really bolstering the idea of current workers supporting prior ones, is it?

But wait, there’s more.

Hmmm, public pensions were set up before private ones — hardly surprising given that most early public pension systems were for the military.

Remember what I said about the founding dates of particular public pension funds? So, public pensions were being paid well before any of those funds were set up. They were pay-as-you-go before then.

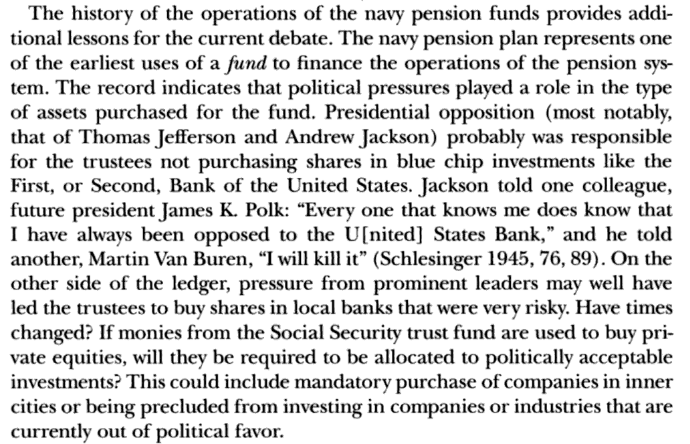

Why did that change? Alas, google scraped only so much of the book, and I don’t have a copy, so let me end with this source thusly:

Hmmmm. Political involvement in pension investments? You don’t say!

Second source:

Costa, D. L. 1998. The Evolution of Retirement: An American Economic History, 1880–1990. Chicago: University of Chicago Press. http://www.nber.org/books/cost98-1.

Awesome. It’s all online. I looked in the index re: funding. Yeesh, it’s a thin index. I didn’t see anything about pre-funding. I did see this:

There was stuff on military pensions and Social Security, and I didn’t really see much re: state and local pensions. I think it may just be a poor index.

But the problem is that, of course, if the focus is Social Security, it was never intended to be pre-funded.

But let’s look up about Baby Boomer retirement. This book is from 1998, when the oldest boomers were in their early 50s. The bulk of the boomers were in their 40s. So retirement was considered 20+ years away (oh, hello, us now!) Here’s the chapter in which it appears:

9.1 An Aging Population

The population of the United States has been aging for over a century, slowly

at first, rapidly in recent times. Figure 9.1 shows that, in 1850, less than 3

percent of the population was older than sixty-four and in 1910 only 4 percent.

By 1940 the figure was 7 percent and by 1990 13 percent. By 2050 the figure

is projected to rise to least 20 percent.

According to this, we’re on track:

In 2017, about 15.6 percent of the American population was 65 years old or over; a figure which is expected to reach 22.1 percent by 2050.

Okay, maybe a bit higher than the earlier projection, but close.

Back to the book:

The aging of the baby-boom generation will dramatically raise the proportion of the population older than sixty-four. In 2025, when the baby-boom generation will be between ages sixty and eighty, 18 percent of the population is expected to be older than sixty-four years of age. In 2050, 8 percent of the population will be older than seventy-nine and 5 percent older than eighty-four. If life expectancies increase faster than expected, the percentage of the population older than sixty-four in 2025 and in 2050 may be even greater than the 18 and 20 percent, respectively, predicted by the intermediate projections of the Census Bureau and reproduced in figure 9.3.

Hmmm.

9.2 A Retired Population

When the baby boomers begin to retire in 2010, the strain on the Social Security retirement system, even under the Social Security Board‘s intermediate projections, is expected to be substantial. The number of beneficiaries is expected to increase much more rapidly than the number of covered workers.

This is an old page, but we see the worker-to-beneficiary ratio for Social Security was 3.4 in 1998. It was 2.8 in 2013. In contrast, it was 8.6 in 1955.

What was that about younger workers supporting the older ones?

The whole chapter from the book is worth reading — how well has what was written 21 years ago come to pass?

But back to my point: both sources point out that various systems may have been set up for younger workers to support older ones, but they both point out the weakness of that approach.

Just because many plans were set up that way doesn’t make it a good idea.

