Troubled Multiemployer Pensions: Central States Teamsters Files for Bailout

by meep

It’s been a while since I’ve checked in on multiemployer pensions.

John Bury reports that Central States Teamsters has filed for their bailout from the Special Financial Assistance program:

The first 34 plans that filed requested a total $8.4 billion in bailout money from the PBGC Special Financial Assistance program for troubled multiemployer plans. No press release but the PBGC weekend update showed one new plan – the Central States, Southeast & Southwest Areas Pension Plan with 364,908 participants which is asking for $35 billion dollars.

By the way, if you’re interested in multiemployer plans, you absolutely should be following John Bury’s site burypensions.

He has been keeping close tabs on the filings for the multiemployer plan bailouts as they come, withdrawals if they occur, approvals, and most importantly, Bury has a spreadsheet with key metrics such as participant count, last unfunded liability reported, and how much is being requested from the SFA program.

I will be doing a few graphs of these amounts from his spreadsheets below.

History of the Central States Teamsters saga and the need for MEP bailouts

Indeed, it looks like the last post I had on the situation was from over a year ago.

I want to pull out a particular point from that post, as it explains why I’m posting now:

April 2021: Multiemployer Pensions: Will the Recent Bailout Destroy Pensions (in the Long Run)?

The main reason the bailout had to happen, if not now but before 2024, was that the Central States Teamsters fund in particular was going to wipe out the PBGC. If they hadn’t bailed out the plans now, they’d have bailed out the PBGC in a few years.

Here is the nutshell version.

The PBGC (Pension Benefit Guaranty Corporation) is one of those government creations that is implicitly backed by the government but we’re pretending is self-supporting. Its revenues come from charges imposed on defined benefit private pension plans. It does not cover public pensions (government pension plans), church plans, or things like Social Security. It does not cover defined contribution plans, like 401(k)s.

In the event that private defined benefit pensions go belly-up, it takes the pensions over and guarantees certain minimum amounts to the retirees and participants. That’s its function. You will sometimes hear about the PBGC in a company bankruptcy, in which the PBGC takes over the pension, and then a new entity, sans pension, goes forward without the old liability.

There are two main types of private pensions: single employer and multiemployer, also known as union pensions. The guarantees for single-employer plans are much higher than for multiemployer plans, and their contribution and valuation requirements are much stricter than multiemployer plans.

Even with relatively low guarantees for multiemployer plans, one particular multiemployer plan was going to wipe out the PBGC reserves for multiemployer plans by 2024 or 2025: Central States Teamsters. There’s a sordid history there, involving the Mafia and Hoffa first, but then involving a grossly undervalued withdrawal liability when UPS left next. In any case, Central States Teamster was going to go under in the near future.

Selected STUMP posts on Central States Teamsters and MEPs:

- Oct 2015: Central States, the Teamsters, and MEPs: Cuts to Begin

- Mar 2016: Pensions Puzzle: What Happens When the Money Runs Out? When Does it Run Out?

- May 2016: Treasury to Central States: You Didn’t Cut Enough

- May 2016: Central States: I Guess the Plan is To Run Out of Money

- May 2016: Why There Will Be No Bailouts — I was wrong here…. or was I?

- Jan 2017: Setting the Stage for 2017: Failing Multiemployer Pension Plans

- Nov 2018: Multiemployer Pensions: Waiting for the Bailout Report

- Nov 2019: A New Plan to Deal with Multiemployer Pensions

- Mar 2020: Multiemployer Pensions: Prior Bailout Plan’s Shortcomings and State of Play

- May 2020: MoneyPalooza Monstrosity! Looking at the Multiemployer Pension Provisions

- Dec 2020: On the Bailouts That Didn’t Happen, Part 1: Multiemployer Pensions

- Mar 2021: MoneyPalooza Monstrosity — The Return: Multiemployer Bailout

- Mar 2021: MoneyPalooza Monstrosity: It Passed! More on the Multiemployer Pension Bailout

- Apr 2021: Multiemployer Pensions: Will the Recent Bailout Destroy Pensions (in the Long Run)?

So that’s a list if you want to travel the recent history.

Let’s see where things stand, because this is a half-assed bailout, in my opinion.

