South Carolina Pensions: Recent Rumblings .... or Rumbles

by meep

In the last post on SC pensions I noted:

- South Carolina returns have underperformed similar pension funds, and have way underperformed their target return on assets.

- SC has an awful lot of “alternative assets” in their portfolio.

I will do a followup to look more closely at the liability side, but I need to pull from more sources on that one, and I want to give Theodore Konshak his due on what he has already written on the subject.

That said, there is a lot going past in South Carolina pensions, and want to cover the state of play.

CURTIS LOFTIS HAS SOMETHING TO SAY

Curtis Loftis is the treasurer of South Carolina currently.

He also had some comments about the pension plan.

In some extremely poorly-designed slides, among other things.

But let me pull some text before posting slides.

South Carolina’s Pension Plan is $24 Billion in Debt

The pension system doesn’t need a Band-Aid, or a temporary fix, it needs a permanent solution before the lawmakers go home in May.

The state has mismanaged our pension system and created a $24 billion pension debt. That debt must be paid but there is no money to pay it. The General Assembly has a duty to the taxpayers to make the pension debt its number one priority. The pension debt is the massive pothole you can’t see. It is the debt that is larger than our state budget. It is the debt that will cause taxes to rise and the money for education, laws enforcement, and essential needed services to dry up.

Here is one set of the slides.

This particular slide puts my teeth on edge:

The basic reason is this: PIE CHARTS SUCK…though a pie chart with three pieces is not so bad.

Okay, now that is out of the way, my main issue is how different bits are characterized/calculated.

To wit – I don’t know. I’m seeing no references, nothing I can check. There is no reason I should trust Loftis’s numbers more than other numbers.

Bad investments? I don’t dispute that – as mentioned at the top, SC asset performance is well below average. And their asset allocation is wonky.

Poor plan structure? ….How the hell did you measure that? Is this the actuarial loss from having bad assumptions on retirements? I have no idea.

