Puerto Rico Watch: PR Defaults! Again! Also, a New Jersey Connection

by meep

Before we get to the “news”, let’s take a look at some visualizations at how deep the doo-doo Puerto Rico is in:

So let’s see. It grew from $24.2 billion in 2000 up to $72.2 billion in 2015.

That’s equivalent to a 7.6% per year growth rate.

Kind of like the assumption of pension asset growth rates, eh? If they had pension assets that could grow.

Still, who knows how sustainable that amount of debt looks like – it’s not compared to anything…

….oh. Hmmm. That doesn’t look good.

PUERTO RICO’S LATEST DEFAULT

A reminder. Puerto Rico has defaulted on payments earlier. Just because they got some creditors to put off payments doesn’t really make it less of a default.

Before: Sunday: Puerto Rico says it will default on Monday

In a television address made Sunday, Puerto Rican Gov. Alejandro Garcia Padilla said the island’s Government Development Bank would not make a $422 million payment due to its creditors by the end of business on Monday, according to Bloomberg.

Well, jeez. What’s the big deal? It already had a default in January. Remember that?

Puerto Rico won’t be making 2 of the 13 debt payments due on Jan. 4 – a $35.9M payment on the territory’s Infrastructure Financing Authority, and a $1.4M payment on its Public Finance Corporation.

The rest of the nearly $1B in payments due on Monday will be made, including one to general obligation bondholders in which half of the payment comes from revenues clawed back from other bonds.

Oh wait, this default is much bigger.

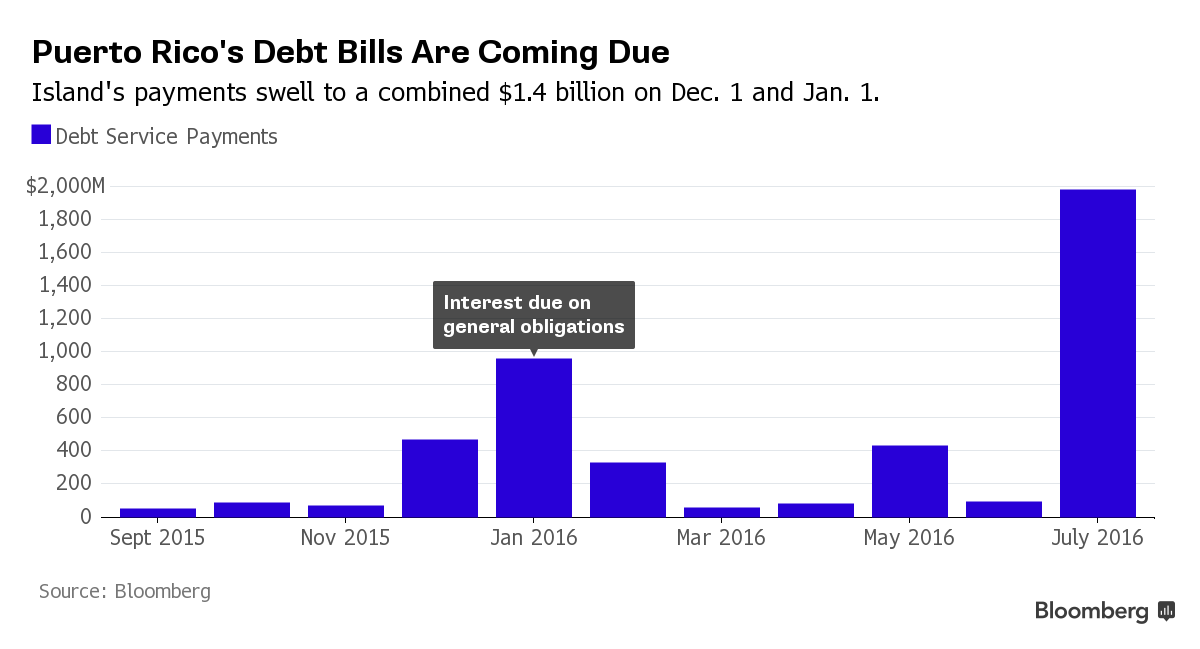

And let’s look at this:

Uh, I think July might be ugly.

