Public Pensions and Finance Round-up: Tuesday April 12 - Money is Mobile and Not Coming in Fast Enough

by meep

It just seems to flow away, doesn’t it?

BULLETIN: REALLY RICH PEOPLE CAN EASILY MOVE

I’ve mentioned this before, in the context of Connecticut.

It seems that New Jersey has a similar problem:

Billionaire’s move puts New Jersey tax rates in spotlight

The departure of one New Jersey resident to Florida has gotten so much attention that lawmakers are calling for changing the state’s tax structure, and a key legislative forecaster is raising concerns over revenue uncertainty.

The spotlight turned to hedge fund manager David Tepper this week when legislative budget forecaster Frank Haines cited the billionaire’s move to Florida as a potential factor in how much income tax revenue the state brings in. Income tax revenues make up the biggest share of cash in state coffers, and a shift in projections of as little as 1 percent amounts to about $100 million, forecasters say.

….

“If a very wealthy individual — potentially a significant taxpayer to the state — relocates and relocates not only as we’ve been reading about it but really relocates for tax purposes … beyond our reach, then that’s something to be aware of,” said Haines, the legislative and budget finance officer.

I find that “beyond our reach” a bit chilling.

How far out do they think they can reach?

So here’s my question for the 99%ers. You want to tax tax tax the 1% really high. How much of the government budget do you want depending on 1% of the population?

What happens when that 1% moves?

Or dies?

That’s promoting a hell of a lot of volatility to state funding.

Speaking of….

PUBLIC PENSIONS: SOURCE OF COST VOLATILITY

From Stephen Eide of the Manhattan Institute:

REPORT

Guaranteed Volatility: Pension Costs and State and Local Staffing Levels

Stephen Eide

April 12, 2016Abstract

Since the end of the Great Recession in June 2009, U.S. state and local governments have faced pension costs that are rising at a rate above revenues; state and local governments have also faced diminished staffing levels. By 2016, U.S. private-sector job levels had long returned to pre-financial-crisis totals; yet state and local government staffing remains lower than it was in 2008.KEY FINDINGS

- Private payrolls began growing in March 2010; in February 2014, they surpassed their prerecession peak and have since grown by 5 million.

- State and local payrolls only stopped declining in 2013; state and local governments currently employ over 500,000 fewer workers than they did in 2008.

- Because of pension debt—the costs of the past—reduced staffing does not necessarily connote smaller government; the cost of state and local government, a more useful measure of size than staffing, will have to remain high for as long as governments must grapple with massive pension debt burdens.

Wait. That doesn’t sound like volatility at all. That sounds like increasing growth rates.

Looks like some good stuff in there.

MORE REPORTS: ILLINOIS

From the Illinois Policy Institute:

What’s driving Illinois’ $111 billion pension crisis

By Ted Dabrowski, John KlingnerDOWNLOAD REPORT

EXECUTIVE SUMMARY

Since the Illinois Supreme Court ruled in its May 2015 decision on Senate Bill 1 that pensions for current government workers can’t be modified, debate over pension reform has faded from view.

But ignoring the problem won’t make it go away. In 2015, Illinois’ state pension debt reached a record $111 billion. Government-worker pensions already consume one-fourth of the state’s budget. And every day Illinois goes without a solution to its pension crisis, the state’s pension debt grows by over $20 million.

The state’s pension crisis threatens to burden taxpayers with massive, ever-escalating taxes to bail out a system that is simply not sustainable.

And while politicians’ underfunding the pension systems has aggravated the crisis, that’s not the main driver. The bigger problem facing Illinois’ five state-run pension funds is the unaffordable pension benefits politicians have given away to government workers and government unions over the past several decades.

The generous rules on retirement ages, cost-of-living adjustments, or COLAs, and employee contributions that are out of sync with their pension benefits have caused pension benefits to grow by more than 900 percent since 1987.

Some of the biggest drivers include the following facts:

60 percent of state pensioners retired in their 50s, many with full pension benefits.

Over half of state pensioners will receive $1 million or more in pension benefits over the course of their retirements. Nearly 1 in 5 will receive over $2 million in benefits.

Almost 60 percent of all current state pensioners can expect to spend 25 or more years collecting benefits, based on approximate actuarial life expectancies. Due to automatic, 3 percent compounded COLA benefits, those pensioners can expect to see their annual pension benefits double in size.