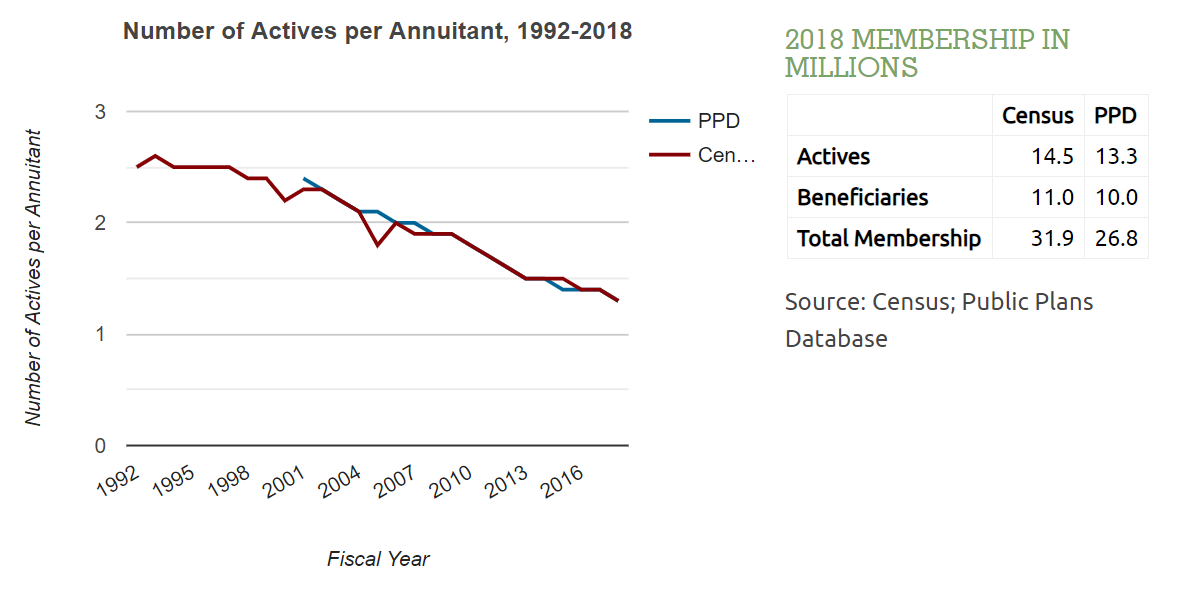

Oh, and here is the ratio for public plans:

It went from 2.5 in 1992 down to 1.3 in 2017.

I don’t really see that current workers are going to be able to provide for current retirees in this case. This is why you pre-fund pensions.

COMPROMISE PROPOSAL: TWO ACCOUNTING STANDARDS

So there’s more to the paper, but I did want to pull out the high level points and a few things I agree with.

But thinking more about this, the problem is that people try to make GASB reporting to be all things to all stakeholders, and I don’t think that’s appropriate.

I come from the world of insurance, and many insurers have to report results on at least two bases: STAT (statutory accounting/requirements) and GAAP (generally accepted accounting practices). (There’s also IFRS, tax accounting, and more, but let’s stick to those two).

STAT is developed by regulators through various mechanisms, and it has one primary purpose: to protect policyholders. Reserves and capital tend to be more conservatively calculated under this standard, and measures based on STAT are used to make judgments on the solvency of insurance companies.

GAAP has one primary purpose: to provide useful information to investors, primarily equity holders. Bondholders also have some interest, but it’s primarily for those who own stock in the company. In general, GAAP approaches are looking for profitability, current and future.

So why not something similar to what goes on in the insurance sphere?

At which point my idea falls apart, I admit.

First, many insurers do not report GAAP, because they are mutual insurance companies. That is, they’re owned by their policyholders. Some mutuals will report GAAP on some of their operations (it’s complicated), but usually their management and reporting is on a STAT basis. The policyholders are the stakeholders for everything, and STAT suits them well.

Now, I would be fine with something akin to STAT for governmental accounting. I don’t think the various governmental decision-makers would be. Risk capital? What are you talking about?!

Second, where would this second standard for public finance come from?

Looking at the about GASB page, it looks like GASB is taking the approach that they’re providing information to… whom? Actually, I’m not sure. I think it’s geared towards the public officials who will have to manage, implement, and decide on various financial matters. I have no problem with that.

But who will develop something separate that would give other stakeholders, such as taxpayers and public employees and retirees, information on how likely public pensions will start eating up all the budget? Or the likelihood that the funds are going to run out (and when)?

If only there were some independent group who could do something like that.

Credit rating agencies already do their own adjustments to official financials and their own tests on these things, so there doesn’t need to be a group for them. They can operate however they wish.

But it would be nice if there were someone who had the duty to warn about likelihood and severity of potential pension needs, wouldn’t there?

Well, one can dream.

As for Sgourus’s paper, there actually are some good ideas in there, in terms of pointing out the bad behavior encouraged by current approaches.

But he ultimately ends up with the Brookings folks, who are trying to claim pay-as-you-go is stable and that getting to pay-as-you-go for public pensions does not constitute a crisis.

PUBLIC PENSIONS IN CRISIS SERIES

- Part 1: My opinion

- Part 2: Is pay-as-you-go sustainable?

- Part 3: Is it just an accounting problem?

- Part 4: On closing DB plans and replacing with DC plans

- Part 5: On Bonds and Bailouts

Related Posts

Wisconsin Wednesday: Pew Research on Its Ability to Weather Bad Experience

Taxing Tuesday: Last One of the Year!

Here We Go: Puerto Rico Tries for Legal Federal Bankruptcy