Get Ready for the Next Chicago Teachers Strike!

by meep

But before we get to the strike, let’s check out on their enrollment:

CHICAGO — Chicago Public Schools student enrollment dropped by 3.5 percent this year compared with last, according to information provided by the district.

That could mean layoffs for 300 teachers and support staff members.

During the last 10 years, enrollment has fallen 6.8 percent at public schools in Chicago, with half of that drop coming since September 2015, according to district enrollment data.

Let’s see what that looks like – Data and graph here, which look dramatic, but I’m going to do it with a more honest vertical scale:

Mind you, in the world of politics, this is dramatic change. Ten percent decrease since 2005 is pretty bad. I’m thinking of the population decline in Detroit, and they had an even larger drop in school population.

Here is a nice inflammatory graph:

That is a bad trend.

THE TEACHERS ARE REVOLTING

Ok, ok, they’re not, in any dimension. But the problem is, they overwhelmingly want to strike… and they really don’t have a lot of leverage.

The Chicago Teachers Union said Monday that 95 percent of members who participated in a poll last week have agreed to authorize a strike this fall.

Some 90.6 percent of eligible teachers, clinicians and aides signed their names on petitions circulated last week at schools and CTU headquarters, according to the CTU. The results — 86 percent of eligible members voting — are slightly lower than last December’s strike authorization vote, which the union decided to repeat to halt legal challenges by the Board of Education. Then, some 88 percent of eligible members voted yes. The CTU did not release raw voting totals.

So I guess we need to wait to see if they actually strike. In October. Right before Presidential elections. I’m sure the Democrats would love that.

The strike, remember, is primarily over a cut in teacher total compensation, via the teachers having to make a 7-percentage point increase in pension contributions, which is a fairly large pay cut. Chicago had been picking up that bit, as the teachers were supposed to have been making those contributions before. As in, years ago.

We’ll get back to the contributions in a bit.

BREAKING DOWN THE TOTAL COMPENSATION EQUATION

Let me explain the total compensation bit — I may be breaking this down oddly, but it’s pretty simple:

Total comp = takehome pay + benefits value [including pension accrued for the year] + taxes paid on income

takehome pay = gross pay – employee contributions to benefits – taxes paid on income

put it together:

Total comp = gross pay – employee contributions to benefits + benefits value

Under the deal, the benefits value doesn’t change (welll…. okay, leave that for later in the post). The gross pay increases some. But the employee contributions increase. I think, on net, the total comp therefore decreases, because the gross pay increase would be too small to counteract the contribution increase.

Which is what it needed to do. Chicago really can’t afford to be raising total comp.

The total comp ultimately comes out of the pockets of Chicago (and maybe greater Illinois) taxpayers. Whether or not the employee “contributes” to the benefits. The money originates with the taxpayer.

I know it can get confusing, but you need to pay attention to the real cash flows — from the taxpayers pockets’ to the state employees’ pockets and benefits. By calling it an “employee contribution”, it really is cutting total compensation, all other bits remaining equal.

GOOD LUCK WITH THAT

Maybe they won’t hold the strike at all, given the unproductivity of the April 1 Day of Action – the strike that really wasn’t a strike, wink wink.

At least this time it would be a real strike, so maybe they wouldn’t get the bad publicity they got last time. Maybe.

If they plan on continuing their rant of thinking they can do One Cool Trick to pull out all the money they want for all the things:

Is Chicago Really Broke?

Activist Tom Tresser doesn’t think so. He’s got a new book full of ideas to balance the books and fund the things we aren’t, and he wants Chicagoans talking about them.BY WHET MOSER

….

But what if the city wasn’t actually broke? That’s the thesis of a new book, Chicago Is Not Broke: Funding the City We Deserve, edited by longtime activist Tom Tresser, cofounder of the CivicLab, NewCity’s “Best activist in the interest of the public defense,” and one of the many people behind the TIF Illumination Project, which gathers and analyzes the money within the city’s massive tax increment finance districts and where that money goes.

….

Emerging from Tresser’s work with the two organizations, Tresser and his co-authors aimed to calculate where the city could save money and where it could bring in new revenues. It doesn’t go through the budget trying to squeeze blood from a stone; they’re big ideas aimed at bringing in, or back, big money.Some you’re probably familiar with, like the cost of corruption in the city (which Dick Simpson and Thomas Gradel estimate to be $500 million a year), or the city’s massive police-abuse settlements (some $50 million a year).

Others are less well known but have been part of discussion and protest, like a state-level progressive income tax (Hilary Denk estimates Chicago would get an additional $85 million), clawing back money from toxic swap deals instead of paying to get out of them (CTU staff coordinator Jackson Potter argues that it’s doable and would save $1 billion), and a financial transaction tax on the Chicago Mercantile Exchange, Chicago Board of Trade, and the Chicago Board of Exchange.