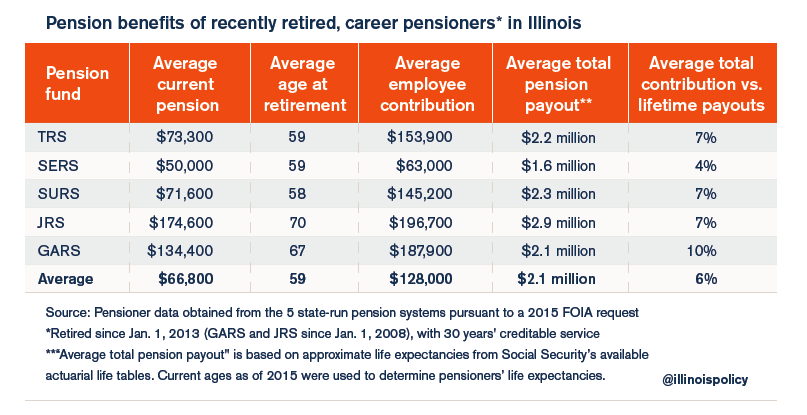

The average career pensioner – retired after Jan. 1, 2013, with 30 years of service or more – receives $66,800 in annual pension benefits and will collect over $2 million in total benefits over the course of retirement.

The average career pensioner will get back his or her employee contributions after just two years in retirement. In all, pensioners’ direct employee contributions will only equal 6 percent of what they will receive in benefits over the course of their retirements.

Have a nice table.

MORE ILLINOIS: HOW NEWER TEACHERS ARE GETTING SHAFTED

The current Tier 2 benefits screw over new hires:

Here’s Why Illinois’ Teacher Pension System Is a Bad Idea

Here’s one question that should be animating the debate about the teacher pensions mess in Illinois: If you’re a 25-year-old teacher hired this year, are you absolutely sure you will still be teaching somewhere in the state in the year 2040?

Most teachers can’t answer that question affirmatively. A quarter century is a long time. But that’s how long a newly hired teacher must wait before she’ll qualify for a decent pension. While large budget deficits grab all the headlines, Illinois teachers are being shortchanged.

Teachers unions must be up in arms about such poorly constructed retirement schemes for their members, right? You might think so, yet Springfield is consumed by budget conversations, not how poorly teachers are being served by the current system.

The state is facing massive pension debt. State politicians have promised $113 billion more in future pension benefits than they have saved to pay for them. The teacher pension system alone makes up over half of the debt, with a total unfunded liability of $63 billion.

…..

These issues, while real and pressing, ignore a longer-term problem—the pension system is inequitable and inefficient. According to the pension plan’s own assumptions, over half of new Illinois teachers won’t qualify for any pension at all. They will leave before the 10-year service requirement to qualify for any pension.Even for teachers who do qualify for benefits, the odds aren’t in their favor. Because of post-recession pension cuts, new teachers are given a bare-bones retirement plan. In fact, on average new teachers will pay more into the system than they’ll ever get back in return. As a group, they’re paying a tax for the privilege of receiving negative retirement benefits.

Yikes.

MORE ON THE MONEY MONSTER

It seems the time of year for reports:

Pension pipe dreams put taxpayers on hook: Analysis

Underfunded pension programs in U.S. states, cities and municipalities are “three or four times worse” than current government projections, said Joshua Rauh, senior fellow at the Hoover Institution think tank.

“The amounts of money [officials] are setting aside [for pensions] are far short of adequate,” Rauh told CNBC’s “Squawk Box” on Monday. “Taxpayers are going to get pretty soaked” when the time comes to make up the difference.

In a Hoover essay, “Hidden Debt, Hidden Deficits,” Rauh argued U.S. public pension systems were actually running at a $3.4 trillion shortfall in fiscal 2014 when “optimistic assumptions about future investment returns” contained in government disclosures were tempered.

“Most public pension systems across the United States still calculate both their pension costs and liabilities under the assumption that their contributed assets will achieve returns of 7.5 [to] 8 percent per year,” wrote Rauh.

The study: Hidden Debt, Hidden Deficits: How Pension Promises Are Consuming State And Local Budgets:

Most state and local governments in the United States offer retirement benefits to their employees in the form of guaranteed pensions. To fund these promises, the governments contribute taxpayer money to public systems. Even under states’ own disclosures and optimistic assumptions about future investment returns, assets in the pension systems will be insufficient to pay for the pensions of current public employees and retirees. Taxpayer resources will eventually have to make up the difference.

That’s assuming the promises will be paid in full.

Speaking of:

PENSION BUYOUT IDEAS

We saw Philly was interested in buying our new retirees…. Illinois is considering it, too::

Pension buyout plan for state workers still being studied

When Republican legislative leaders announced a plan last week to pay for a variety of human-services programs, they said money for it could come in part from enacting changes to state pensions.

Their list included several items sought by Gov. Bruce Rauner’s administration. It did not include a plan that would allow workers to cash in their pension benefits.

While that buyout plan still hasn’t gotten a vote of any kind, the idea is alive and could be acted on this spring.

…..