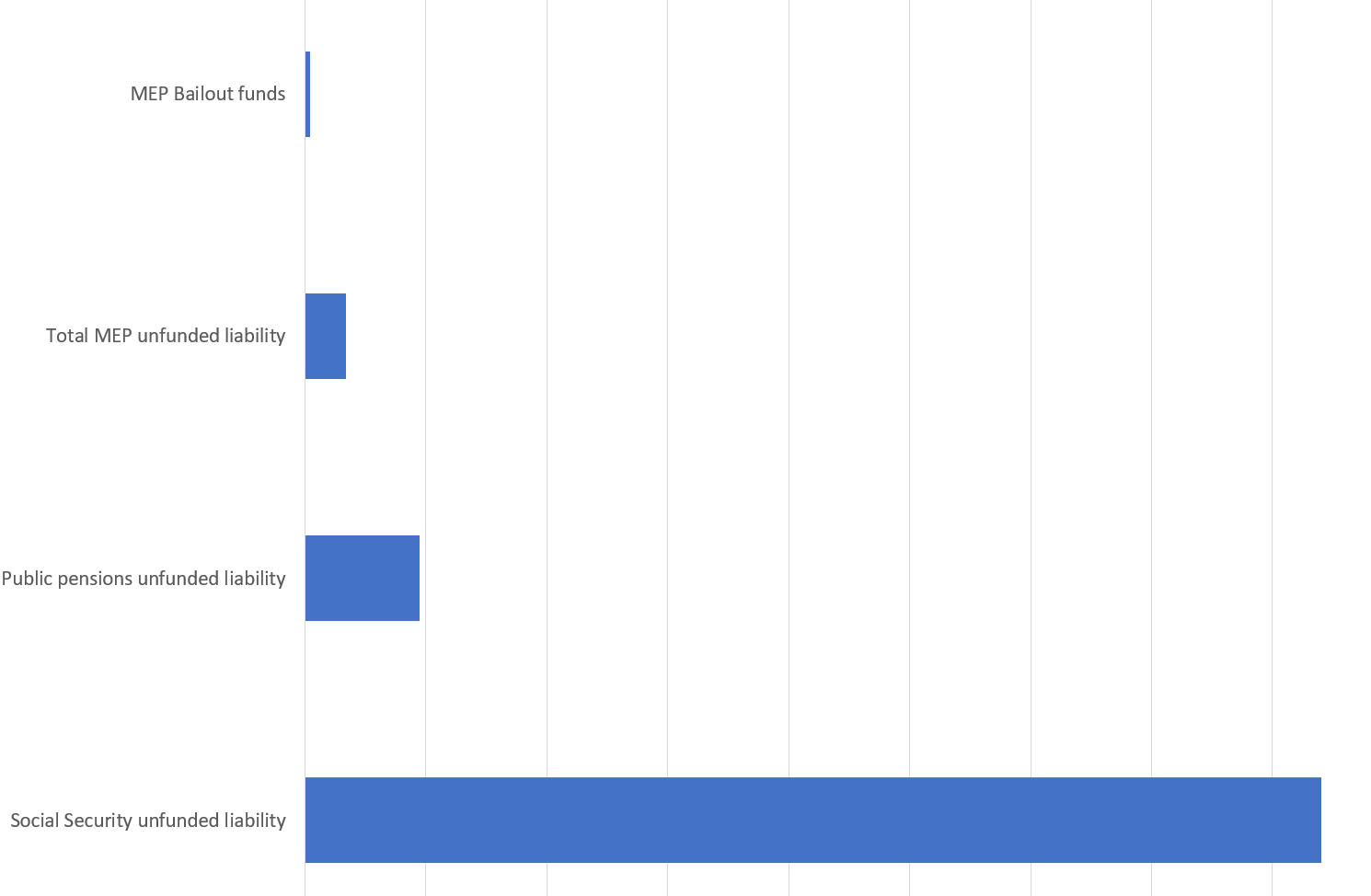

The comparison I made back in 2021:

- The total MEP unfunded liability is 8 times that of the bailout bill amount

And you can see how much other items were at the time to consider the likelihood of other bailouts.

Now, a lot of MEPs have unfunded liabilities that will not file for “help” at all. And we’ll see below that the plans aren’t filing for their full unfunded liabilities as they stand now.