I follow these issues closely, and yet one idea was completely new to me: a public bank based on the state-run, almost century-old Bank of North Dakota. It’s been widely covered elsewhere, by Mother Jones, Governing, the Wall Street Journal, Bloomberg, Time, The American Prospect, and many other outlets. But the piece in Chicago Is Not Broke, by public policy consultant and former Daley admin policy analyst Amara C. Enyia, was the first I’d ever heard anyone propose the idea for Chicago.

I had ignored this when it first came out a few weeks back. I thought it was a stupid idea then, and I still think it’s a stupid idea now.

Yes, let’s have a public bank in a city known for its pristine financial dealings, especially when governmental entities are involved.

Well, let’s get it straight from one of the co-authors:

Don’t be fooled: Chicago is not broke

…..

A new book I co-authored with Ralph Martire, Dick Simpson, Thomas Gradel, Jackson Potter, Jamie Kalven, Hilary Denk, Ron Baiman, Bill Barclay, Amara Enyia and Jonathan Peck examines ways Chicago could save and generate $5 billion in revenues annually. We focus on three buckets of funds:• Money that is stolen from us. Money that we should not have spent nor continue to spend. Corruption in Chicago, toxic bank deals and police abuse cases have cost the city roughly $7.5 billion since 2004. The solutions we propose—such as a forensic audit on all aspects of the city’s finances, ending patronage and double dipping, backing out of toxic bank deals and changing the way we do policing—are not new but bear repeating.

• Money that is hidden from us. These are funds we know the city is collecting in the form of tax increment financing but we just don’t know where they are. Billions of property tax dollars pass through the TIF program—an unregulated and unaccountable slush fund—and the $1.36 billion that was sitting in TIF accounts on Jan. 1 could be sent to the local units of government that rely on property taxes for their operations. If this were done, the Chicago Public Schools would get a one-time bump of $680 million. Wouldn’t that be better than laying off 1,000 CPS educators and support staff?

• Money that is not collected but should be. Here we offer three ideas for new revenues for the city.

First, a progressive income tax for the state will also benefit the city by at least $50 million annually.

Second, a financial transaction tax on certain trades at our exchanges could yield $2.6 billion annually for Chicago. (For our book, the economists who authored the chapter on the financial transaction tax offer multiple examples where it has been successfully implemented and cite reasons that the exchanges can’t move their operations in an attempt to flee this tax.)

Lastly, a public bank for Chicago modeled after the almost 100-year-old enormously successful Bank of North Dakota. Here we propose the creation of a bank that would serve the people, not fleece them, by making available cheap credit—credit to finance a first home, a business expansion, a student loan or a farm loan. In North Dakota, no small community bank has failed in over a decade. Contrast that to the sad state of community banking in Chicago, where we have lost South Shore and Parkway National Banks—institutions that lent heavily in African-American communities. Also, a public bank could finance our own infrastructure expansion: If Chicago had a public bank in place we would not have had to sell our meters to Morgan Stanley, a deal that will yield them 10 to 1 profits.

Ralph Martire?!

The 80 percent funded is a healthy target Ralph Martire? The I’ve got a cunning plan to fix the pensions Martire?

That guy?

I swear, you people are trying to kill me.

Anyway, we’ve already seen the loads of taxes Rahm Emmanuel is trying to load up on Chicago taxpayers. So far, it’s not been going that well.

WHAT CAN TEACHERS DO

First, you may think that really high percentage vote means that there’s an overwhelming response among teachers.

Read this editorial from before the official vote was taken:

But here’s why the strike approval is a foregone conclusion: Instead of secret ballots — which would permit dissent — teachers and other CTU members are being asked to authorize a strike via “petitions” circulated at schools. The details aren’t clear, but that reportedly means union delegates will gather members’ signatures to authorize or reject a strike. Presumably that means members will be able to see how their colleagues vote. And so will union bosses.

Could teachers who dare defy the union be intimidated by the prospect of being ostracized by fellow teachers who are lockstep supporters of union higher-ups and want to strike? Do we really need to answer that?

The 2011 law that mandates this strike-authorizing vote doesn’t say how the votes are to be cast or tallied. It is silent, too, about independent oversight of the voting process. But we doubt Illinois lawmakers had this petition charade in mind.

At the time the law passed, many Illinois legislators believed the 75 percent threshold provision would be a poison pill, sure to prevent a teachers strike. They whispered that 75 percent was a nearly impossible hurdle. They were wrong. Nearly 90 percent of CTU members voted to support a strike in 2012. Unlike this vote, however, that was a secret ballot.

Given that, you would think CTU leaders would be confident of prevailing in a secret vote now. And probably they are. So we’re perplexed about why they have come up with this Big-Brother approach that falls into the See?-Everyone-Voted-For-Me school of electioneering.

I don’t think they’re perplexed. I think they saw the defections from April, even after threats, and were going to make sure people fall in line.

They ran a bunch of items on the CTU blog, and I will link a few particular posts. You can follow the links to see the text yourself.