The concept is that people enrolled in one of the state pension plans could take a lump-sum payment at retirement and give up the traditional pension benefit of receiving a monthly retirement annuity for life. The important thing for the employees is the lump-sum payment would be based on the net present value of the pension at retirement, or what they would expect to collect in pension benefits during a normal period of retirement.Batinick previously supplied an example of a school teacher about to retire at age 62 with a $60,000 annual benefit who would have a net present value of nearly $800,000.

At the same time, the employee wouldn’t get a lump sum for every penny they’d expect to collect in retirement. Batinick’s bill specifies the worker would get 75 percent of the net present value of the pension benefit. Still, the lump sum could be willed to other family members upon the retiree’s death, whereas the pension payment could not.

Comment: Wake up. The state pensions are 40% funded. If you give the pensioners anything more than 40% of the net present value of their benefit then the unfunded liability would worsen. And nobody seems to be addressing the problem of negative selection. That is, those in poor health, like cancer victims, would be the first to take the option. It would be impossible to distinguish the healthy from the unhealthy, and that would doom this idea, unless you could get lots of takers accepting pennies on the dollar.

I have an additional comment: most of the Illinois employees and retirees probably think like Rauh… that the taxpayer will step in to bridge the gap. That there is no danger of their pensions getting whacked like the Central States current retirees will.

So only the ones who know they’ll get more via lump sum because they’ll die early would take the deal.

That would be some hideous selection bias.

ARE YOU READY FOR THE PUBLIC PENSIONS THRILLER?

This guy has a movie pitch. Hear him out:

We Need a Sequel to The Big Short to Critique Public Pensions

The Big Short is clearly a hit. Nominated for (and winning) a host of major awards, the film has reportedly clocked $131 million worldwide on a $28 million production budget.

That should give screenwriters the incentive to follow up with the true-to-life sequel. Call it The Big Short, Part Two.

Part one offered rare insight into the usually arcane world of government finance. When the film’s protagonists (played by Brad Pitt, Christian Bale, Ryan Gosling and Steve Carell) prepare to bet that the housing bubble is about to blow, they identify the culprits: The bad guys are not just the sellers who prepared mortgage debt securities but the buyers of those toxic securities as well. And the biggest buyers of all were the managers of America’s public-employee pension funds.

The housing bubble may have collapsed, but the public-employee pension fund managers are still with us. If anything they’re bigger than ever, still insatiably seeking high returns just over the horizon line of another economic bubble.

And where do these predators go for their high returns? Along with their high-risk investments in hedge funds and private equity (where we have minimal transparency), pension fund managers invest in housing, once again inflated to unaffordable levels, thanks to over-regulation and low interest rates. They invest in public utilities that collect guaranteed fixed profits on overpriced services, thanks again to over-regulation. They invest internationally. And they invest in domestic stocks.

In every case, the goal of these powerful pension funds—Wall Street’s biggest players—is to rack up another year of high returns. And to do this they need corporate profits, financial sector profits, rising home prices, rising utility rates—all of it fueled by debt accumulation.

……

The National Conference on Public Employee Retirement Systems—the self-proclaimed “Voice for Public Pensions“—is arguably at the forefront of this unsustainability lobby. This powerful trade association is run by public sector union executives from across the nation. Their president is also the treasurer of the powerful American Federation of Teachers. Their first vice president is a 30-year member of the Chicago Fire Fighters Union, IAFF Local 2. Their second vice president was union president of Fraternal Order of Police Queen City Lodge 69. And so it goes: Officers of government unions populate virtually every board position. Government unions run this organization.…..

The National Conference on Public Employee Retirement Systems has thoughtfully created a list of “foundations, think tanks, and other nonprofit entities [that] engage in ideologically, politically, or donor-driven activities to undermine public pensions.” The California Policy Center and UnionWatch are both on that list. But our organization does not advocate eliminating the mechanisms that run this scam. We support reforms to restore financial sustainability to pensions—not just for taxpayers but for retirees depending on income from government pensions.We actually fulfill only one of their criteria for this list—we’re an organization that “advocates or advances the claim that public defined-benefit plans are unsustainable.”

Yes, we do. That the unsustainability lobby has recognized our work is a distinct honor. Winning an Oscar—or maybe just a credit—for our contribution to the forthcoming movie The Big Short, Part Two is our new ambition.

Stick a hot chick in a bubblebath to explain the incentives to pile on asset risks in underfunded plans, and you’ve got your next blockbuster.

I guarantee it.

Related Posts

Around the Pension-o-Sphere: Illinois, California, Shareholder Activism, and Puerto Rico

Calpers Governance Watch: Fallout from ex-CFO Meng Resignation

Hey Amazon: Come to Hartford, CT!