A wee bit.

SOME POLITICAL FIGURING

The Puerto Rican issue hasn’t really caught on as a big election year issue.

Yet.

It is getting play in the Congress:

Ryan’s Biggest Test Yet: Saving Puerto Rico From Congress

Puerto Rico’s complex debt crisis is shaping up as the first true test of Paul Ryan’s six-month old speakership.

The Wisconsin Republican has pledged publicly that the U.S. House will find a “responsible” solution to the island’s debt crisis. The issue may not factor widely in the November elections, but failure could prove disastrous — both to Ryan’s credibility and in terms of the billions of dollars Congress would need to prop up the island’s finances.

Unlike many of his previous challenges, this isn’t a mess he can blame on his predecessor. If he can’t forge a solution, it also doesn’t bode well for Ryan’s ability to bring his recalcitrant conservative caucus along on other spending and tax plans, which could be a recipe for the continuing gridlock and peril that ousted John Boehner.

He can blame all sorts of actors (including Boehner, if he wants to). It seems that most of that debt growth is occurring in Puerto Rico itself.

Blaming Congress for PR’s fiscal trouble would be similar to blaming Illinois’s or New Jersey’s troubles on Congress.

Speaking of…

JOHN BURY: THE NEW JERSEY CONNECTION

Bury notices something in common between NJ’s Atlantic City and Puerto Rico:

Coincidentally both Puerto Rico and Atlantic City faced default on bond payments today but they have something else in common.

Both sponsor pension systems that are essentially pay-as-you-go with Puerto Rico’s plan having an 8.4% funded ratio as of 2012 and Atlantic City having employees as part of the New Jersey Retirement system and a Beach Patrol pension plan with improperly valued liabilities, arbitrary contribution requirements, and no foreseeable means of being able to pay out anywhere near the benefits promised (referring to both the New Jersey and Beach Patrol plans).

Bury wrote about Atlantic City’s pensions recently:

In Over Their Heads On Lifeguard Pensions:

Atlantic city is broke with a reported budget deficit of $100 million, debt of $550 million, and the governing body is currently debating whether to make their next bond payment. You would think the first step to recovery would be to restructure some of that debt to future years but in attacking the poster-issue of Atlantic City’s presumed profligacy, pensions for lifeguards, New Jersey legislators have thrown them another anchor.

…..

The fund is pay-go as the 4%-of-salary contributions made by active lifeguards are not enough to cover the $1 million being paid out annually to retirees so that ‘to the extent funded’ line might be interpreted by some future court as meaning nothing is due upon termination since nothing was funded.However, if it was intended that IRC termination rules and regulations apply, then what S2085 will do for Atlantic City is take away that $1 million annual contribution amount and replace it with a requirement to to come up with the full $30 million* immediately to settle liabilities (government plans not being covered by PBGC) either by paying inflated lump sums at 417(e)(3) rates or by purchasing annuities for all participants.

Well, that’s pleasant.

WHO’S NEXT?

Something else to note, in a connection: in January ZeroHedge looked at PR bankruptcy, and who would be the next to go:

As Wilbur Ross so eloquently noted, for Puerto Rico “it’s the end of the beginning… and the beginning of the end,” as he explained “Puerto Rico is the US version of Greece.” However, as JPMorgan explains, for some states the pain is really just beginning as Municipal bond risk will only become more important over time, as assets of some severely underfunded plans are gradually depleted.

…..

As a brief summary, we computed the ratio of debt, pension and retiree healthcare payments to state revenues. The blue bars show what states are currently paying. The orange bars show this ratio assuming that states pay what they owe on a full-accrual basis, assuming a 30-year term for amortizing unfunded pension and retiree healthcare obligations, and assuming a 6% return on pension plan assets. States below the green bar are spending less than 15% of total revenues on debt, which seems manageable from an economic and political perspective. When this ratio rises above 15%, harder discussions in the state legislature about difficult choices begin.

