Chicago Public Schools: Who is Profiting?

by meep

A quick blogging note: my internet connection at home is… not there. So my blogging will likely be a lot less. I have to build up the posts over several days, in order to have the content I want.

Thanks to my linkers!

Howdy to some of my livejournal friends. I generally post non-political/non-finance stuff over there.

CHICAGO BONDS: WHO BOUGHT THEM?

I saw one Chicago debt mystery get solved (for me) this week: who was on the other side of a private placement done by the Chicago Board of Education this summer?

It was J.P. Morgan, and they profited from their short-term deal.

Chicago’s Struggling Schools Made Wall Street $110 Million From $763 Million in Bonds

J.P. Morgan, Nuveen invest in school board’s bonds at big profit

The Chicago school system needed money—fast. Two Wall Street players saw an opportunity to invest.

J.P. Morgan Chase & Co. and Chicago-based Nuveen Asset Management have made realized and paper profits exceeding $110 million on purchases this year of $763 million in Chicago Public Schools bonds. The school system has said it needed the money to replenish its dwindling coffers before the new school year and to build and repair facilities.

The terms of the bond sales highlight the choices the school district faces after years of pension shortfalls and relying heavily on borrowing. The 397,000-student school district struggled to sell municipal bonds in February until Nuveen bought about one-third, and the district decided in July to borrow directly from J.P. Morgan for fear that investors might balk again, a spokeswoman for the Chicago Board of Education said.

“CPS did not have the luxury of waiting longer to demonstrate to the market that the progress we were making was real,” said Ronald DeNard, the school district’s senior vice president of finance, in an emailed statement about the bonds purchased in July by J.P. Morgan.

J.P. Morgan, the country’s largest bank by assets, made a 9.5% profit on $150 million in bonds it bought in July and sold in September, or 82% annualized. Nuveen, an investment firm managing $160 billion, has bought $613 million in bonds since February for a total return, including price gains and interest payments, of about 25%. That is almost 50% on an annualized basis, an especially large gain at a time of near-zero interest rates.

The school system’s bonds are a favorite for John Miller, Nuveen’s co-head of fixed income, who said the firm bought when the market feared a default, a concern he called overblown. “At the end of day, this school system is critically important to Chicago—to the whole country really,” he said.

…..

Chicago’s school district operates on a budget of $5.5 billion with a below-investment-grade, or junk, credit rating on nearly $7 billion of bonds. Its teachers union is threatening to strike, in part, over proposed changes to its pension plan, which has a nearly $10 billion funding gap. The school system’s rainy-day fund is nearly empty and relies on short-term borrowing.“J.P. Morgan and Nuveen are taking advantage of a distressed school district at the expense of our most vulnerable students,” said Jackson Potter, staff coordinator at Chicago Teachers Union.

…..

Still, when the school district turned to J.P. Morgan for more money in July, it decided to sell the bonds directly to the bank to avoid the risk that investors would reject it. Instead, demand for the bonds rose throughout the summer, and J.P. Morgan sold all of the debt for a $12 million profit in September, Wall Street Journal analysis of data from the Municipal Securities Rulemaking Board shows.“You’ve gone from having maybe two to three people being interested in these deals to all of a sudden having 20 investors interested,” said Mr. Miller of Nuveen.

…..

J.P. Morgan has a longstanding relationship with Chicago Public Schools and is the top underwriter of its bonds over the past 10 years, according to data from Thomson Reuters. The bank views the school board as a high-priority client that it understands well and is willing to support its short- and long-term capital needs, the bank spokeswoman said.

I will come back to the bolded quote in a moment. I want to question the use of a private placement for the stated purpose.

WHY PRIVATE PLACEMENTS?

Two STUMP posts on Chicago borrowing in August:

- Chicago Update: Pensions, Taxes, and Bonds

- Do the Hokey-Pokey: Chicago Public Schools Strike Threat and Debt

From that second post:

I will just mark this down on my calendar, to keep an eye when this “short-term” debt use would kick in. Maybe Claypool is on the level, and this is just a liquidity issue.

