2020 Project: Digging Through Connecticut Pensions

by meep

I have chosen CT pensions to dig through because its in the worse position, compared to New York.

I pay a lot of taxes to both CT and NY, so I have direct interests in both states. I have issues with NY pensions, but it’s more a case of governance, and I will get to NY issues eventually.

Two items popped up on my radar recently that has nudged me into this project (especially as February seems a bit late to announce a 2020 project).

CONNECTICUT: DESPERATE FOR REVENUE

Even without graphing state/local revenues, I can give proof — the insane plan to try to put a toll on a one-mile stretch of highway.

Yes, really.

Toll On Mile-Long CT Stretch Of I-684 Would Be ‘Unfair Taxation,’ Westchester County Exec Says

A proposed toll gantry on a brief stretch of I-684 that runs through Greenwich has drawn criticism from Westchester County Executive George Latimer.

Connecticut Gov. Ned Lamont introduced a plan for 12 statewide tolls, including one in a stretch of I-684 near the Greenwich-North Castle town line that will force truck drivers to pay a toll as high as $20 despite being in the state for only about one mile.

I-684 is the main highway that goes by my town, and we use it to go down county. We’ve always laughed about that short stint where you see an “entering CT” sign in a little bit of Connecticut that juts into Westchester County:

Yeah, that’s really sad. I can think of all sorts of nasty things that would happen, should CT try to enforce tolls on 684. NY state is far bigger than CT, and would have no issue with trying to screw CT over.

The county executive (who I think is a Democrat, but it doesn’t much matter for local politics) said:

“The proposed toll site on the one-mile stretch of I-684 in Greenwich is used primarily by New York traffic, both trucks, and passenger cars, and a toll here to benefit the State of Connecticut would be an unfair taxation of those who do not have a voice.”

Latimer compared the proposed toll to placing a toll on the Port Chester side of the I-95 bridge that crosses over the Byram River.

“Connecticut stands to gain an estimated $13 million dollars to rehabilitate that causeway – a tremendous enhancement to the state’s transportation needs – and an additional $5 million dollars per year in revenue for the Greenwich toll. But the tax would largely be on the backs of New York State truck drivers.

“We don’t believe in retaliatory border tolls. We are all neighbors, and this will create an unhealthy relationship between the two states. The fear is that even with a toll on trucks only, avoidance traffic would follow on New York’s local roads, primarily Route 120 and Route 22.”

By the way, here is the I-95 bridge:

It is a major path from CT into NY. I suppose there is no toll there.

Yet.

Even putting the idea out there is not a reasonable negotiating position with New York. It’s insane. You do this only if you’re getting desperate.

PENSION PARTICIPANTS ARE GETTING DEFENSIVE

I was going to pick the following piece apart, but let me just link and pull out a few quotes and a few remarks I have to make.

The person who wrote this is the president of the State Vocational Federation of Teachers in Connecticut, Ed Leavy.

Op-Ed by Ed Leavy in the Hartford Courant, 26 Jan 2020: If we want great teachers, we must invest in keeping them

And by “invest”, he means, of course, pensions!

Anyone who works for the state of Connecticut, as I have for my entire professional career, gets used to the negative rhetoric that surrounds our work and blames our state’s problems on those responsible for keeping our communities safe, clean, efficient, and educated.

For some reason, we are unable to shake the false narrative that state workers collect lucrative salaries coupled with even more exorbitant benefits – when the facts clearly show that teachers like myself and those I represent will receive only a moderate pension even after many years of service.

I tried to look up what the pensions teachers actually get, but I was having trouble with various data tools and decided to go to the plan documents.

Looking at this worksheet from the CT Teachers Retirement Board, it looks like it is average of top three years salary, multiplied by a factor that ramps up to 2% per year of service [depending on your retirement age]. If you retire past age 60, it looks like you’re good to go. That’s a fairly high multiplier.

Age 60 is very young to retire. Especially if you’re a teacher.

DIGRESSION: THE GROSSLY UNDERFUNDED TEACHER PENSIONS OF CT

Teacherspensions.org has ranked CT as one of the worst pension systems for teachers. If you actually dig into it, it’s really because CT has been grossly underfunding the teacher pensions.

If I look at the Public Plans Database for these pensions, I see multiple problems already.

I can see they did a pension obligation bond in fiscal year 2008 (WHAT TIMING GUYS). I see they’ve been valuing the liabilities using an 8.5% discount rate up until a couple years ago… they’ve finally gotten it down to the “more reasonable” 8% discount rate. The ARC has been steadily growing as percentage of payroll, and it’s over 30% of payroll now. That’s firefighter levels. And the funded ratio has been bouncing along at less than 60% for about a decade. It’s never been fully-funded.

That CT has a problem specifically with teacher pensions is not unique to it. Teacher pensions are a problem for loads of governments, as teachers are long-lived and the most numerous of government employees.

But many other systems managed to be fully-funded in 2000, at the top of the dot-com boom. Not CT, though.

WHAT’S THE RETIREMENT AGE?

Back to Ed Leavy’s piece:

It is even more frustrating for state workers to have the concessions that we made in the 2009, 2011, and 2017 State Employees Bargaining Agent Coalition (SEBAC) agreements largely ignored in this warped story line. I was part of the past two concession agreements, so I am well aware of the sacrifices my members and I have made over the past decade.

Our teachers in the technical high school system have forgone negotiated raises, seen their health care and pension contributions increase, normal retirement age rise and early retirement penalties double. These changes were negotiated by union leadership and ratified by members; over 80 percent of our members approved these changes.

Okay, let’s talk about that normal retirement age.

I’m seeing age 60 as “full” retirement age on this worksheet, and that’s really young. What was it before? 55?