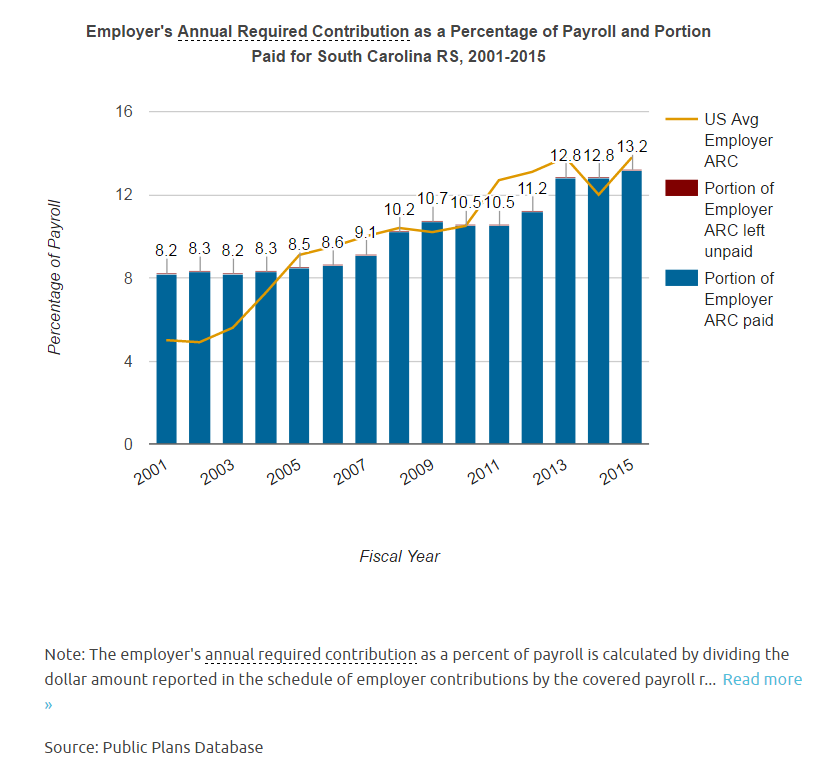

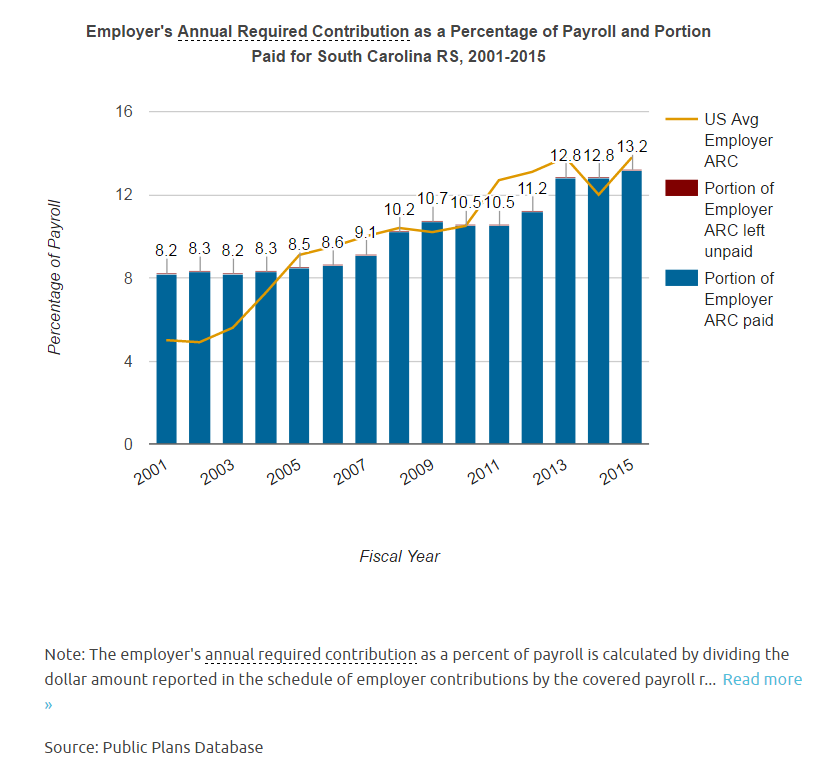

Intentional underfunding? I’m going to be mean for a moment and post the funding for SCRS:

Looks like they’re fully funding – right? They’re making full contributions, as the actuaries recommend!

The mean part: Loftis is correct about the underfunding, and the above graph is deceptive. So I’m not going to explain this part in this post. You’ll have to wait to when I look at liability trends.

WHERE DOES SOUTH CAROLINA RANK?

This is not the only slide presentation up there by Loftis.

A presentation from October 2015, focusing on the investment performance.

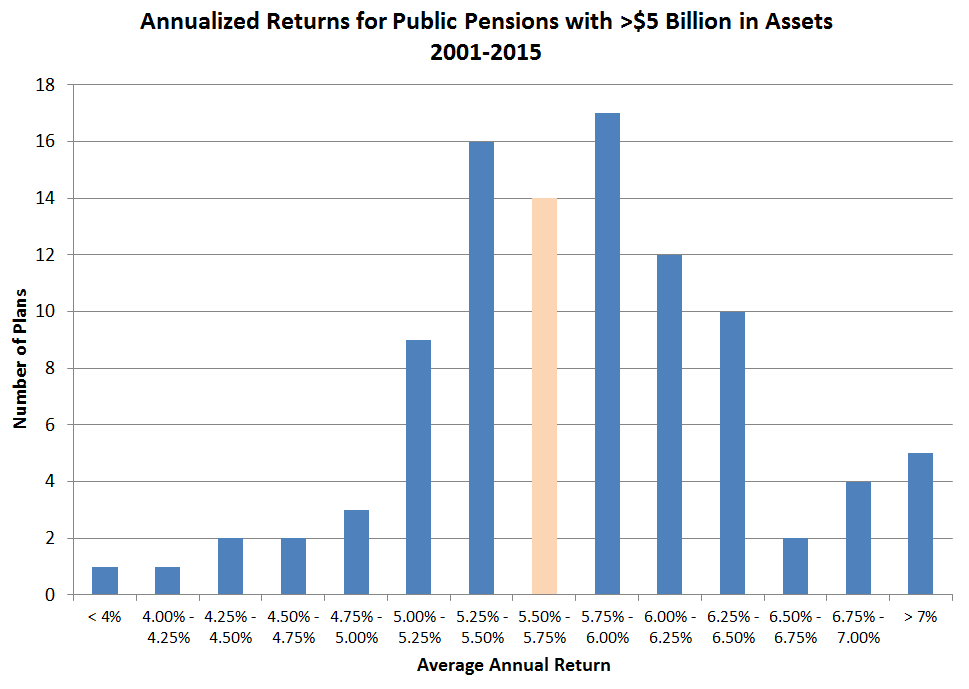

Ugh, another awful graph. I have to go to the last slide of the presentation to find out he’s comparing to other public plans >$5 billion in assets. So… I’m going to do a rough comparison using the Public Pensions Database.

I looked at average return since 2001, for all the plans in the database, using fiscal year 2015.

I got 98 pension plans as a result, which is awfully convenient. And SCRS came in 55th from the top. Basically, smack dab in the middle. I could do the 10-year comparison, as opposed to 15-year comparison, but really.

A better way of demonstrating where SC’s returns come in is using a histogram, rather than giving a percentile. The reason: there is a heck of a lot of clumping.

The orange bar – smack dab in the middle – is where SCRS sits.

Yes, I’m doing the 15-year return, not the 10-year. For what it’s worth, Calpers’ average is lower than SC’s. Just something to think about.