From CTU President Karen Lewis, there was a message to CTU members saying that voting for the strike was imperative. I will excerpt one sentence:

We are asking that the mayor and his handpicked Board of Ed properly fund our classrooms with the hundreds of millions available via progressive revenue sources such as the city’s TIF surplus, a corporate head tax and/or taxes on LaSalle Street commodities traders.

I added the bolding.

I find it interesting that even in the face of this message, a few people voted, essentially publicly, that they’re against the strike. I wonder if they anticipate recriminations. Especially when the upcoming strike will net the union nothing. Why not blame the 5% of defectors?

And then in this post from VP of the union, Jesse Sharkey, there is an objection to the Chicago Tribune saying the vote was a foregone conclusion. You can go to the link to read the message yourself.

Seriously, I’m supposed to believe a 95% vote to authorize strike occurs without something a little off? Come on, even the Russians, when they had their phony Ukraine elections, weren’t trying that hard to fool folks. To be sure, the teachers here have a direct interest, so I will give that.

But even so, you don’t get to 95% response without heavy-handed tactics. That vaunted “communication”, I’m sure.

Illinois Policy Institute points out teachers can resign from the union, but if the union managed a 95% vote, I don’t see there will be much stomach for defying the CTU.

I bet as time goes on, more teachers will join these two in not wanting to strike.

SERIOUSLY YOU NEED MORE MONEY IN THE PENSION, TEACHERS

The chances of being to get any more money out of the city is extremely low without the teachers bearing some of that extra cost. They may have leverage over the state legislature, but not the governor. Moody’s just pushed the Chicago school system farther into junk status, so forget about the bond market.

That magic trinity of “progressive revenue sources” is not going to be producing much of anything for the CTU. You keep pushing that line, but it’s going to get you nowhere.

When the Greeks (as in the current ones, not of Achilles’ time) had demonstrations and strikes over their pensions getting cut, do you know what happened?

Nothing.

They’re still cut. They don’t have more money coming in. They’re stuck.

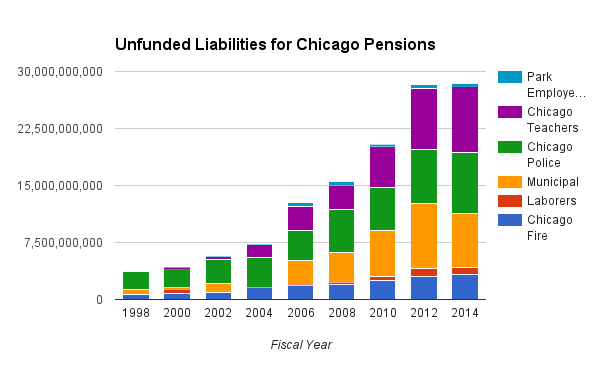

Here’s the state of Chicago pensions overall:

That purple part of the bar is the teachers pensions. Chicago has more trouble than just the teachers pensions. The vertical scale is dollars – as in, $30 BILLION dollars in the hole.

But let us focus on the teachers pensions.

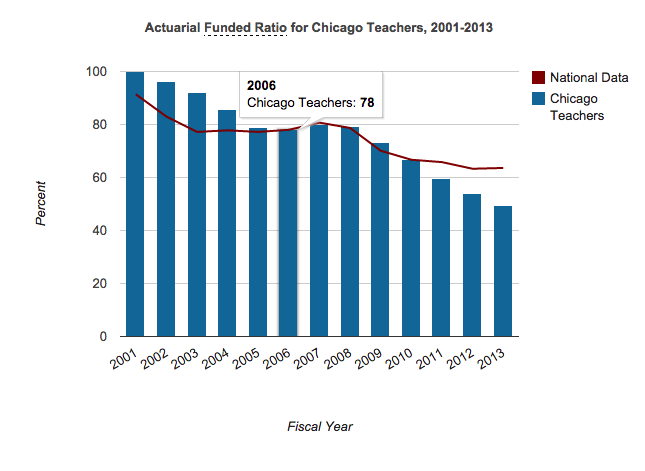

That’s a couple years back, but that’s a gap pushing $10 billion (with a B) as of fiscal year 2013. Yes, undercontributions were a large part of that gap, but there’s so much more.

They’ve got almost as many retirees/beneficiaries as they’ve got active members:

Funded ratio? Yeah, about that…

That’s a bad trend.

Remember at the top, where I said the total comp included the value of benefits accrued?

Well, those accrued benefits might be worth a lot less than the official numbers show. Because the benefits not getting paid is a very real possibility.

You think the pension plan can’t fail? That’s not a safe assumption.

Younger teachers especially may be aware that they might not be able to get the benefits the older teachers are getting. Makes one wonder about that 95% vote.

So yes, it was a strike authorization. But it doesn’t mean the teachers will actually strike. But if they do strike…. I don’t think the magic money fairy of “progressive revenue sources” will be visiting.

But I could be wrong.

Related Posts

Mornings with Meep: I'm Happy I Didn't Wait

Nevada Pensions: Asset Trends

Public Pensions Watch: Choices Have Consequences