But I find this worrisome, in terms of the magnitude of the line of credit. It is dwarfing the new long-term debt they want to take on, and is fairly large compared to the $5.4 billion operating budget. And I don’t think the secrecy surrounding the capital improvement projects really inspires confidence, either.

That large bond payment in February — is that capital spending bonds, or is it the accumulated “scoop and toss” crap (i.e., a bunch of old operational costs that were turned into long-term debt.)

And don’t get me started on the CPS pensions.

Not today, at any rate.

Oh, I will today. I will today.

But before I get to the pensions, I am extremely skeptical of this whole arrangement. Private placement bonds are not necessarily in and of themselves suspicious, any more than private equity or hedge funds.

But there is a reason that there is suspicion around governmental entities operating with these opaque investment and financing vehicles — the possibility of corruption in the forms of kickbacks, slush funds, political favors, yadda yadda.

And then there is the whole “getting their money’s worth” issue.

Chicago may have gotten a better interest rate, never disclosed in the article by the way, if they had gone to the public market… but remember the key detail that their bond offering failed in February.

And they seemed a bit desperate — they needed cash fast.

Think about payday loans – people who have poor credit and NEED! CASH! NOW!

I think you know that the terms such people get tend to be less than optimal for the borrower. I still didn’t see what the interest rate was on these bonds, but maybe it’s hidden in there somewhere.

WHO IS PROFITING?

Remember this quote from the original news item:

“J.P. Morgan and Nuveen are taking advantage of a distressed school district at the expense of our most vulnerable students,” said Jackson Potter, staff coordinator at Chicago Teachers Union.

Here was the other option: those companies could have avoided profiting at the expense of the most vulnerable students by not buying Chicago’s bonds.

And maybe nobody else would, either.

How you like dem apples?

There were more options than that, of course. But let us go to somebody else’s opinion:

The American Interest comments on the situation:

Students Lose, Wall Street Wins in Blue Model Merry-Go-Round

The catastrophic fiscal mismanagement of Chicago’s public schools is creating a windfall on Wall Street as the district borrows from big banks at ruinous rates.…..

The seeds of the crisis in Chicago were planted long ago when powerful teachers’ unions negotiated implausible lifetime pension guarantees, and politicians, eager to win their favor, acceded. It turns out that Wall Street financiers are an unexpected beneficiary of this corrupt bargain.Debt service is already eating up ten percent of the Chicago School District’s budget, and city’s deteriorating finances may cause creditors to jack up rates even further. If it doesn’t find a way to plug the holes in its fiscal ship, Chicago could well face the same fate as Puerto Rico and Detroit the next time a recession causes its tax base to contract.

The leftwing champions of blue model governance think that they are siding with the little people against powerful interests. But while financiers and teachers’ unions are doing just fine under the Chicago status quo, the district’s disadvantaged students seem to lose out—over and over again.

So here’s a question.

Who, exactly is profiting from the situation here? The two firms made a nice short-term return… which they’re going to have to plow back into some other investments elsewhere.

Private placements don’t always perform well. Nuveen and J.P. Morgan could have had stinkers on their hands when Chicago teachers strike, no state aid is forthcoming as state tax revenue is down, and the cash flow situation just gets worse and worse because nobody will buy Chicago’s bonds.

Not saying that that would have definitely happened, but Nuveen and JPM knew that they could have lost money on this deal.

But there is a group who thinks they can’t possibly lose money on their deals, and they suck away a lot more than $100 million each year.

Yes, you know who it is.

THE TEACHERS’ TAKE

Let us take a look at how much of the Chicago Public Schools pays each year to teachers, shall we?

My data source is the Historical Expenditures tabs from the Chicago Public Schools FY17 Budget Interactive Reports. These are actuals, not projected/proposed. My spreadsheet is here.

I took the slice of Operating Funds (as these are operating expenses), and this is the graph from absolute amounts:

Here is the stacked columns as percentages:

Okay,you do want teachers to be a large part of the operational budget. Thing is, they’re undervaluing the cost of the teachers in those budgets. Because they’re really undervaluing the operational cost of the pensions.