Given that the “loans” can’t be clawed back, I’m not sure why they’re not trying for it all, but maybe there’s some sort of limit of how much they can ask for, as a percentage of their liability.

Visualizations of SFA applications

I thought this might be a useful comparison.

All the data comes from John Bury’s most recent posts: the Central States update from Friday and the SFA update with 5 more approvals from Friday.

For right now, I do not want to analyze the distinction between approvals and waiting for review. There had been a prior program allowing MEPs to cut benefits, but stay above guarantee levels, and some applications had been denied. That was a different situation than we’re seeing here, and as I’ve not yet seen any application be denied, I will just look at all the plans together.

Central States is just larger than all the other plans that have applied so far, which is hardly surprising — it is far larger than most of the multiemployer pensions out there, period, whether or not they’re failing.

Here is a graph:

Central States Teamsters has asked for $35 billion. This is hardly surprising, since its hole is about $44 billion deep.

There are three plans the next size down that have asked for about $1 billion each.

These are not really fair comparisons as they have a very different number of participants. Central States has almost 365,000 participants, and the next largest plan has 51,000 participants — yes, there will be scale differences.

Why not compare with respect to the amount per participant being requested?

That said, wouldn’t you like a $100K boost to your own retirement savings? I will circle back to that thought at the end of the post.

Finally, how much of the current unfunded liability is actually being requested?

Now, due to market prices moving about, yadda yadda, perhaps the valuation they have in hand has these percentages a lot closer to 100% than the overall 75% average for the whole group.

Does everybody get a bailout?

We were given a price tag of $86 billion for this SFA bailout, and with the Central States application, the total is at $43.6 billion, or a little more than halfway there.

At the time this passed I was feeling sour and made this:

But since then, a lot of people have found that the “bailouts” we got over the last couple of years weren’t exactly “free”.

The Fed’s Preferred Measure of Inflation Jumps to 6.6%, a 40-Year High

The PCE price index for March increased 6.6 percent from one year ago, reflecting increases in both goods and services.

Energy prices increased 33.9 percent

Food prices increased 9.2 percent.

Excluding food and energy, the PCE price index for March increased 5.2 percent from one year ago.

Yes, some of the price movements are due to supply issues, but some price movements are due to a bunch of extra money flooding the markets the last year.

That may have distorted some stuff, doncha think?

And now we’re looking at student loans potentially getting written off (without taxing the people on the forgiveness, I assume… though it would be hilarious if they did hit people with that, too.)

So hey, maybe all this will get wiped out by inflation anyway.

When I was contemplating no bailouts, I did caveat that Central States and MEPs might get a bailout, but that Illinois would get stuck, etc.

When I was contemplating no bailouts… I didn’t think that just turning on the money printers and ignoring inflation was going to be considered just fine.

And when I was contemplating no bailouts, I certainly didn’t think that an unrelated pandemic was going to be used as an excuse for all of it.

So, I guess we’ll see if any of this will get reined in before anybody remembers why inflation and, more importantly, stagflation was so bad.

For those who don’t think taxation is theft, because they often get to dodge it, inflation is theft on a scale they cannot comprehend. That’s one you cannot escape.

There is a reason that one of the biggest crimes of a leader throughout history, no matter the economic or political system, was seen as the debasement of the currency. It comes as no surprise to me that the Fat Bastard (as I like to call him) not only messed about with the Church and his wives, but also debased the country’s currency. PTUI!

Anyway, shoveling a bunch of money out at people does seem very popular, but the problem with shoveling it out at everybody is that that money gets to be worth less, hmmm? Ain’t that a kick in the pants.

So yes, while I’d like more money for myself, what with inflation and all, this gets to be a bit of a bind with the money printers going BRRRRRRR. Could we shut down those printers for a while, hey? Maybe they’re getting overheated.

I’m happy to see the PBGC will not get wiped out in a couple of years by Central States Teamsters, but the poor retirees will find their money doesn’t go as far.

Related Posts

A New Plan to Deal with Multiemployer Pensions

MEPs on the Rocks: Furniture Workers Pension Allowed to Cut Retiree Benefits

It's Happening: First Union Voted to Reduce Retiree Benefits