Yet corporate conservative attacks remain unencumbered by good faith or facts, bemoaning that Connecticut’s loss in population is disastrous because of “exploding pension debt,” while ignoring that pension changes negotiated in 2011 and 2017 have greatly reduced liabilities, and that the “population loss” they discuss was only an estimated 6,223 people. The retirement plans negotiated in 2011 and 2017, Tiers 3 and 4, are completely solvent, another fact that is mostly ignored.

Oh, I will visit that, but those tiers, obviously, are for people starting after those went into effect. The problem is not the new people who will not retire for decades to come.

It’s for the grossly underfunded tiers from before. The people who are retired now, and the people who will be retiring in the decade to come. You know, the Boomers.

As for the 6200 people who left, it really matters which people they were. I understand there’s an office to keep tabs on a few key people… perhaps Leavy should ask if anybody really lucrative left in the past few years.

WRAPPING UP WITH THE TEACHERS

I will be visiting the teachers pensions, as well as other pension systems in Connecticut.

As for Mr. Leavy’s piece, he does have portions in it I totally agree with. Remember that he’s the President of the State Vocational Federation of Teachers. He teaches in a vocational school, and I agree they should be supported, but, again, I am really confused by some of this:

In 2012 more than half of tradespeople were over the age of 45, meaning impending retirement could result in big shortages not only in people available to work in these trades, but also in people available to teach these trades to our students. It has been clearly shown that the state’s ability to hire and retain teachers at all levels drops significantly when they close their pension system to new hires or make deep cuts to existing benefits.

I am 45 years old. I am not going to be retiring for at least another 20 years, and yes, tradespeople cannot be retiring at age 55 unless they’ve got a really heavy smoking history (or save a lot more money than most people do).

It would have been more to the point if they told us how many tradespeople are over 60 years old — that’s close to retirement. Not 45.

Then there’s this:

A staggering 92 percent of teachers say eliminating pensions for the public workforce would weaken the U.S. education system. If we are going to continue to be able to recruit quality trades teachers, we must preserve our right to effectively collectively bargain these benefits with the state.

Are you really kidding me.

Look, I come from a family of teachers, but this is absurd. You ask public school teachers about whether their pensions be cut? What response are you expecting? How is this supposed to be at all convincing to non-teachers?

Yes, we understand teachers like having real pensions.

The question is whether, as currently constituted, the taxpayers can actually support those pensions.

I am very supportive of lifetime retirement income for people, with a certain minimum that’s guaranteed.

I just think the amount guaranteed in CT is high (2% * number of years of service * average of top 3 years salary), and that prior generations did an awful job in funding those pension promises in Connecticut in particular.

One can talk about who is at fault, but that doesn’t really solve the problem going forward.

I plan on digging through the details — through the history of the pension benefits (I want to see how retirement age has changed over the years), history of the funding pattern, history of the negotiations between politicians and public employee unions (as well as what “negotiating with other people’s money” means).

DOCUMENTS FOR THE FUTURE

For those who want to jump ahead of me, here are some of the information sources I will be using.

Here are some relevant documents at the state comptroller.

The Public Plans Database will be my friend.

I will also be using my cash flow projection tool.

There are a few other sites I may try, but many of them don’t give me access to the data in the way I want… so I may need to bide my time.

POSTS OF THE PAST

I have some of my CT posts of the past listed here, but let me pull out a handful, some of which aren’t (yet) on the compilation list.

- Nov 2015: A Week of Bad Pension Ideas: Splitting the Pension Plan to Save It?

- Jan 2017: Connecticut Pensions: Pushing Off Payments Til Later Ain’t Reform

- Mar 2017: Pensions Catch-Up Week: Connecticut Trying to Fix a Hole

- Mar 2018: The Fiscal State of Connecticut: Totally Screwed

Another 2020 project may be a reorganization of this site, but that may have to wait til Stu can do it for me. A lot of my organization, etc., fell apart at the end of 2017, when Stu was diagnosed with cancer.

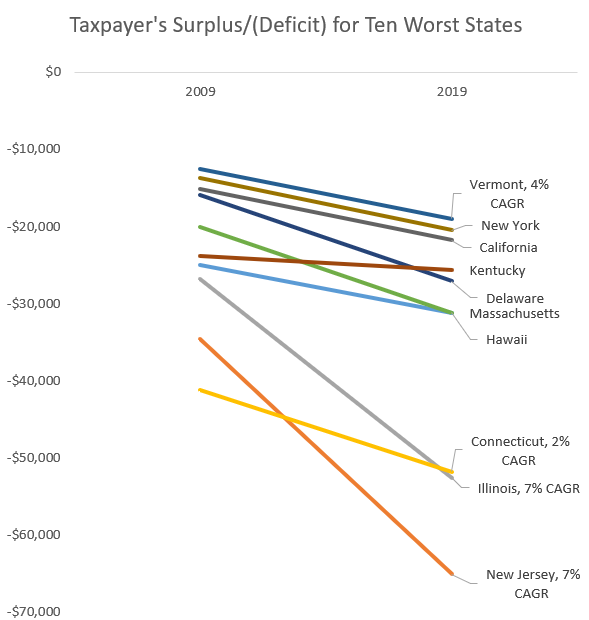

And, for a parting thought, where CT landed on the last State of the States from Truth in Accounting:

CT is the yellow line.

“We’re not as bad as Illinois and New Jersey!” is not quite the selling point.

Related Posts

Public Pension Assets: It's Not Your Money to Play With, Pension Trustees

Wisconsin Wednesday: Is Contribution Growth Moderate?

Taxing Tuesday: Illinois Tax Persiflage