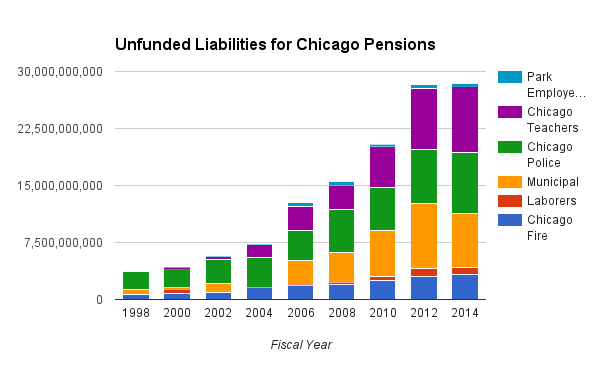

See this:

The budget is including only the blue part of the bar. The red part is what they didn’t pay. But that is an estimate of what they should have been paying.

Of course, that red bit includes the effect of the underpayment from prior years (not directly.. that shortfall is amortized), and many of us argue that that red bit is still too small, but let’s just take that as gospel.

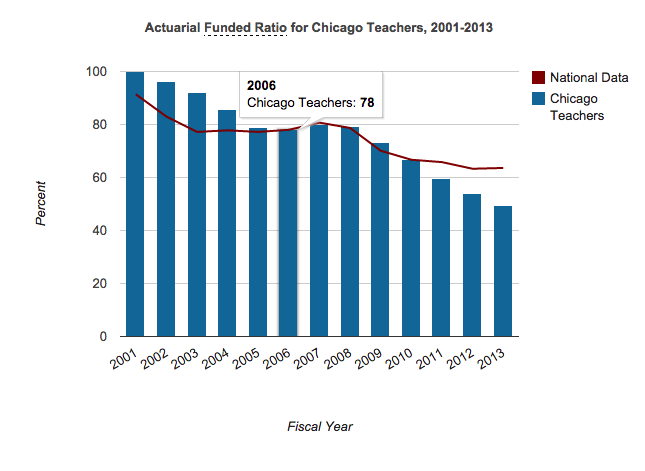

The teachers are theoretically taking far more than the budget is giving…. of course, CPS may not make good on those pension promises over time:

That’s only through 2013. The current funded ratio is about 52%, as increased payments have been made over 2014 and 2015.

In any case, JPMorgan and Nuveen had a short-term profit that may be difficult to replicate. The teachers have a many-years deal that they think will profit them as well.

In both cases, all parties participated in non-coercive negotiations to make contracts that they believe profit them. It just so happens that the teachers profit a lot more.

I cover the amounts Chicago teachers are getting in their pensions in this post.

WILL TEACHERS STRIKE?

But the teachers seem to be unhappy with the current deals on the table. As mentioned in a previous post, one of the major bones of contention is over the teachers having to increase contributions to the pensions.

The teachers union CTU authorized a strike to start next week on October 11.

Nothing much has changed from the spring, when they had their “day of action” (because they couldn’t legitimately strike at that point.) Nothing happened as a result.

I’m not seeing them having much of a result this time, either.

The Chicago Teachers Union’s House of Delegates is due to meet this evening for an update on how contract negotiations are going with Chicago Public Schools.

Most parents would love to be inside to find out if their kids will be out of school as soon as Oct. 11.

Reliable sources tell me the situation hasn’t changed. A possible contract that CTU leaders would support is within reach.

But avoiding a threatened strike depends on two things: whether union members, as opposed to leadership, are willing to be at all reasonable; and whether Mayor Rahm Emanuel is willing to take the political heat and suffer through a strike, rather than cave and make financial concessions CPS cannot afford.

…..

“We are working tirelessly to reach an agreement that is fair and balanced,” he told reporters this afternoon. “I continue to believe that the agreement we reached in January was a good agreement.”Emanuel was referring to a preliminary deal that CTU President Karen Lewis cut to give teachers a steady stream of pay hikes over the next four years, but to soak up some—and in some cases all—of that extra income by requiring teachers to begin contributing the 7 percent of their salaries for pensions that CPS now pays.

That deal was rejected, and ever since, CTU and particularly some factions of the union have continued to beat the drum that big pots of money are there to be spent: tax-increment financing reserves, an employee head tax on every business in the city, maybe a tax on Chicago’s commodities exchanges, etc. Much of that just isn’t real, though.