Also notice how pretty much all the plans have 15-year returns much lower than 8%. To be sure, those specific 15 years had a big blip… but that’s reality. We’re dealing with reality, not a “beautiful theory”. And this has given me impetus to roll out looking at returns (yet again) in another post. I’m not sure how much to trust the numbers I’ve been seeing, and I want to dig further.

Separately, you can check out my spreadsheet at this link and see if I did this correctly.

Here is another slide presentation from January, with the exhortation to keep the treasurer on the Retirement System Investment Commission.

For what it’s worth, I agree with Treasurer Loftis on the underlying problems — there are issues with the asset management, there are issues with how the plan is designed, managed, and funded.

As well — I agree that the treasurer should remain on the Retirement System Investment Commission.

CURTIS LOFTIS MAKING A STINK FOR A LONG TIME

Yves Smith at Naked Capitalism:

How Experts Enable Corruption: The Role of Conflicted Lawyers at CalPERS and Other Public Pension Funds

…..

A reader e-mailed me after I wrote about how the South Carolina GOP was trying to remove State Treasurer Curt Loftis from the pension fund board, after he had done a heroic job of reform. The state’s fund had been in the bottom 10% performance for large public pension funds. And that was due to an excessively large allocation to underperforming alternative investment funds.Not only did Loftis pressure staff to cut its allocation to dodgy, high fee fund managers, but he has been a leader in getting better disclosure of fees and costs. Industry standard-setter CEM Benchmarking, in a seminal paper in 2015, cited South Carolina as one of the two public pension funds that had gone furthest in obtaining information on fees and costs, and their work revealed that most other funds were only reporting only about half their fees. That is shocking lapse, particularly given that ERISA, which public pension funds comply with even though they are not formally subject to ERISA, requires that pension fund trustees evaluate the cost of an investment strategy in deciding how to commit funds.

Yet soi-disant fiduciary experts, rather than praising Loftis and urging their clients to emulate Loftis, are instead demonizing him. And what is the basis for their criticism? That he is making life hard for South Carolina’s staff.

The venom of the attack reveals the realpoitik we described above: that the fiduciary counsel’s role is to protect his client even when that entails enabling bad behavior, rather than act as an independent expert and tell them what they need to do to serve their beneficiaries and taxpayers properly.

From a reader via e-mail after we ran a post calling on readers to go to bat for Loftis:

I’ve run into Funston Advisors, the firm that did the “fiduciary audit” that Loftis said made the recommendation to kick him off the board.

I made some kind of comment along the lines of, “That guy Loftis has done an incredible job of driving reform and transparency there.” The senior Funston guy then looked me in the eye and said, “You should never praise Loftis to any public pension fund official. The staff at the SC pension system hate him, and in our view, he is very disruptive. The public pension fund staff people around the country all talk to each other, so you are really hurting yourself if you praise Loftis to any public pension fund official.”

I then defended my comment by saying that I thought he was executing his fiduciary duty by speaking out publicly. One of the Funston people then trotted out the argument that Loftis had a “co-fiduciary duty” NOT to speak out in a way that was critical of the pension system. I argued about this with them but they clearly thought that I didn’t know what I was talking about.

As we indicated above, law professors disagree with Funston on its claim that a “co-fiduciary” duty means trustees should all play nice. So if you strip away that bogus objection, what do you have left? That Loftis was making life hard for a poorly-performing and potentially corrupt staff. And what was the position of this “fiduciary” advisor? Effectively, that having life be comfortable for staff was more important than improving performance and cutting fees, and that the only thing that matters is the avoidance of controversy and public embarrassment.

I don’t know if the staff of SC RSIC are corrupt — could be, but it doesn’t take corruption to get bad investment results… one could just be wrong — but I don’t see why being annoying has anything to do with fiduciary anything.

I would hope if things are going wrong, a fiduciary would make a stink.

Yes, the targets of said stink aren’t going to be happy about it. That’s the point.

Here’s Smith’s earlier post on Loftis – I will excerpt:

Despite considerable opposition, South Carolina Treasurer Curt Loftis, the only elected official on the state’s six-member pension board, has made great progress in exposing corruption and incompetence in the management of the pension system. For instance, South Carolina has been cited by public pension industry standard-setter CEM Benchmarking as one of the two pension systems in the US that has gone the furthest in getting disclosure of fees and costs from private equity funds. And to give you an idea of how far South Carolina has gone relative to its peers, consider this section of our write-up:

Moreover, CEM also points out that most public pension funds are not complying with government accounting standards in how they report private equity fees and costs, and that based on their benchmaring efforts with the South Carolina Retirement System Investment Commission and foreign investors, most public pension funds are missing at least half of the total costs.

…..