Here’s their graph:

So let’s see, from worst to best:

- Illinois

- Connecticut

- Hawaii

- New Jersey

- Kentucky

Sounds like I need to do a bit more digging in Hawaii numbers. But other than that, yeah, I’ve seen those coming, too.

George Will made remarks that what happens in PR won’t stay there:

Puerto Rico’s approximately 18 debt-issuing entities have debts — approximately $72 billion — they cannot repay. The Government Development Bank might miss a $422 million payment due in May, and the central government might miss a $2 billion payment in July. Congress will not enact a “bailout,” meaning an infusion of U.S. taxpayers’ money.

….

The most complex Puerto Rico issue is what treatments should be authorized for various categories of bondholders. Shed few tears for those who, by buying Puerto Rico’s (or Illinois’) debt, enable the sort of high-spending, vote-buying governance that bankrupted Detroit and soon will have Illinois begging for what does not and should not exist — a bankruptcy option for states. Puerto Rico’s debts should not be restructured in a way that sets a precedent allowing Illinois to dodge both debts and reforms, particularly reforms pertaining to government employee unions that have contributed to the territory’s dysfunction. The more Puerto Rico is allowed to evade existing legal processes and the need to negotiate with creditors, the more leeway it will have to resist reforms.Puerto Rico’s political class recoils from a control board exercising federal oversight, which Gov. Alejandro Garcia Padilla calls a “shameful and degrading” measure to deprive the island “of its own government.” But curtailing this class’ discretion might not be seen as a deprivation by the 71 percent of Puerto Ricans who in a recent poll favored an oversight board for a government that is warning about being unable to fuel police cars and fund school services.

Neither official bankruptcy (which at least would force a negotiating process) nor U.S. Congress taking over PR governance via an oversight board are particularly attractive. I can’t imagine the U.S. Congress having to babysit Illinois finances. Jeez, fail on your own recognizance.

BACK TO PUERTO RICO

But today’s about Puerto Rico’s larger default, and ever increasing default sizes.

Let’s check today’s coverage:

- Puerto Rico defaults on $422 million

- Default Set to Push Puerto Rico’s Debt Crisis onto Dangerous New Ground

- Puerto Rico and creditors agree more talks despite default

- Puerto Rico government bank misses payment, talking with creditors

- How Puerto Rico amassed $72 billion in debt

Yes, how exactly did Puerto Rico amass so much debt?

The USA Today timeline doesn’t exactly answer anything. Sure there were various tax breaks taken away, but this bit seems key:

2006: Congress fully repeals the tax break for U.S. companies operating in Puerto Rico. As the economy weakens, people leave for the U.S. mainland, reducing the island’s tax revenues even more. The housing crisis later hits, and Puerto Rico officially enters recession. In response, the island’s government issues bonds to pay for [s]ervices, even using new bonds to pay off older bonds.

(Yes, there was an s missing from services. Don’t ask me.)

When you start taking out long term debt for operating expenses (which, oh wait, is what you’re doing when you don’t fully fund pensions), you are starting down a debt spiral.

And it only stops with bankruptcy — de facto or de jure. The money spigot gets cut off and you have to figure out how to restructure everything. Because this shifting stuff PR has been doing doesn’t get anything done. There has to be more than just requiring creditors to suck it up.

Let’s go back to the debt graph:

The growth rate does seem to rev up after 2006. As noted, from 2000 to 2015 is a 7.6% per year growth rate.

If we look from 2007 to 2012, that’s an 8.6% per year growth rate.

Anyway, if you take out long-term loans to pay for regular living expenses, as Mr. Micawber would tell you, you’re going to come to misery.

Welcome to misery. And somebody please take the credit card away.

Related Posts

More on High-Tax States Trying to be Clever in Helping Rich People Avoid Federal Taxes

Pension Assets: Investment Returns are in for FY 2017 and They're GREAT!

Taxing Tuesday: Maneuvering to Benefit the Rich, Hope the Suckers Stop Looking, and More