But in continuing to fire up the troops to hit the picket lines, CTU leadership has raised expectations. Whether those expectations of a potential big payday can be tamped down without a painful strike is not at all clear, though I hear lots of non-economic, work-rules kinds of concessions are being dangled by the union.

That, then, would put the onus on Emanuel to either hold firm or duck a political controversy and put the cost on CPS’ credit card.

Well, if the credit card has gone “private”… if they can’t really go back to publicly issuing bonds…. what then?

I really don’t see the bond market being enthused with the idea of an increased CPS budget.

FOR THE CHILDREN

So here’s the deal: when they say that resources are being taken away from poor children, they are meaning the teachers’ total compensation is being cut. Obviously, they’re not talking about money going directly to the kids.

Teacher compensation (including pensions) is a large part of the operating budget, and they’re not even costing in the total effect, because of undercontributions to the pension fund.

To be fair, this is what the teachers union says:

Did teacher and PSRP [paraprofessionals and school-related personnel] compensation cause CPS’ financial crisis?

No. The two biggest cost drivers in the CPS budget are debt service and charter expansion. Instead of going after teachers who already have experienced pay freezes, mass layoffs and budget cuts, the mayor and his CPS CEO should go after the big banks that ripped off the city and the schools with toxic interest rate swaps worth over $1 billion. They should also call for a charter moratorium and empty the $500 million TIF fund, both of which remove a considerable amount of district resources that would be better used in our classrooms.

Charter tuition really has been growing (from $437 million in tuition in FY2011 up to $753 million in FY2015). That was an increase of $317 million. And obviously, charter school tuition is money that directly follows the children. As charter schools are filled only by those choosing to be there, this really is “for the children” spending.

Just looking at the teachers bit, their pay & compensation (paid) has also been growing. From $2.3 billion in FY2011 to $2.6 billion in FY2015. Increased $284 million. But that’s ignoring how much more the pension costs really increased over those years, as mentioned before. The increase should really be much higher.

As for debt service and capital outlays (not part of the operational budget above) – that was level according to the actuals I’m seeing here. Definitely not on the order of $300 million. It fluctuates a bit.

Oh, and this is as CPS student count has been decreasing (I don’t know if that includes the charter students or not).

The swaps issue is something Rauner is dealing with for the state, and Chicago has suspending doing business with Wells Fargo for a year – over the individual account fraud, but partly because of the swaps.

The thing about emptying $500 million from the TIFs is that’s a one-time windfall, in my understanding. As opposed to a source of $500 million each year. You can’t have that used for an operational expense, unless you want to be in the exact same place one year from now.

I don’t think Chicago has much wiggle room to negotiate with the teachers union. They don’t have the money to fill the union’s appetite. Their tax ideas are stupid (like the corporate head tax).

The teachers are not getting any movement toward the items they keep putting forward:

Even those who support unionized teachers are seeing this potential strike as the irresponsible and selfish cash-grab that it is. Alderman Howard Brookins, chairman of the City Council’s Education Committee said, “Some of the most fervent supporters of the CTU in the City Council believe the best deal they can get is on the table.”

This reveals problems deeper than this one particular fight about salaries and pensions. As National Review Online contributor Frederick M. Hess said in his AEI blog yesterday:

“Chicago is a case study in how teacher unions have siphoned vast sums out of classrooms and into retirement and health benefits that do nothing for students — and that frequently, I’m afraid, aren’t configured to help attract or keep terrific teachers.”

Chicago teachers are doing just fine. Maybe they should concern themselves with their city’s finances and its students, rather than squeezing as much money as is possible out of the system before it goes bang.

And this going on while Chicago suffers from violence, and there’s an oxygen-robbing presidential election going on. Chicagoans have already been hit by increased taxes.

I don’t think the teachers are going to be finding a lot of support if they go ahead with the strike.

But they seem to believe that the money can be scraped together to fill those appetites.

I would guess they’re going to strike and get…. nothing.

Related Posts

Taxing Tuesday: A Break from Coronavirus

STUMP Podcast: Meep Starts Her Taxes

Taxing Tuesday: Happy New Tax Year!