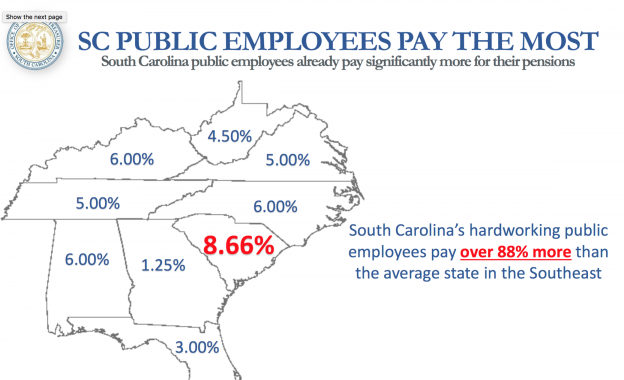

And not only are taxpayers on the hook, but state employees are also overburdened:

And Loftis figured out early on that the pension system was far too cozy with high-fee alternative investment managers who were under-delivering. From a 2012 New York Times story (hat tip David Sirota):

Today, the pension fund has a higher share riding on private-equity and hedge-fund plays — called “alternative investments” in some circles — than almost any other state’s: $13 billion, or more than half its total….

But here in South Carolina, the state treasurer, Curtis M. Loftis Jr., is worried that pension officials have had their heads turned by Wall Street players who stand to benefit from the state’s money. “This is a world where people have private jets, massive apartments overlooking Central Park, people who live exotic lives,” said Mr. Loftis, reclining in a chair in his baby-blue office at the State House, as his black Labradoodle, Camey, snoozes nearby…

Note that this is early into the huge shift into alternatives by SC, at least according to the Public Plans Database.

And SC isn’t alone in that shift, though it does have a relatively high allocation there.

But I want to address that high contribution rate by SC employees…. hey, employees… get ready for more pain.

HIKE HIKE HIKE UP THE EMPLOYEE CONTRIBUTIONS

SC pension fix with 9% cap for public workers heads to House:

The S.C. House’s budget panel unanimously approved a proposed solution Thursday to the state’s ailing pension system, which is roughly $20 billion in debt.

The full S.C. House could consider the plan as soon as next week.

The plan would raise the amount deducted from the paychecks of public-sector workers for their retirement to 9 percent of their wages, up from 8.7 percent, and cap it at that level.

Meanwhile, S.C. House budget writers are considering putting an added $160 million into the pension system. That money, from the state’s $8 billion general fund budget, would pay up to half of the higher contributions that public-sector employers — including cities, counties and schools — will have to pay into the pension system.

If the pension system bailout plan is approved, those public-sector employers, financed by taxpayers, would start paying 13.6 percent of each employee’s pay toward their retirement costs starting on July 1. That rate — now 11.6 percent — would increase to 18.6 percent over the next six years.

Lawmakers propose to pay the full added costs of employer contributions for state agencies in the budget.

Earlier pieces on that plan and the trouble that drove it:

- Public safety to ‘look different’ under pension plan, local sheriff warns

- Time to tackle pension reform

- State pension reform to go before SC lawmakers

- Schools, cities, counties to pay much of cost of pension fix

- $24 Billion in Debt And You May Be Footing The Bill

- South Carolina’s looming pension crisis

- What’s it going to take to fix South Carolina’s failing pension system?

- Pension problems much worse than initially forecasted

That last item… isn’t it funny how that always happens?

It’s not unique to South Carolina.

But back to that increase to 9% contribution… at which it would be capped.

It’s actually a reduction from what was originally going to happen:

wltx 12:53 PM. EST December 13, 2016

COLUMBIA, S.C. (AP) – Pension costs will dig into the paychecks of South Carolina’s public workers for a sixth consecutive year, and state officials warned deeper cuts are coming.

The State Fiscal Accountability Authority on Tuesday approved increasing how much workers and their employers pay for retirement benefits.

On July 1, both will pay an additional half of a percent.

That means workers in the main plan will contribute 9.2 percent of their salaries. Officers and firefighters in the smaller, law enforcement plan will contribute 9.7 percent.

Meanwhile, the rates paid by their taxpayer-funded employers will increase to 12.1 percent and 14.7 percent, respectively.

So the shift is mainly to the employers, and not the employees. The total contribution will work out to the same amount, the difference being the net taken home by employees….and if employers pay more, that means taxpayers pay more.

But the contribution increases aren’t necessarily going to fix the issue. The contribution rates have been increasing — remember that funding graph above?

Interesting that it was rather level up to 2006, and that it has steadily risen since then. Those numbers aren’t matching up with what is in the news. Hmmm.

Anyway, the politicians passing that contribution cap may think they’ve done with their fixes… this year.

Good luck with that.

Related Posts

Around the Pension-o-Sphere: the "Strong Men" of Venezuela and Russia Can Do Only So Much

Data Visualization: People and Books in 1946

Divestment and Activist Investing Follies: Shooting Yourself in the Foot?